Investing is an important part of your financial life. Ideally, a larger chunk of your income should go into investing, but in many cases, debt devours most of it.

It’s difficult to not give in to debt, with some type of loan beckoning at you at every step, promising to offer a better lifestyle and easy cash. Credit card and BNPL (buy now pay later) loans are some examples of these.

On top of that, most households have bigger debts for different needs. For example, you may take an education loan for higher studies, a home loan when you feel ready and find the house of your choice, and a car loan and personal loan for other needs, among others.

It won’t take much time for the debts to pile up, if you are not conscious enough. Loans can weigh down on your finances and lifestyle for which you took the debt in the first place.

Debt-free life is stress-free life. Marketing professional Siddhesh Jamsandekar, 35, understands that well and worked strategically to achieve the goal of being debt-free. When the stock markets fell substantially in 2020, Siddhesh started investing in a mutual fund through a systematic investment plan (SIP). The idea was to pay off the Rs 6 lakh car loan (at an interest rate of 7.05 per cent) he had taken in June 2018 with the profits made through the SIP. “I needed a car for travel, but I really didn’t want to keep paying EMIs for a long time. The market dip opened an opportunity to make some profit,” says Siddhesh.

His strategy worked. His SIP gave good returns over the last two years, and he used the money to foreclose his car loan entirely last month. “I paid about Rs 6.5 lakh, and now I am debt free.”

Being debt-free can also make more room for investments. Siddhesh has now started another SIP of Rs 12,000, the amount that was earlier earmarked for the car loan equated monthly instalment (EMI).

Siddhesh had one loan to pay off, but it may become a problem managing multiple EMIs at the same time. Here are a few ways to get rid of multiple debts.

Avalanche Method

This method involves attacking the costliest loans first.

Multiple loans may leave little or no surplus to prepay any of the loans. If you do not have additional capital, continue your EMIs. “When the loan with the shortest tenure is paid off, you may route its EMI amount towards the highest interest rate loan and so on, until you are done. By focusing on the loans that are the most expensive, in the long run, you would pay less over time with this method,” says Pankaj Kamra, founder, Finology, a Sebi-registered investment advisory.

