In India, investing in real estate is considered to be a very lucrative form of investment. Many people want to invest in houses or apartments to earn a passive income from rentals. But along with the benefits, there are also responsibilities that you have to shoulder. Rental incomes are not without taxes.

According to the Income Tax Act 1961, the rental income from a house or building is taxable under - Income from House and Property. However, if the property owner earns any income from renting out their vacant land and any other property, such income will be taxable under Income from Other Sources.

It is crucial to understand taxation on rentals for both owners and rentals.

Taxation On Rentals For Owners

The rental income earned by the owner/s of property is taxable as income from house property. However, certain deductions are available from the same, which are paid municipal taxes, irrespective of the year to which the same pertains. In addition, further standard deduction @30 per cent is allowed on net annual value, which is gross rent less municipal taxes.

Says Anita Basrur, partner, Sudit K Parekh and Company LLP: “Over and above these, interest on borrowings for the purposes of purchasing the property is also allowable. The entire interest paid, in respect of let-out property, is allowed. However, the loss on account of interest to the extent of Rs 2 lakh is available for set off against other income earned during the year, and the balance amount of loss on account of interest over and above Rs 2 lakh is only allowed to be carried forward and set off in the subsequent years up to a maximum of eight years.”

Also, interest on the pre-construction period is allowed as a deduction in five equal installments starting from the year the property construction is completed. It is to be noted that if a property is co-owned, the rental income would be taxed in the ratio of their share, and the deductions would also be similar. The principal amount of the loan repaid is allowed as a deduction u/s 80C up to Rs 1.5 lakh. In respect of property that is held as stock in trade and the same is not let out, no income is taxable up to two years from the year in which the certificate of completion of construction is received. Thereafter, the taxability would be on a deemed let-out basis.

Taxation On Rentals For Tenants

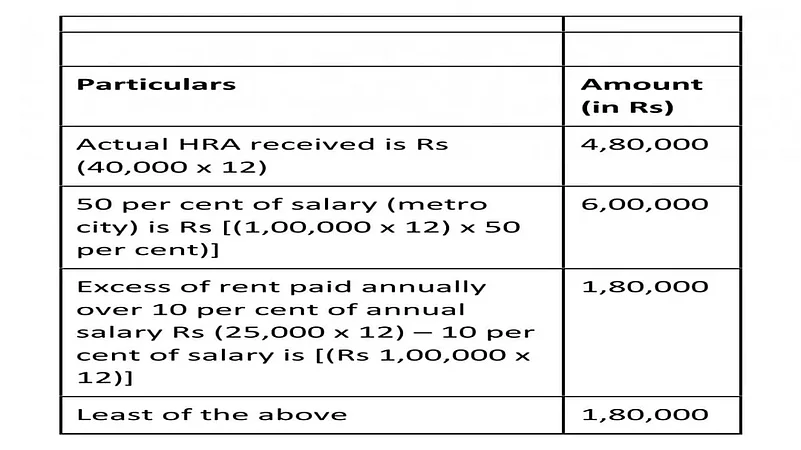

The Income Tax law allows a deduction of House Rent Allowance (HRA) in the case of salaried employees if and only if HRA forms part of the salary. To claim this deduction of HRA (rent payment), the employee should live in a rented property, and the rent is paid. The deduction amount is restricted to the least of the actual HRA received; rent paid more than 10 per cent of salary or 50 per cent (40 per cent in case of non-metro cities) of salary. This deduction is not available if the person lives in an accommodation owned by him.

For persons other than employees, rent deduction is available up to Rs 5,000 per month or 25 per cent of total income, whichever is lower. “In case a person avails a home loan and pays interest on the same, the deduction for interest is available, as per limits specified, irrespective of the fact that the person is living in rented accommodation. It is to be noted that the deduction of both HRA and housing loan can be availed only if the person is working in a city different from where he owns the accommodation,” adds Basrur.

For example, an individual with a basic monthly salary of Rs 1 lakh receives an HRA of Rs 40,000 and pays Rs 25,000 for accommodation in a metro city. To avail of HRA benefit, the least of the following amount (yearly) is exempted; the rest is taxable:

Rs 1,80,000 is the least among the above-obtained figures. Hence, Rs 1,80,000 is the exempted HRA, and the rest of the HRA i.e. Rs 3,00,000/- is taxable.