When Astrid D’Silva, 33, got an offer to work as a compliance officer in the UK around two years ago, her biggest worry was taking care of the medical needs of her senior citizen parents. So, before leaving, she set up an emergency corpus of Rs 10 lakh for sudden medical expenses and bought a health cover for her parents. “My sister stays in India, and that’s comforting, but I wanted to ensure that my parents are taken care of in their old age,” she says.

For non-resident Indians (NRIs), taking care of ageing parents back home is a constant worry. For them, distance amplifies every gap in the system, turning even small medical episodes into high-stress situations that can be dealt with foresight, structure, and preparedness.

That means just having a decent insurance cover is not enough. What truly matters is whether the parents can access treatment and funds quickly and smoothly when it counts, along with having an ongoing care plan if required. For that, they need to draw up a holistic plan.

Choose The Right Health Plan

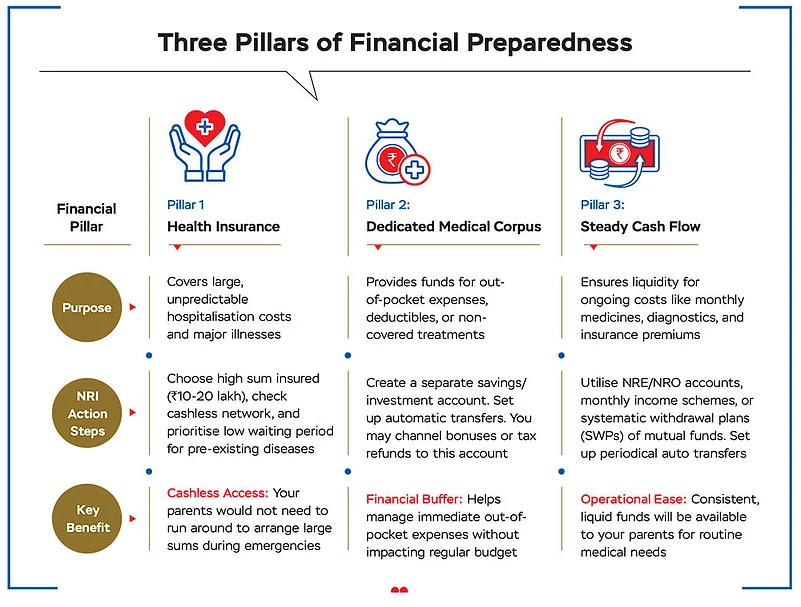

The first thing that NRIs should ensure while choosing a health policy for their elderly parents is having a high sum insured. People are more prone to diseases as they grow older, and with medical inflation rising each year, it is important to have sufficient sum insured to ensure quality care and treatment.

“Given rising healthcare costs, a minimum cover of Rs 10-20 lakh is advisable, with automatic restoration and no-claim bonuses to prevent coverage depletion,” says Narendra Bharindwal, president, Insurance Brokers Association of India (IBAI).

The second aspect to take care of is coverage of pre-existing diseases. Elderly parents are likely to have some lifestyle diseases. So, one should ideally choose a policy that offers shorter waiting periods for pre-existing conditions. “(Some policies) will allow your parents to get a cover for pre-existing conditions, with a waiting period as low as 12 months,” says Amarnath Saxena, chief technical officer – commercial, Bajaj General Insurance.

Third, quick access to a good cashless network hospital is important for elderly parents as it reduces the operational burden, especially when children are staying abroad. It will ensure that “in case of emergencies, they can access treatment quickly without losing time,” says Saxena.

The biggest benefit of cashless treatment is that you don’t have to run around to arrange funds. Says Madhupam Krishna, a Securities and Exchange Board of India-registered investment advisor (Sebi RIA) and chief planner, WealthWisher Financial Planner and Advisors: “In a cashless cover, the insurer or the third-party insurance (TPA) settles admissible bills directly with the hospital. So, parents need to pay only for non-covered items and co-pays instead of arranging the full bill amount at the time of admission or discharge. This is critical in senior care because emergencies (heart attack, stroke, fractures) require immediate admission, and there is often neither time nor capacity to organise funds or manage reimbursement paperwork.”

Cashless treatment is usually available only in network hospitals. Insurers maintain a list of empanelled “network hospitals” on their website; agents too have a list. “NRIs should shortlist insurers whose network includes multiple reputable hospitals (with 24x7 ICU and emergency services) within a short travel radius of the parents’ home and verify this list annually, as panels are subject to change,” says Krishna.

Fourth, one should ensure that the insurer has a high claim settlement ratio. This increases the likelihood of successful claim settlement without last-minute problems.

Get Additional Coverage

Covering all aspects of healthcare is recommended for effectively managing unpredictable healthcare expenses for ageing parents. So, one can buy additional covers or add-ons.

One may supplement the indemnity health insurance product (which pays when a claim is raised) with additional defined benefit products (which pay a lump sum on diagnosis), such as critical illness (CI) insurance and hospital daily cash.

Says Arti Mulik, chief technical officer, Universal Sompo General Insurance: “CI insurance makes a lump sum payment on diagnosis of CI, providing vital support in times of need. Hospital daily cash can be used for ancillary expenses of food and travel that are over and above the hospitalisation costs.”

“Domiciliary treatment is another feature that many standard plans offer; it helps if hospital beds are not available or treatment cannot be provided in a hospital,” adds Saxena.

Another important coverage one should plan for is outpatient department (OPD) expenses, because these are more frequent. “Find a suitable limit that covers the diagnostic tests, consultations, and pharmacy bills,” says Mulik.

