Summary of this article

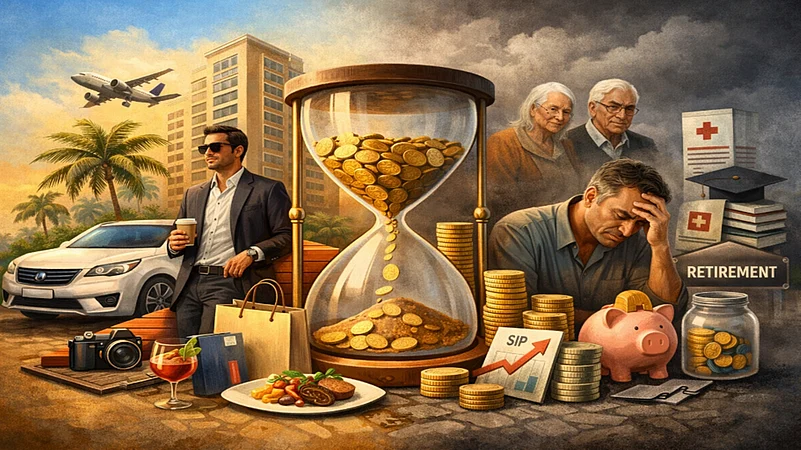

Many people overlook the power of compounding. Money invested in your 30s has decades to grow, money delayed has to work much harder later.

The problem isn’t spending, it’s allowing spending to rise faster than savings.

Delaying serious investing means saving larger amounts later, often under pressure, with less time for compounding to do its work.

When Gurugram-based product manager Rakesh turned 30, life looked settled. His salary had crossed Rs 12 lakh, his career was on track, and his lifestyle finally matched the effort he had put in through his twenties. A better apartment, a car on equated monthly instalments (EMI), regular holidays, dinners out – it all felt earned.

What didn’t change was his savings.

At 25, earning Rs 6 lakh, he used to save about Rs 8,000 a month. At 30, earning double, he is still able to save the same amount. The upgrades happened automatically. The wealth-building didn’t.

A decade later, at 40, he was earning well, but feeling behind. His daughter’s education loomed large, his parents needed financial support, and retirement felt worryingly underfunded. Despite earning over a crore across 10 years, his investment corpus stood at just Rs 18 lakh.

That, in essence, is the biggest money mistake Indians make in their 30s – not bad decisions, but unconscious ones.

The Decade Most People Underestimate

The 30s sit at an uncomfortable intersection. Income rises meaningfully, but responsibilities haven’t yet peaked. It feels like the right time to enjoy the rewards of hard work. And socially, that’s encouraged. But financially, this decade is decisive.

Says Sanjiv Bajaj, joint chairman and managing director, Bajaj Capital: “Your 30s are when income grows, but so does the temptation to spend it all. The real difference between financial comfort and stress later often comes down to whether savings grew along with income or stayed static.”

What many overlook is compounding. Money invested in your 30s has decades to grow. Money delayed has to work much harder later.

The Lifestyle Inflation Trap

The pattern is predictable. Higher salary means a better house, car upgrade, lifestyle subscriptions, and travel. Each decision feels reasonable on its own. Together, they consume every raise. The problem isn’t spending, it’s allowing spending to rise faster than savings. When income doubles but savings don’t, wealth quietly stalls.

If he had simply increased his savings in proportion to income from Rs 8,000 to Rs 15,000 a month, his corpus at 40 would have been nearly double. That gap doesn’t stay small. Over 20 more years, it compounds into crores.

Adds Bajaj: “Earning more does not automatically mean building wealth. Wealth is created only when the gap between income and spending widens, year after year.”

Why Catching Up Is Harder Later

Many people assume they will save more in their 40s. Some do. Many can’t. School fees rise. Healthcare costs increase. Aging parents need support. Career risk goes up, not down. The flexibility your 30s offer of time, energy, and fewer obligations doesn’t last forever.

Delaying serious investing means saving larger amounts later, often under pressure, with less time for compounding to do its work.

What Actually Works

This isn’t about extreme frugality. It’s about intention.

Tie savings to income growth. With every raise, divert at least half the increase into investments before upgrading lifestyle.

Start retirement investing early. Even modest systematic investment plans (SIPs) in your 30s outperform aggressive saving later.

Build protection alongside wealth. Health and term insurance are cheapest and easiest to get before health risks rise.

Invest beyond savings accounts. Long-term goals need assets that can outpace inflation.

Understand your money. Financial literacy compounds just like returns ignorance compounds losses.

The Quiet Cost of Inaction

The tragedy of this mistake is that it doesn’t feel like one until years later. There’s no single bad moment, just a decade where money flows in and flows out, leaving little behind. Your 30s are not an extended reward for surviving your 20s. They are the foundation for the freedom or financial stress of everything that follows. And the most expensive mistake isn’t earning too little. It’s earning well and letting the decade slip by unnoticed.