Over the last two years, the Indian equity market had one of its best phases, thanks to the liquidity injected by the US Federal Reserve and other global central banks, in a bid to help citizens overcome the pandemic-induced hurdles. This swan song period came to an end though when inflation started touching multiple-decadal highs in several parts of the world.

The ensuing quantitative tightening and hiking of interest rates was a swift one to tackle the inflation menace which started off with the Russia-Ukraine conflict in February 2022. The equity markets, too, reacted sharply with double-digit corrections in several economies.

Amid all this, India was relatively insulated because the Reserve Bank of India (RBI) and the government, through various policy measures, judiciously manoeuvred the challenging times. In the meanwhile, corporate India, too, deleveraged its balance sheets significantly. Credit growth took off and corporate profits-to-GDP improved to a decade-high, creating further headroom for capacity utilisation (currently at 72 per cent).

The strengthening of India Inc. balance sheets coupled with robust policy measures and execution ensured that India remains one of the most structural markets in the world.

One of the strong tailwinds for India going forward is the manufacturing opportunity. The positive developments in the manufacturing space came in the form of production capacity expansion, policy support through production-linked incentive (PLI) scheme and the likes, increased investments from venture capitalists (VCs), private equity (PE), among others.

All of these are enabling a robust pipeline for India’s sustained economic growth over the next decade. With increased domestic manufacturing, the positive ripple effect is expected to be visible across sectors and also in terms of employment. Further, many sectors in India over the last decade have gone through a consolidation phase. This means better pricing power and larger market share for the existing players.

Consequently, from the perspective of foreign investors, India presents a secular growth story unlike any other emerging or developed market. Valuation-wise, India remains one of the most expensive markets globally, given the rising optimism around the Indian economy amid global turmoil.

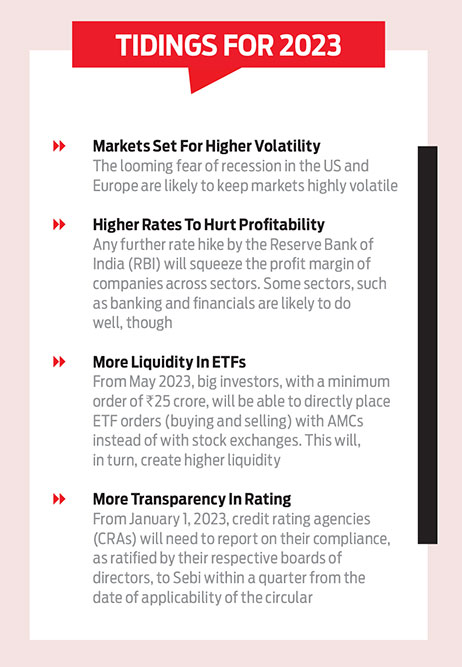

From an investment perspective, the year ahead will be an interesting one, as foreign investors will have to choose between investing in a structurally strong market and a valuation-wise inexpensive market. Either of these decisions will have consequences for the Indian market. But, overall, there is not much to worry for India.

Way Forward For Investors

Given these circumstances, it is better for investors to stick to asset allocation and continue with their investments in a staggered manner via systematic investment plans (SIPs), as markets are likely to remain volatile.

Meanwhile, debt funds appear to be better placed, owing to the higher yields provided by high inflation and rising interest rates. Over the past several months, yields have improved considerably.

Floating rate funds and low duration funds are likely to be great investments for investors in this evolving scenario. Floating rate funds because of their inherent nature to adjust to rising interest rates and coupons which accrue to investors, keep rising, as the benchmark or overall RBI rates move higher. Also, floating rate bonds have a positive correlation with rising interest rates and, therefore, the returns on them are positively aligned to rising rate scenarios.

Dynamic bond fund is another category that an investor can consider. For short-term parking of funds, liquid and ultra-short funds are better placed than any other instrument, given that short-term rates are likely to remain elevated owing to tight liquidity.

An interesting asset class for 2023 is likely to be gold. After the structural failings in cryptocurrencies, combined with global central banks tapering, commodities like gold and silver look interesting. Another aspect which works well for the yellow metal is that cryptocurrencies are no longer the source of comfort for investors globally. In this scenario, an increased allocation to gold is likely, as they are not dependent on any central exchange or individuals. One of the tactical ways to allocate to gold is via a multi-asset fund, where the fund manager will be investing across equity, debt, gold and other asset classes. In this manner, an investor can have calibrated exposure to gold.

To conclude, the year ahead presents an interesting case for debt, gold and multi-asset investing. In case of equities, investors will be well-placed by opting for schemes which have the flexibility to invest across market capitalisations and sectors/themes. Continue with SIPs and do not be deterred by short-term volatility which could play out from time to time.

Sankaran Naren Chief Investment Officer (Equity), ICICI Prudential Asset Management Co. Ltd