Summary of this article

Economic Survey 2026 was released today

GDP growth in FY27 expected between 6.8-7.2 per cent in FY27

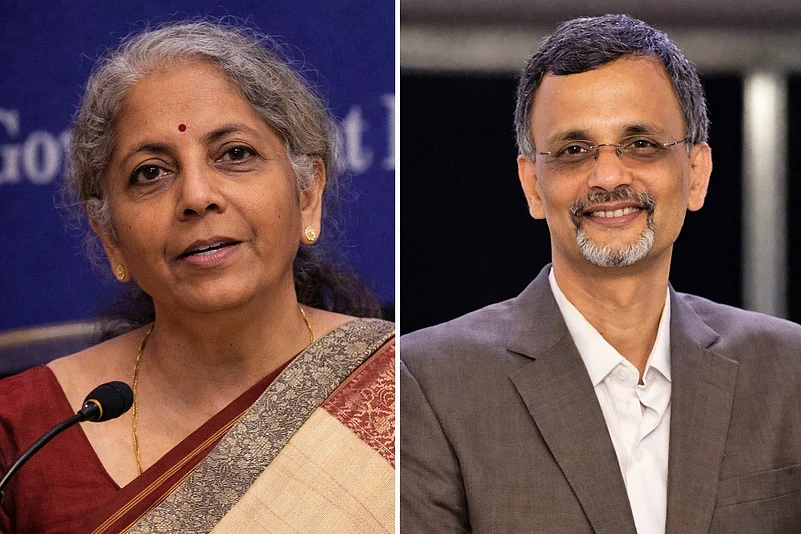

The Economic Survey for the ongoing financial year 2025-26 was tabled in the Parliament by Union Finance Minister Nirmala Sitharaman today, on January 29. The Survey, a precursor to the Union Budget to be presented on February 1, says strong reforms along the lines of macro fundamentals and regulations could help the economy expand at 6.8-7.2 per cent in the upcoming financial year (FY27).

The Economic Survey was prepared by Chief Economic Advisor to the government, V. Anantha Nageswaran, who is also the head of the Economic Division of the Department of Economic Affairs. The report says that while global economic growth remains uncertain, the Indian economy has reflected a firm growth momentum. The Survey reviews the performance of the economy, government policies and gives an outlook for the upcoming year.

Here are the key takeaways from the report.

Domestic Economy At Stable Footing

According to the Survey, the domestic economy was at a stable footing even as the medium-term outlook for the global economy remained weak and has downside risks.

"For India, global conditions translate into external uncertainties rather than immediate macroeconomic stress. Slower growth in key trading partners, tariff-induced disruptions to trade and volatility in capital flows could intermittently weigh on exports and investor sentiment," the Survey said.

The report said that ongoing trade negotiation with the US is expected to be completed during the year, and if that happens, it should reduce the economic uncertainty on the external front. The report also said that strong domestic macroeconomic fundamentals, along with policy reforms in recent years, have helped lift the medium-term growth potential of the economy to near 7 per cent.

"With domestic drivers playing a dominant role and macroeconomic stability well anchored, the balance of risks around growth remains broadly even. Taking these considerations together, the Economic Survey projects real GDP growth in FY27 in the range of 6.8 to 7.2%. The outlook, therefore, is one of steady growth amid global uncertainty, requiring caution, but not pessimism," the Survey said.

Inflation Expected to Rise in FY27

The report suggested that core and headline inflation rates will be higher in the upcoming financial year than in FY26. Inflation in the current year had dropped to new lows, with 0.25 per cent headline inflation reported in October, but has risen from those levels. However, the Survey said that the rise in inflation will not be a reason for concern.

Both the Reserve Bank of India (RBI) and International Monetary Fund (IMF) have estimated a gradual rise in headline inflation in FY27, which will bring inflation around the RBI’s target range of 2-6 per cent.

Food inflation levels are expected to remain at moderate levels in the upcoming months owing to below-normal temperatures and above-normal monsoon.

“The government's efforts to increase fertiliser supply may help keep input prices in agriculture in check, thereby containing inflationary pressures in the food basket. The continued pass-through of GST rate rationalisation into commodity prices may also temper inflationary pressures on the cost side,” the Survey said.

The Survey also highlighted that the rise in inflation could also come due to the rupee’s weakness, which could lead to imported inflation. However, the impact could be limited as prices in global commodities are expected to remain soft.

Fiscal Deficit and Discipline in Consolidation

The Centre’s fiscal deficit stood at 62.3 per cent of the Budget estimates as of November, according to the Survey.

“Based on the broad trends observed during the year, the central government remains well on track to achieve its envisaged fiscal consolidation path, aiming to attain a fiscal deficit target of 4.4 per cent of GDP by FY26,” the Survey said.

To this extent, the Survey highlighted that sovereign borrowing costs will be affected if there is fiscal indiscipline at any state level. The report also put emphasis on the fact that relations between the Centre and states on the fiscal front will also be shaped by the recommendations of the Sixteenth Finance Commission.

With markets taking note of the consolidated government debt, revenue deficits, or higher expenditures at the state levels could also impact sovereign bond yields, the Survey said.

Finance a Catalyst to Development

The Survey highlighted that a fundamental rethinking of finance as an architecture of economic transformation was necessary towards fulfilling India’s development goals.

"Finance is the central enabler. When finance builds trust, fosters competition, and enables innovation, it becomes the catalyst of development," the Survey said. The report also emphasised the need for a simpler and service-oriented tax system for fostering certainty and predictability.

FDI rose during the first 8 months of FY26

During the April-November period, gross foreign direct investment (FDI) saw inflows rising to $64.7 billion, against $55.8 billion during the same period in the previous year, the Survey said. Net FDI also rose nearly seven-fold to $5.6 billion during the same time from a year ago, and inflows came into various categories, including digital services, data centres and IT infrastructure.

"The magnitude of inflows during the first eight months of the year highlights sustained investor confidence despite a subdued global environment and reflects the underlying strength of India’s digital economy, as well as the continued policy emphasis on manufacturing and infrastructure," the Survey said.

MSMEs Crucial in Next Phase of Industrialisation

The Survey said that a calibrated shift towards a model focused on scale, competitiveness, innovation, and deeper integration into global value chains was required to get to the next phase of industrialisation.

For this purpose, India needs to build strategic resilience via diversification and deep capabilities rather than just seeking self-reliance in each segment. It was necessary to increase investment of the private sector in research and development, technology adoption, skills, and quality systems towards this end.

"MSMEs will be crucial in this journey, evolving from micro-scale production toward deeper participation in formal and export-linked supply chains,” the Survey said.

Infrastructure to Remain a Key Driver

Infrastructure now includes digital systems, clean energy, water management, and new technologies, the Survey said. It said that a sustained investment in infrastructure, along with greater participation from the private sector, was necessary.

"Going forward, sustained investment, greater private sector participation, and a focus on decarbonisation, digitalisation, and resilience will be crucial. Infrastructure will remain a key pillar of India’s medium-term growth and its long-term Viksit Bharat at 2047 vision,” the Survey said.

Global Growth Outlook

The Survey said that global growth is expected to remain moderate, but the downside risks to it dominate. With surging market valuations as investors build on artificial intelligence capabilities, a risk of correction also looms.

"(If) AI boom fails to deliver the anticipated productivity gains, it could trigger a correction in overly optimistic asset valuations, with the potential for broader financial contagion,” the Survey said.

Additionally, mounting uncertainties on the global front are also led by possibilities of trade conflicts, which could potentially further weaken the global growth outlook and weigh on investments.