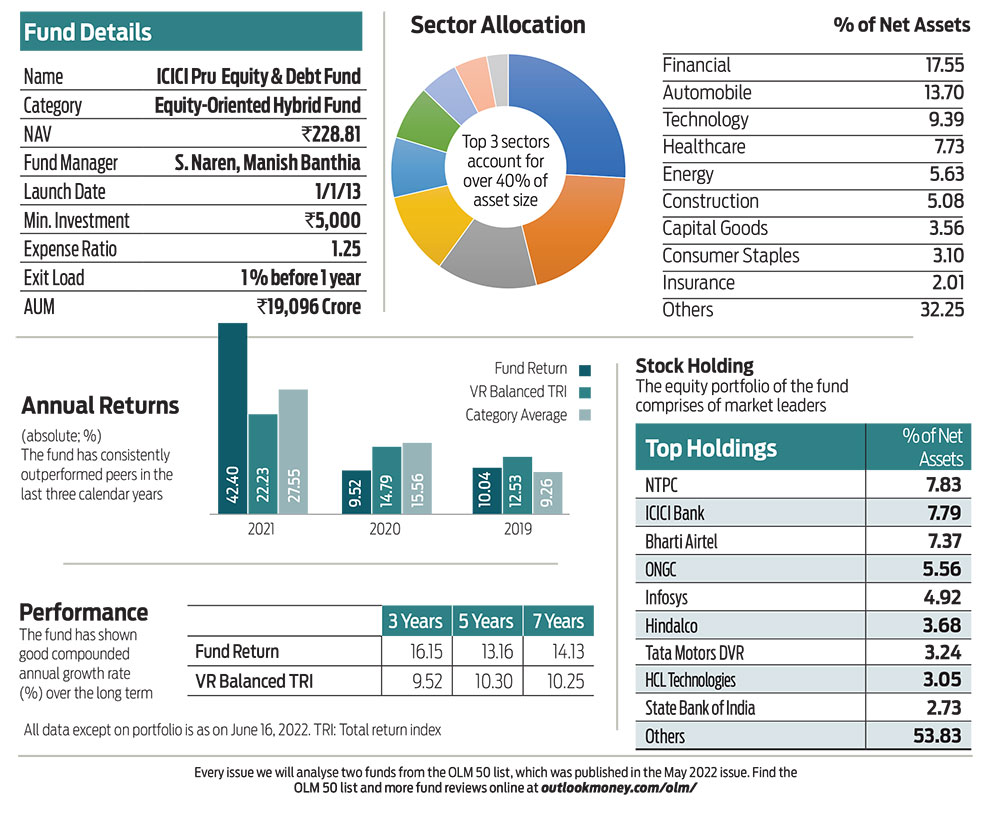

ICICI Prudential Equity & Debt Fund

Perfect Balancer

With volatility engulfing the equity markets, and debt offering better returns, it is ideally advisable to invest in a fund that derives benefit from both these asset classes. ICICI Prudential Equity & Debt Fund is one such fund that offers investors a blend of safety and capital appreciation. It combines a portfolio of high-quality equity stocks, safer debt, and money-market instruments.

It maintains an equity portfolio of 65-70 per cent with the rest in debt, cash, and cash equivalents. The fund manager has balanced out the exposure to equity by increasing or decreasing investment in debt, which consists of high-rated sovereign, AAA- and AA-rated papers, ensuring both credibility and safety.

Its long-term performance and ability to contain volatility makes it a good investment option for those seeking advantage of both debt and equity markets. Consistent performance makes it a worthy investment for your portfolio.

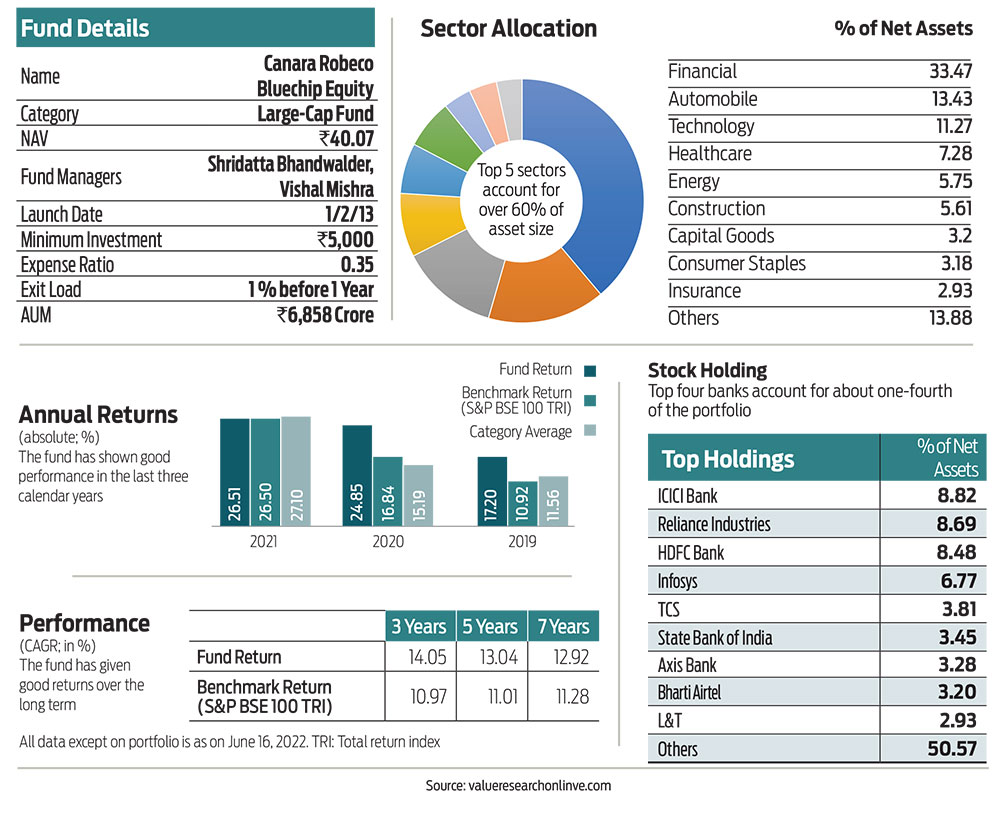

Canara Robeco Bluechip Equity

Consistent Performer

This is a good choice for those who wish to begin investing in equity funds that have a long track record of superior performance, and proven ability to protect downside better than their peers during market downturns. The fund has consistently outperformed its benchmark on an annual basis in the last five years. Since its inception, it has managed to deliver steady returns rather than superior returns, a consistency that makes it worthy of being a part of an investor’s core portfolio. Focused exposure to large-caps makes it well-suited for

all market conditions.

The fund follows a concentrated portfolio strategy with 45-50 stocks, which is fine given its size. It follows a focused investment strategy and invests in companies and sectors that are expected to perform better than the market.

The fund uses a proprietary quant model to identify winning stocks for the portfolio. The fund manager’s ability to spot the winners and astute stock picking have been key to its consistent performance over time.