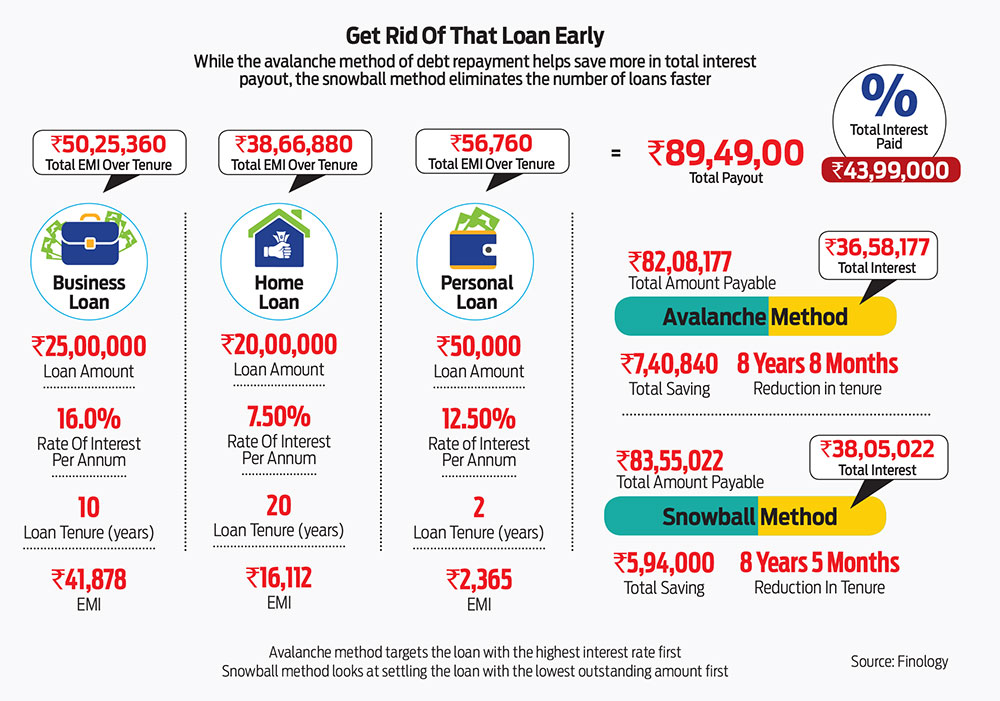

Let’s assume you have a business loan, home loan and personal loan of Rs 25 lakh, Rs 20 lakh and Rs 50,000, respectively (see Get Rid Of That Loan Early). Once the personal loan gets repaid in two years’ time, re-route the EMI of Rs 2,365 to repay the business loan, which has a higher rate of interest than that on the home loan. Calculations show that this method will help you reduce your loan paying tenure by 8 years and 8 months.

“In the normal course, you would have paid a total of Rs 89.5 lakh to become totally debt-free in 20 years, but the avalanche method will help you reach there earlier,” says Kamra.

Another approach to attacking the costliest loan is to look at the quantum of interest payout and not the rate of interest. In the above example, assume there were only two loans—home and personal. While the personal loan has the higher rate of interest, the interest quantum is higher in case of the home loan.

If you have a surplus to foreclose any of your loans, hit the home loan first.

“The higher the rate of interest or monthly interest quantum, the more that loan should be prepaid. Unsecured debt (personal loans and credit card debt) is costlier by rate. But secured debt (home loan or car loan) may attract a much higher quantum of interest. So, borrowers must decide on the basis of their circumstances. For instance, in the initial years of your home loan tenor, despite the low rate of interest, there’s a huge monthly interest outgo. So, prepay this loan first,” says Adhil Shetty, CEO at BankBazaar.com, a credit card and loans platform.

Siddhesh jamsandekar, 35

He prepaid his car loan with the profit from his MF investments

“I needed a car for travel, but did not want to keep paying EMIs for long. I paid about `6.5 lakh and am now debt free.”

But if you have an unsecured debt, such as credit card dues, you will be better off paying that first. “Around 4 per cent monthly interest outgo on credit card will start pinching you, as the debt gets bigger each month. So, prepay this on priority, else you will be paying interest on items like groceries or movie tickets, which is bad for your finances,” explains Shetty.

Snowball Method

Under the snowball method, you tackle the loan with the lowest outstanding first. “Once that debt is paid, you take the money you were putting towards that payment, and roll it onto the next-smallest loan. Ideally, this process would continue until all debts are paid off,” says Kamra.

In the same example, once the personal loan is paid off, the EMI can be added on to the EMI of the home loan first, because it has a lower outstanding compared to the business loan. In this case, the total tenure will reduce by 8 years and five months (see graphic).

“The snowball method provides the much-needed psychological boost as you see debts getting eliminated from your books one by one, while you continue with the arrangement. If you prefer to see progress quickly, then the snowball method may be a better fit for your debt management goals, even though the avalanche method is more effective in terms of savings and timeline to become debt free,” says Kamra.

The Last Resort

If you find yourself stuck with high-cost loans, such as credit card debt, which can be as high as 35-40 per cent per annum, you would be better off taking a personal loan, which comes with a relatively lower rate of interest to pay off the hgh-cost debt.

Delhi-based mutual fund distributor Avdesh Mishra, 31, took a personal loan at 11.50 per cent when he realised the Rs 20 lakh loan he had taken from his broker at 24 per cent was too expensive.

If nothing works for you because of the quantum of the total EMI outgo and you are unable to handle the situation on your own, you could approach a financial advisor or a debt counselling centre. They help in reducing the liabilities based on your specific financial situation.

“If a person has multiple loans, I will check whether he can manage the ongoing EMIs along with mandatory investment for other important goals, such as retirement, children’s higher education etc. If he can manage both, he is not in a bad position, otherwise I’ll ask him to use the monthly surplus to foreclose loans in the correct order,” says Melvin Joseph, a Sebi-registered investment adviser and founder of Finvin Financial Planners.

The availability of easy loans does seem enticing, but unless it is a compulsion, stay away from debt.

The author is a Financial Journalist