Summary of this article

Growth to continue, but slower: Housing prices are expected to rise in mid-single digits in 2026, with sharp divergence across cities and micro-markets.

Premium segments to outperform: Luxury and well-located projects may see stronger traction, even as mass and mid-income segments stabilise.

Limited scope for correction: High construction costs and disciplined supply are likely to prevent any broad-based price decline.

Buyers gain leverage in select markets: With volumes normalising, end-users may find better negotiation opportunities outside prime, high-demand projects.

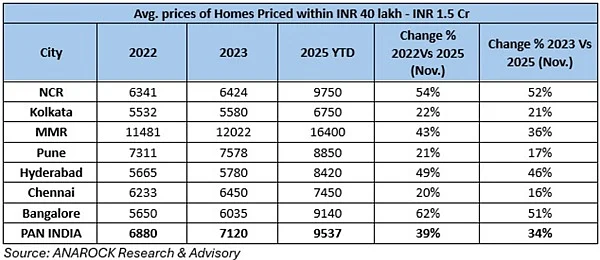

Housing prices, which have risen sharply since the Covid-19 period, continued to rise through 2025, though the pace varied sharply by city and micro-market. The average residential prices across the top seven cities surged by a sharp 21 per cent in 2024 compared to 2023, rising from Rs 7,080 per sq ft at the end of 2023 to Rs 8,590 per sq ft by the end of 2024, according to Anarock Research.

So far as the current year is concerned, on an annual basis, average housing prices across the top seven cities in India increased by 8 per cent, rising from Rs 8,590 per sq ft at the end of Q4 2024 to around Rs 9,260 per sq ft by Q4 2025.

Delhi-NCR led the price surge, recording a sharp 23 per cent year-on-year increase, with average residential prices climbing from Rs 7,550 per sq ft in 2024 to close to Rs 9,300 per sq ft in 2025. In contrast, other major cities saw more moderate, single-digit price growth of 4–9 per cent in 2025, a significant deceleration from the 13–27 per cent appreciation recorded in 2024.

The recovery remained largely end-user driven, with premiumisation, infrastructure-led upgrades, and tighter supply in core locations supporting price growth even as volumes normalised in some markets.

Says Sam Chopra, president and country head, eXp Realty India: “At a national level, certain industry research and expert polls indicate that average residential prices rose by about 4 per cent in 2024, accelerating to roughly 6–6.5 per cent in 2025, suggesting that price momentum strengthened in 2025 rather than slowing. From a city perspective, quarterly market assessments across major metros show year-on-year appreciation in all large cities, broadly in the 6-16 per cent range, with sharper gains reported in select markets during the year.”

The price appreciation in most major cities was largely driven by the premium and luxury housing segment, while the mid-range segment continued to drive transaction volumes, especially in infrastructure-led corridors.

Will Housing Prices Continue To Rise In 2026 Or Moderate?

According to industry experts, most forward-looking indicators suggest continued price growth in 2026, though at a more measured and market-specific pace. Premium segments are expected to remain relatively stronger, even as the post-pandemic luxury surge gradually normalises.

“Certain medium-term outlooks project around mid-single-digit annual price growth over the next couple of years at an all-India level,” says Chopra.

Saurabh Garg, co-founder and chief business officer, NoBroker, says that housing prices are unlikely to see a meaningful correction in 2025.

“Demand in most major cities remains structurally strong, and developers have responded to this demand by launching a large number of new projects, particularly in the mid-to-premium segments. With construction costs also remaining elevated, there is limited headroom for prices to move down in a broad-based manner,” he says.

Parvinder Singh, CEO, Trident Realty, observes that India’s housing market delivered a strong 2025, with end-user demand, rising incomes, and steady buying sentiment supporting prices across major cities.

“As we set our sights on 2026, we think the rally can be sustained if we continue practising discipline in supply and remain focused on quality and transparency. Interest rates, job security, and infrastructure will continue to be significant impulses. Today’s buyer is informed and prepared to pay a premium for credible and well-planned communities. This structural demand makes the market healthier than past cycles and supports long-term appreciation rather than short-term speculation,” Singh adds.

The price momentum seen through 2025 reflects confidence in India’s economic story and the growing aspiration for home ownership. “We anticipate this strength to continue into 2026, although the rate of increase may moderate as additional supply enters the market. A growing opportunity lies in senior living, where thoughtful, age-friendly communities are now being viewed as a premium necessity rather than a niche option. As long as policies remain stable, the housing market is expected to grow in a balanced and sustainable way,” says Anil Godara, Founder and Managing Director, J Estates.

Key Positive Drivers:

Infrastructure-led micro-market upgrades translating into tangible improvements in connectivity and commute times.

Sustained end-user demand in top cities, alongside ongoing premiumisation.

Developers focusing on fewer, higher-quality launches with stronger delivery credibility.

Continued participation from NRIs and globally mobile Indians in select markets where usage and rental logic is clear.

“Digitally-enabled distribution, better compliance, and structured advisory are also increasingly influencing conversions, particularly in premium and NRI-led transactions,” says Chopra.

How To Tackle High Prices?

Homes have become more unaffordable for many as skyrocketing prices across the top cities have pushed many aspiring buyers into a wait-and-watch mode.

“Given that housing sales volumes have tapered down in 2025 as against 2024, we may see developers keep a check on prices and not escalate it further, at least till demand begins to take off seriously again,” says Anuj Puri, chairman, Anarock Group.

According to Puri, buyers need to do their research well before zeroing in on a property. Besides this, buyers today have plenty of options to choose from, and they can also negotiate good deals with developers.

However, the top listed and large developers with projects in prime locations may not really leave much room for negotiations if their project is already in high demand.

Adds Puri, “An investor must always keep a long-term horizon for reaping maximum returns.”