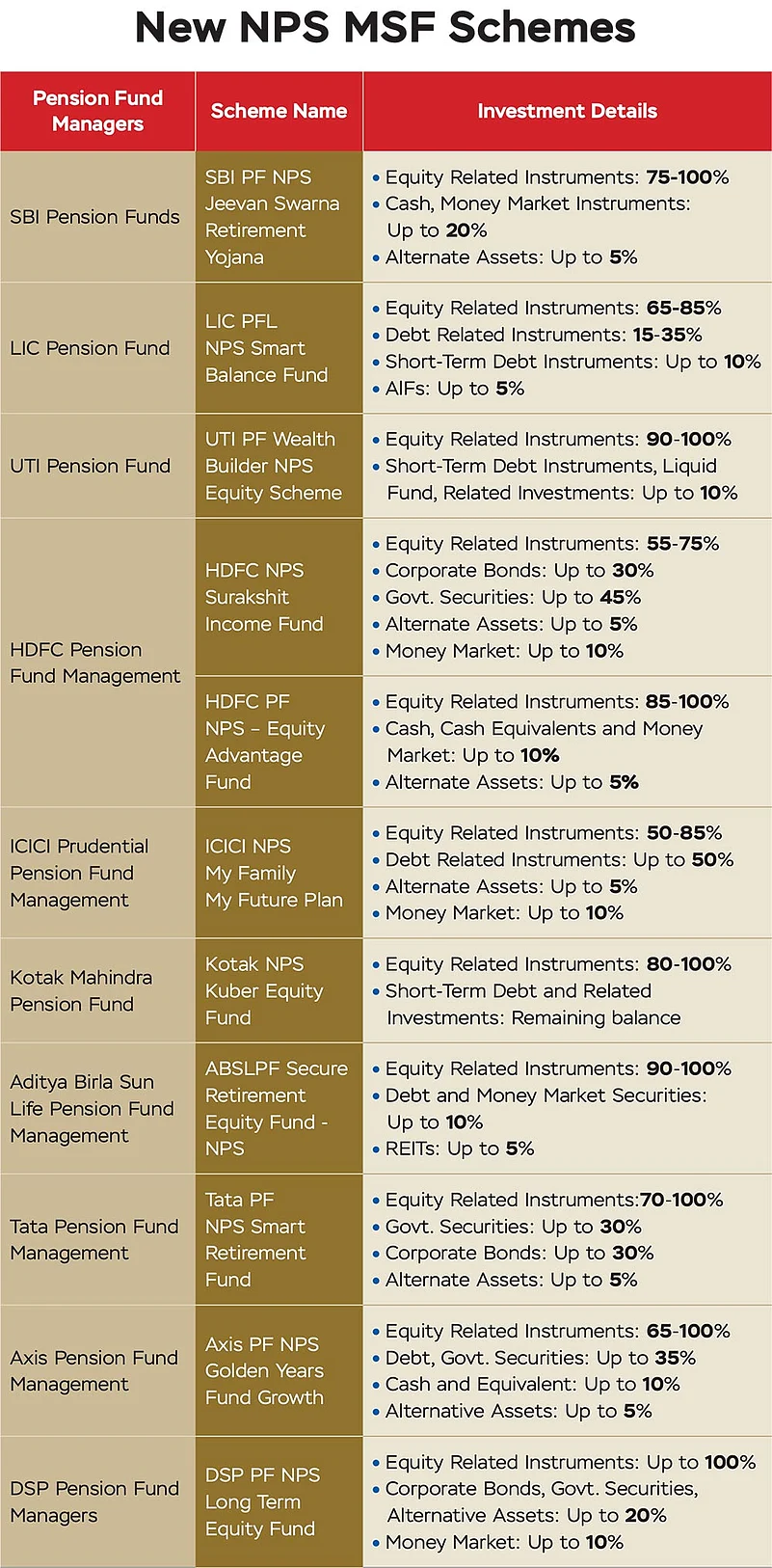

The National Pension System (NPS), has undergone massive overhaul under the new Pension Fund Regulatory and Development Authority (PFRDA) chairman S. Ramann. The most significant change has been the introduction of Multiple Scheme Framework (MSF) on October 1, 2025, under which the pension fund managers (PFMs) have floated their own customised schemes (see New NPS MSF Schemes).

The primary rationale behind launching MSF is to offer greater choice to NPS subscribers and provide them a larger pie in equity investment (up to 100 per cent). The base NPS scheme, Tier-I, offers up to 75 per cent equity exposure, while the Tier-II scheme gave the option of investing 100 per cent in equity, but was available on a voluntary basis. Also, only Tier-I subscribers could opt for Tier-II. Both are now called common schemes.

Mamta Rohit, executive director of PFRDA, talking to media recently, said that the goal of MSF is to offer subscribers greater choice, flexibility, personalised retirement solutions, and attract young investors.

Let’s understand what MSF schemes are and whether a multitude of offerings from NPS could overwhelm investors.

What Is MSF?

While existing NPS schemes serve all subscriber segments, MSF schemes are available only for non-government subscribers, including self-employed individuals, gig workers and others. PFMs can offer schemes with variants ranging from low, moderate to high risk.

Greater Equity Exposure: MSFs offer up to 100 per cent equity exposure without having to subscribe to NPS Tier-1. The latter gives two choices—auto and active. Under auto choice, the maximum equity limit is 75 per cent up to 35 years of age, 50 per cent up to 45 years of age, and 35 per cent at 55 years and above. Under active choice, one can increase equity limit at any age, but up to 75 per cent.

