We are coming out of a two-year period of benign interest rates. During the pandemic, rates had been kept low to accommodate economic growth. During this period, we also saw home loans being benchmarked to the repo rate. With the pandemic, the Reserve Bank of India started slashing the repo rate. We saw home loan rates fall to as low as 6.40 per cent from nearly 9 per cent just three years back. Today, over two dozen lenders have their lowest home loan rate pegged at under 6.95 per cent for eligible borrowers.

Economic indicators, however, are signaling the bottoming out of interest rates. The inflation rate has hardened to nearly 7 per cent. The 10-year Government of India bond yield hit a three-year high of 7.2 per cent in April. Several banks have increased their rates of deposit and marginal cost of funds-based lending rates (MCLR). Experts predict that rates could gradually rise by as much as 100 basis points in this financial year, and by up to 200 basis points in two years. A hundred basis points are one percentage point.

WHAT THIS MEANS FOR HOME LOAN BORROWERS

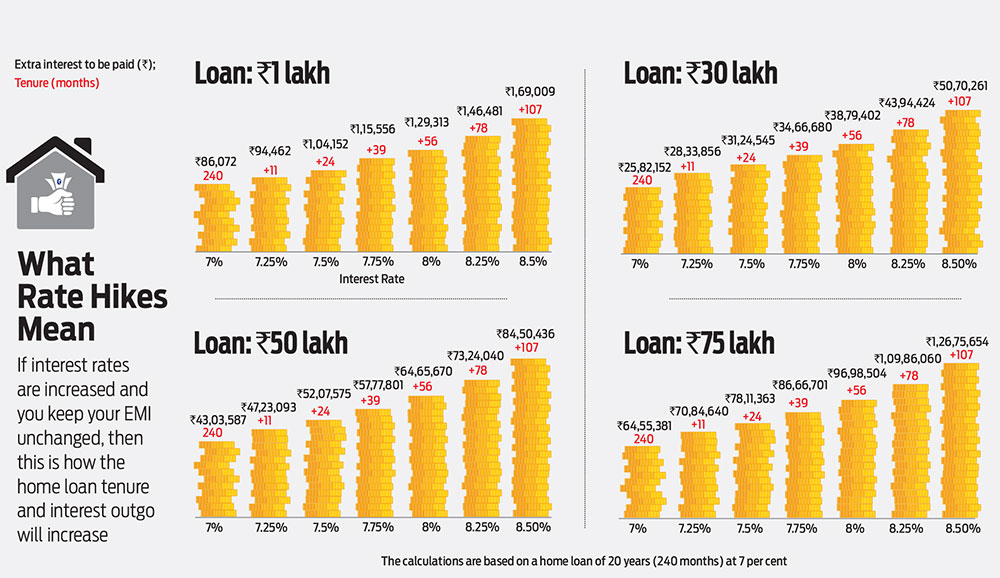

Home loan borrowers enjoyed two years of all-time low rates. But as rates rise, their loan tenures will get longer and interest outgo will increase. The journey out of debt will get slower. Assume you have a loan of Rs 50 lakh at 7 per cent for 20 years. A rate hike of 25 basis points would add 11 more EMIs to your loan. It would also increase your interest projection from Rs 43.03 lakh to Rs 47.23 lakh. The bigger the hike, the more is the number of EMIs added.

The hikes are cyclic. At some point, rates will fall again and your interest burden will soften again. But what can you proactively do now to ensure the additional interest payment doesn’t eat into your finances?

Let’s understand the rate hike math. Assume you have a home loan at 7 per cent with 20 years left. For every lakh you owe your lender, your interest is Rs 86,072. If your rate rises to 7.5 per cent, your per-lakh interest would jump nearly 21 per cent to Rs 1.04 lakh. Plus, you would need to pay 24 more EMIs. If your rate were 8.5 per cent, the per-lakh interest nearly doubles to Rs 1.69 lakh, with 107 more EMIs.

