The Securities and Exchange Board of India (Sebi) on January 29, 2025, announced a crackdown on financial influencers who are apparently spreading misinformation under the guise of imparting financial education.

In an attempt to curb the spread of false information on stocks and financial planning, Sebi implemented a few updates barring people not registered with regulatory bodies from using data relating to stock or security prices of the last three months in their information dissemination campaigns or broadcasts.

What Are The Restrictions On Authorised Advisors And Their Agents?

Here are the restrictions imposed by Sebi.

1] Any individual regulated by Sebi and their agents should not have any direct or indirect association with a person involved in spreading illegal equity advice or misleading content under the likeness of education.

2] Sebi also emphasised that an individual who educates others via social media platforms can not use the stock market price of the last three months.

These two prohibited activities according to Sebi are:

A: Providing advice or any recommendation, directly or indirectly, in respect of or related to a security or securities, without being registered with or otherwise permitted by the Board to provide such advice or recommendation

B: Making any claim of returns or performance expressly or impliedly, in respect of or related to a security or securities, without being permitted by the Board to make such a claim.

Why Sebi Cracked Down On Finfluencers?

With the rise of financial influencers on social media platforms, Sebi has been constantly putting effort into tackling the problem of deceit or misinformation online under the garb of financial education.

Many self-proclaimed financial gurus have been providing stock tips as recommendations without any qualification or following guidelines. This had put a lot of retail investors at risk.

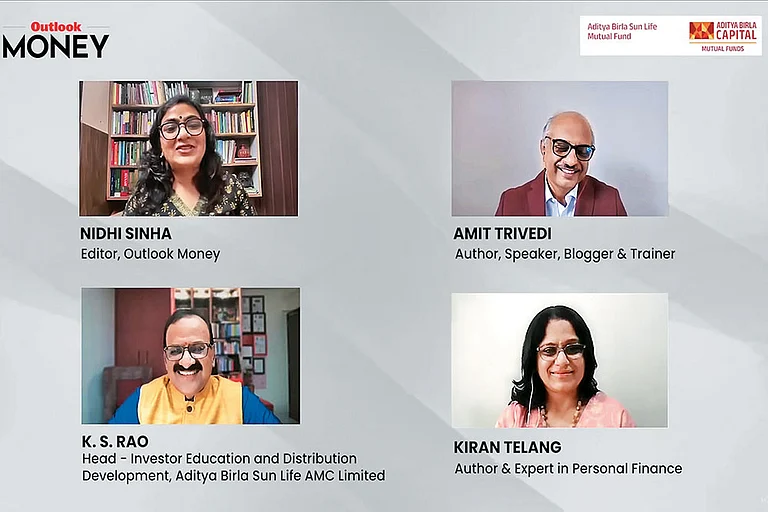

The Role Of Financial Advisors

However, it is not practically possible for every individual to do their due diligence while investing due to reasons, such as paucity of time, knowhow or understanding of the subject.

In such cases, an individual has to seek the advice of financial advisors. However, it is crucial to pick the right advisor.

Legitimate financial advisors can give more insights and reliable information on investment.

A certified financial planner (CFP), certified financial analyst (CFA) and Sebi-registered investment advisors (Sebi-RIAs) are authorised and regulated by industry bodies. These professionals also have to keep themselves updated in accordance with the norms specified by the respective regulatory bodies.

Follow Outlook Money's Budget 2025 Coverage Here.

Meanwhile, a finfluencer may not have had formal training in the domain. A lot of their advice is based on their personal experiences and can be driven by vested interest. This leads to biased and even unreliable financial advice being circulated and made to believe as trustworthy.

Choosing The Right Financial Advisor

Choosing the right financial advisor from the clutter is a challenge.

If an individual is in a phase of their life where they have their family and financial responsibilities to take care of, it is better to look for someone who is a certified advisor and has the skill and expertise to navigate the pitfalls and help you reach your financial goals.

One should also assess if one needs to meet the advisor in person or offline. If the goal is achievable through online meetings. It opens accessibility to certified advisors all across the country over the Internet.

Someone who is not very familiar with online platforms should go for advisors who are available offline and live in the same city.

What Are The Red Flags To Avoid?

If an advisor is more focused on pitching a product instead of understanding your financial need and goal, then it is a red flag.

Second, if someone talks about insurance products as an investment, treat it as a red flag.

Third, if someone pushes for a new fund offer (NFO), or a newly launched mutual fund that hasn't been heard about, it could be a possible red flag.

Additionally, notice the focal point of the advisor during the initial meetings. If it is more about a product and less about understanding your financial needs, take it as a warning sign.

What Should Be An Advisor’s Qualifications?

Sebi-RIAs are authorised to act as investment advisors by Sebi. An RIA should be registered with Sebi. Sebi-RIAs typically charge a fee for giving professional advice. One can even get in touch with an investment firm that can give services to both Sebi-RIAs.

A CFP can also help in reducing debts, choosing the right insurance, retirement planning, estate planning and other financial planning rather than just helping in investments and growing funds.

Chartered accountants are often seen as experts in the field of finance. However, their expertise lies in taxation, audit, advisory and other related financial matters. They may or may not have the skills or expertise to suggest the right product or the asset allocation for investment purpose in relation to one’s specific investment goals and tenure

Mutual fund distributors also offer advisory service. However, they work on a commision basis, so their advisory may not be in your best interest. Second, they may not be registered with Sebi as Sebi-RIAs, and, so, may lack the professional skill, expertise, and most importantly, permission from Sebi to offer financial advisory service.