Other Asset Classes: MSF schemes can invest in the same asset classes as common schemes. These include equity, government securities (G secs), corporate bonds, and alternative investment funds (AIFs). However, the proportion of investments in various asset classes can be customised by PFMs.

Lower Vesting Period: The new schemes have a minimum vesting period of 15 years, with an option to exit at age 60 or at retirement. So, if you invest in an MSF scheme at age 25, you will be allowed to exit at age 40. However, PFRDA allows a switch from MSF schemes to the common schemes within the vesting period of 15 years and to other MSF schemes after the completion of 15 years.

The new schemes under MSF have a vesting period of 15 years. PFRDA allows a switch from MSF schemes to NPS schemes within this timeframe

The common schemes do not have an explicit vesting period. However, withdrawal from NPS Tier-I account is permitted after 60 years of age. Premature full withdrawal is also allowed, but only if one has maintained the NPS account for at least five years, as per the NPS Trust. Withdrawal from NPS Tier-II account is allowed at any time. One can join NPS until the age of 70 and remain invested till age 75.

Slightly Higher Cost: The charges under MSF schemes at 0.30 per cent are higher compared to the common schemes whose charges are restricted to 0.09 per cent of the assets under management (AUM). In addition to this, PFMs can charge an additional 0.10 per cent if 80 per cent of their MSF subscribers are new enrolments, but this will be payable for three years from the date of the scheme’s approval or enrolment of 5 million subscribers, whichever is earlier.

Taxation: The MSF schemes will enjoy the same tax benefits under the Income-tax Act, 1961, as common schemes. Says Kurian Jose, CEO, Tata Pension Management, “As long as you stay in the NPS architecture, there is no tax influence. If you look at NPS, it’s an exempt exempt exempt (EEE) investment where the last E is exempt a little, not fully.” The lump sum payment is tax-free, but the annuity is taxable at slab rates.

Operational details: Under MSF, subscribers can hold multiple schemes across the three Central Recordkeeping Agencies (CRAs) with separate Permanent Retirement Account Numbers (PRAN).

Rajesh Khandagale, senior vice president-NPS, KFin Technologies, a CRA, explains, “Subscribers can have more than one PRAN, each associated with one CRA. Within this PRAN, subscribers can choose one or more PFMs and one or more schemes under each PFM. These choices will be available in the subscriber portal for each CRA.”

For MSF schemes, PRAN will continue to serve as the operational account for transactions, and Permanent Account Number (PAN) will be the unique identifier.

CRAs manage recordkeeping and back office work, the trustee bank manages contributions, points of presence (PoPs) are the point of contact for subscribers and are responsible for onboarding, switching, and exit formalities.

The Benefits

The key benefits of MSF are personalisation, flexibility, enhanced investment choices, and low cost.

Says Sriram Iyer, managing director and chief executive officer, HDFC Pension Management, “MSF recognises the evolving customer preferences. With greater flexibility that individuals are exercising in the way they work (part time, full time, multiple gig employments, etc.), it is important for retirement-focused products such as NPS to adapt.

“MSF allows an individual to build a basket of solutions suited to their risk appetite and life stage. I would like to reiterate that non-MSF schemes (referred to as common schemes) continue to be available to subscribers. In fact, under the MSF framework, an individual could hold a combination of common schemes and new schemes,” Iyer adds.

Moreover, at a cost of 0.30 per cent, it is among the cheapest products and only marginally costlier than common schemes.

Iyer adds: “The 0.30 per cent per annum charge includes fund management and distribution charges. There is currently a fragmented charge structure under the common scheme, with fees for various PoP services beyond the 0.09 per cent fund management charge (FMC). So, on an overall basis, the 0.30 per cent charge under MSF is comparable to the consolidated costs under the common schemes. Even then, NPS remains the cheapest active fund management option suited for building a retirement corpus over longer timeframes.”

Agrees Suresh Sadagopan, MD and principal officer at Ladder7 Wealth Planners: “The cost structure is very competitive even now.”

Is Too Much Choice Good?

Famous American venture capitalist Guy Kawasaki once said, “When you give people too many choices, it makes them hesitate and not buy.”

So are more choices good or bad? Experts say it could be a challenge for those who do not understand financial products and are shy of going to advisors. Jose says, “Most people may not be financially very astute. So they may find it difficult.”

For them simple products may work best. Says Sadagopan: “A multiplicity of choices results in decision paralysis, as arriving at the decision becomes complex and could take more time. I would bat for keeping the product simple.”

But having options may not always be bad. Adds Jose: “If you look at global examples, there are so many options, and investment advisors guide them (investors) through the options. So, confusion should not be a reason not to have options.”

Retirement Goal Diluted?

NPS is among the most flexible instruments for retirement planning, but to build an adequate corpus, one, needs a long-term commitment. MSF’s 15-year vesting rule may go against this if one withdraws the funds instead of switching to another MSF or common NPS schemes.

“Allowing someone to take out a good portion of the accumulation after 15 years in MSF does not augur well in facilitating a well-funded retirement,” says Sadagopan.

PFRDA has proposed changes in NPS, such as allowing six partial withdrawals instead of the current three, reducing annuity from 40 to 20 per cent, among others. Could these measures defeat the purpose of consistent long-term saving for retirement?

versha@outlookindia.com