Build A Dedicated Medical Corpus

Insurance is a must, but during hospitalisation or even otherwise, there may be out-of-pocket expenses, such as co-payments on a policy or additional expenses on medicines, or commuting to the hospital, among others. A dedicated medical corpus, therefore, comes handy, especially when the treatment is long-winded.

But this corpus cannot be static. It’s important to keep adding to it in sync with medical inflation, and in view of possible future needs as and when any new medical condition emerges. Before deciding on the amount, research about the costs of senior care in the best nearby hospitals.

Says Saxena: “You can create a savings or investment account only to be used for medical expenses. Regular proportional contributions can be made by each of the earning resources of the family based on their earnings. You can allocate unexpected funds, such as tax refunds or any bonus received, to the account you are using for medical savings.”

If multiple family members are contributing to the funds, for better communication and coordination, one can maintain a shared digital file or spreadsheet containing all medical bills, insurance claims, and other medical expenses, adds Saxena.

Create Steady Cash Flow

NRIs now have access to a wide range of remittance-based financial instruments that can allow them to provide for the ongoing medical needs of their elderly parents.

“There are many financial products available today that were created specifically for NRIs, including non-resident external (NRE), and non-resident ordinary (NRO) bank accounts and monthly income schemes,” says Arun Ramamurthy, co-founder, Staywell Health, a health-focused insurance and care platform.

In addition, systematic withdrawal plans (SWPs) are available through low-risk debt mutual funds for planning regular monthly cash flow, which can help cover medical costs or insurance premiums. “Some families set up weekly auto-transfers from their accounts to their parents’ accounts to ensure liquidity for buying medications, scheduling diagnostic tests, or consulting physicians,” says Ramamurthy.

Additionally, under the old tax regime, Section 80D of the Indian Income-tax Act, 1961 provides NRIs the opportunity to claim a deduction on the amount paid as premium on behalf of an individual aged 60 years or more. These are additional advantages that allow families to lower their total out-of-pocket expenses for providing adequate coverage to their elderly dependant(s).

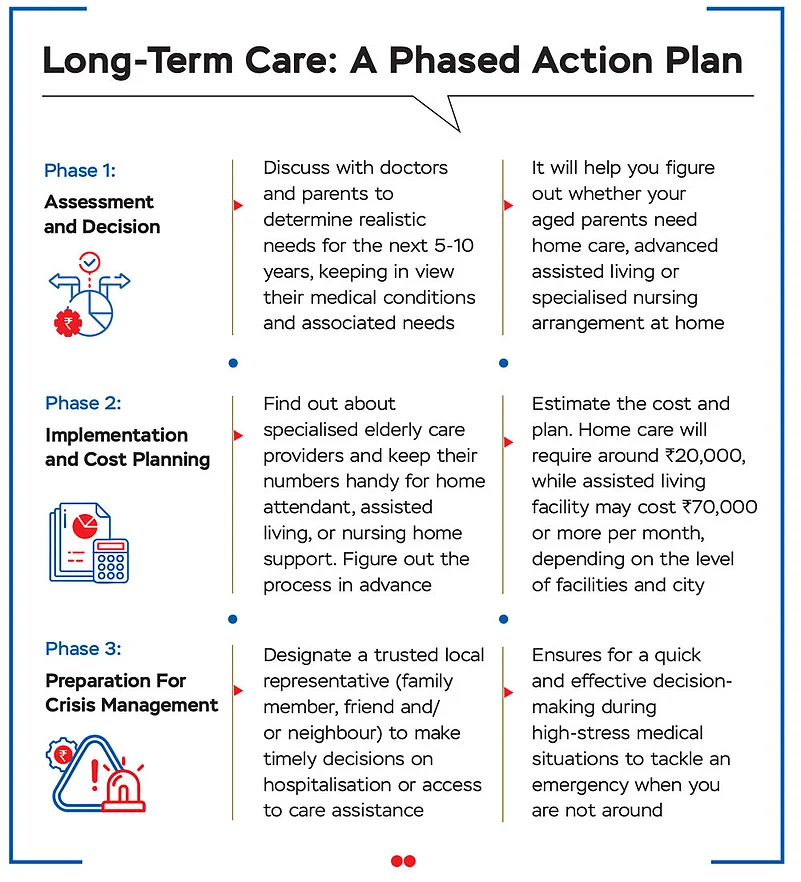

Plan Long-Term Daily Assistance

Long-term care planning is critical for seniors. It usually involves putting in place systems such as home care assistance and nursing. Find out about the processes before a crisis hits to ensure immediate assistance is available when required.

The planning can start with discussions with doctors as well as parents. “Requirements may entail arranging for independent living with help to deal with risks of dementia, fall, and post-stroke care, and so on,” says Krishna. Also, decide whether you want to opt for care at home or at assisted living facilities.

Bharindwal says one can designate a family member or trusted friend to do the needful when required.

Also, estimate the cost and start planning accordingly.

“At present, the ballpark monthly cost of a basic home attendant is about Rs 9,000-20,000. The cost of assisted living or better old-age homes is roughly Rs 25,000-70,000 or more, while intensive nursing at home costs about Rs 60,000 per month or more, depending on the city, the medical complexity and the facilities,” says Krishna.

Lastly, ensure your parents have physical and digital copies of their health cards, policy schedules, ID proofs, and insurer/TPA helpline numbers, and that nearby family members or neighbours know where these are kept. It also makes sense to brief them about the procedure of hospitalisation and arranging follow-up care. Ensure they have a handy list of numbers of relatives, neighbours, friends, and hospital and insurer helplines.