By Gaffar P. Kandy

In India’s diverse real estate landscape, one of the critical factors that significantly influences investment decisions but is often overlooked is stamp duty. The state-level tax on the sale and transfer of a property is known as the Stamp Duty and it varies greatly from region to region and has considerable bearing on property acquisition cost, Investing ROI and buyer behavior. For when an Indian is buying property, geography is not the only thing that is determining the view; it is the financial logic that is being reinvented. Every homebuyer, investor and developer has to account for stamp duty, the rate of which varies widely from one Indian state to another. It can radically alter the math of the overall investment.

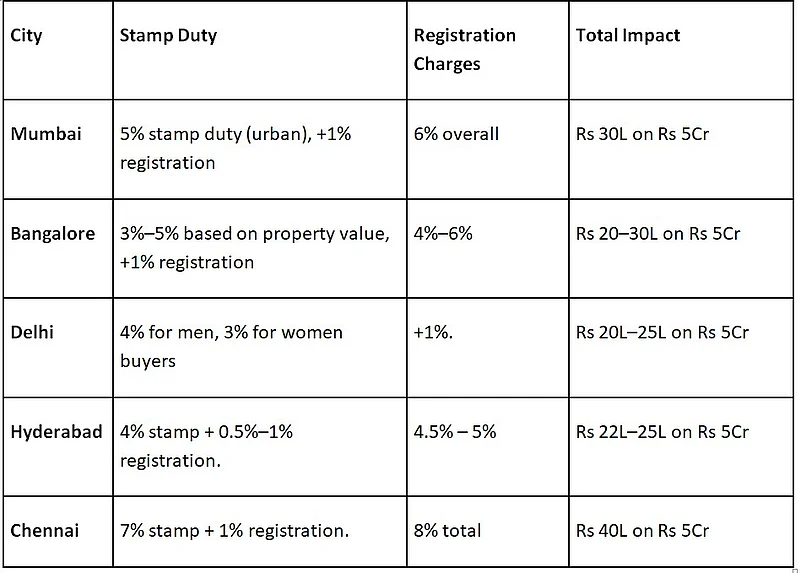

For reference a Rs 5 crore home, the buyer is not only paying for marble, fittings, or location. Several lakhs are also being paid to the government, an amount that depends entirely on the city where the property is located. These variations are large enough to cause buyer sentiment to shift, decision timelines to be delayed, or transactions to be rerouted to states where better tax efficiency is offered.

It’s Not Just a Fee, It’s a Deciding Factor

Stamp duty is a mandatory tax paid to the state government when property changes hands. It’s not something you can skip or push into the future. And while the concept stays the same across India, the rate itself doesn’t. Each state decides its own percentage, which means the same Rs 5 crore property can come with very different price tags depending on where you’re buying. In one city, you may pay Rs 20 lakh extra purely due to how stamp duty is calculated.

Real Decisions, Real Impact

Let’s say someone is choosing between two cities to buy a home. The property prices are similar. Both neighborhoods look promising. But the difference in stamp duty? It could mean an extra Rs 10-15 lakh in upfront cost. That amount isn’t part of the loan, it comes out of pocket. And in today’s world, where most buyers are managing EMIs, family expenses, and long-term investments, that difference matters. This is where planning around stamp duty becomes more than a legal necessity, it becomes a smart move.

How Much Do the Big Cities Charge?

Developers are Re-Evaluating

For the Investors, Every Percentage Matters, Real estate investors in particular tend to think long-term. In response to these regional disparities, developers are adjusting their strategies. Buyers today ask detailed questions, not just about carpet area and amenities, but also about taxes and registration costs.

This shift is especially evident in emerging second-home destinations like Ooty. While Tamil Nadu’s stamp duty stands at 8%, comparable to Goa’s 8.5%, the overall cost of ownership tends to be lower in Ooty. Luxury plots and villas in Ooty offer better value when base property prices are factored in. For instance, a buyer choosing between a Rs 2.5 crore home in Ooty and a Rs 3.2 crore home in Goa could save upwards of Rs 10–15 lakh in combined costs, even if the percentage duties are close. That savings can be decisive.

Today’s Buyer Is More Aware

If you walk into a high-end project site or scroll through property discussions online, you’ll notice something interesting. Buyers are asking sharper questions. “How much is the stamp duty here?” “Is it included in the price?” “Will this affect my return if I rent it out or resell later?” These aren’t just casual questions, they show a deeper understanding of real estate as a financial decision, not just an emotional one. In today’s maturing real estate ecosystem, stamp duty isn’t a bureaucratic afterthought, it’s a strategic lever. Buyers in the premium segment are asking sharper questions, and developers are responding with greater financial transparency.

Ultimately, for anyone investing in property, whether a Rs 2 crore apartment in Bangalore or a Rs 10 crore villa in the Nilgiris, the real question isn’t just how big is the home? It’s: “What’s the real, real cost?” Factoring in stamp duty at the planning stage is no longer optional, it’s essential.

Stamp duty, though a statutory cost, plays a silent yet powerful role in shaping real estate investment decisions. By understanding how variations across states affect the financial dynamics of property purchase, investors can make informed, tax-optimized, and strategically sound decisions.

(The author is Managing Director, 42 Estates)

(Disclaimer: Views expressed are the author’s own, and Outlook Money does not necessarily subscribe to them. Outlook Money shall not be responsible for any damage caused to any person/organisation directly or indirectly.)