Keep your loan amortisation schedule handy as it carries details of your loan payments and balance at the end of each month. You can get this from your lender on email. Use an online EMI calculator to compute your interest. To soften the burden of rising interest, there are two broad options. One, get a lower rate on your loan. Two, pre-pay. Let’s examine these in greater detail.

1. REFINANCE YOUR LOAN

Refinancing means taking a fresh loan at better terms to pay off a running loan. This is also called a balance transfer. Refinancing is useful when there’s a sizeable difference—at least 25-50 basis points—between your current rate and the rate offered. It’s also useful when you are closer to the start of your tenure rather than the end. The bigger your loan balance, the more interest you could save via refinancing.

Refinancing can be done in two ways. One, through your existing lender. You can ask the lender to move you to a lower rate. There may be a processing fee payment. Many have used this option to refinance their MCLR- or base rate-linked loans to repo-linked loans, which are cheaper currently. Two, if your lender is not giving a competitive rate, refinance to another lender with a balance transfer. This will involve a little more paperwork if you are new to that lender. You will need to pay a processing fees and loan registration charges as applicable.

Calculate your refinancing savings by subtracting the costs from interest savings. For example, if your loan is at 7.5 per cent for 20 years, your per-lakh interest is Rs 1.04 lakh, and refinancing to 7 per cent loan reduces it to Rs 86,072, you save around Rs 18,000 per lakh. If your loan balance is Rs 30 lakh, the savings will be around Rs 5.4 lakh. From this, subtract processing fees and loan registration charges. Assuming that these are Rs 30,000, your total savings will be Rs 5.1 lakh.

Here’s a pro tip. I call this the ‘Switch Hit’. When you refinance to a lower rate, don’t take a lower EMI. Keep paying your original, higher EMI. This will close your loan sooner.

2. INCREASE YOUR EMIs

Let’s understand ‘Switch Hit’ better. Your loan has a minimum EMI. For example, on a loan of Rs 50 lakh at 7 per cent for 20 years, the EMI is Rs 38,764. Your interest is Rs 43.03 lakh. Say, you voluntarily pay a higher EMI of Rs 45,000 because you got a salary hike. The additional Rs 6,235 per month acts as a micro pre-payment and will be adjusted against the loan principal.

This is a clever hack because a usual home loan pre-payment needs to be equal to at least one EMI. Astonishingly, this small additional payment cuts down this loan from 240 months to just 180, and your interest to Rs 30.81 lakh. This is a very small and easy adjustment to your loan plan but it yields a powerful result.

The more you increase your EMIs with time, the faster is your journey out of debt. Such adjustments are small and incremental and will likely not disturb your domestic finances.

3. PRE-PAY ANNUALLY

Despite the spectre of a rate hike, home loans are still cheap today. You could still get one between 6.5 per cent and 7.5 per cent. However, market indices have been returning 12 per cent in the long term. That’s a substantial 5 per cent opportunity for wealth creation. You can borrow cheap to create equity in your home and invest your savings to create wealth through the markets. One must remember that while it is important to repay debts quickly, it is also important to invest for other financial goals. Your savings are limited. Therefore, a balance needs to be struck.

As per our calculation, the optimal pre-payment on home loans is around 5 per cent of the reducing balance once a year. Pre-paying 5 per cent of your balance at the start of every loan year helps pay off a 20-year loan in 12 years. Regular pre-payment also cushions you against rate hikes. So the hikes will add EMIs to your loan, and your pre-payments will reduce them.

Since you are targeting only 5 per cent, the maximum repayment will happen through EMIs, which is what you want, and you will still have savings for investing. As you invest, your solvency improves. And the loan becomes less of a problem.

For best results, mix all three options: refinance to a lower rate, voluntarily pay a higher EMI, and pre-pay 5 per cent annually.

Lastly, watch your credit score every month. If you have slowly risen above 800, you may be eligible for a cheaper home loan.

The author is CEO, BankBazaar.com