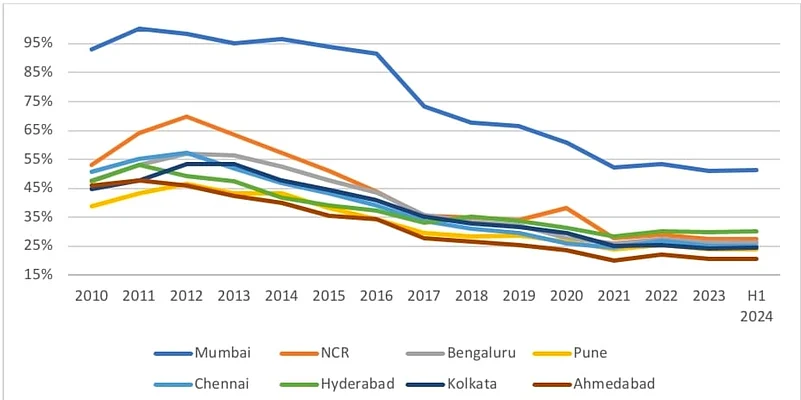

According to Knight Frank India's proprietary Affordability Index research, house affordability remained consistent in H1 2024 (January to June 2024), since loan rates have been steady since late 2023. Ahmedabad is the most affordable housing market among the top eight cities with a 21% ratio, followed by Pune and Kolkata at 24% each. Mumbai is the only city to exceed the threshold, at 51%.

The Affordability Index which tracks the EMI (Equated Monthly Instalment) to income ratio for an average household showed steady improvement from 2010 to 2021. This trend was particularly notable during the pandemic when the Reserve Bank of India (RBI) reduced the policy repo rate (REPO) to decadal lows. The RBI later increased the REPO rate by 250 basis points over nine months starting May 2022 to address inflation, impacting affordability in 2022. Since February 2023, the steady REPO rate and healthy income growth have countered rising prices and high interest rates, restoring affordability to current levels. Demand has been strong since 2023 and continues at multi-year highs in H1 2024. The stable interest rate scenario is expected to persist, supporting ongoing economic growth.

The Knight Frank Affordability Index measures the proportion of income required to fund the EMI of a housing unit in a city. For example, an Affordability Index level of 40% indicates that households need to spend 40% of their income on the EMI. An EMI/Income ratio above 50% is deemed unaffordable as banks typically do not underwrite mortgages at this level.

Source: Knight Frank Research. Note: For H1 2024, affordability and income levels are calculated keeping all variables constant, except for the interest rate

Assumption:

EMI: Based on a 20-year loan tenure, 80% loan to value, and average home loan rates.

Housing Unit Size: Fixed for each city but varies according to average preferences.

Housing Price: Median price for each city.

Source: Knight Frank Research

Shishir Baijal, Chairman and Managing Director at Knight Frank India, stated, "Stable affordability is essential to sustaining homebuyer demand and sales momentum, which, in turn, drives the economy. As income levels rise and economic growth strengthens, financial confidence grows, encouraging long-term asset investments. With the RBI's 7.2% GDP growth estimate for FY 2025 and stable interest rates, income and affordability are expected to continue supporting homebuyer demand in 2024.”

The COVID-19 pandemic catalyzed changes in the residential real estate market, recalibrating property prices and lending rates and significantly boosting demand. This momentum has persisted due to strong economic factors like effective inflation control and robust growth improving home affordability. In H1 2024, affordability reached the highest levels compared to the pre-pandemic year of 2019. For example, Mumbai's affordability index improved by 16 percentage points from 67% in 2019 to 51% in H1 2024. This level has been stable over the past 18 months due to steady policy rates and controlled property price increases.

Sales volumes have been strong, with prices increasing across all markets: Bengaluru saw a 9% YoY growth, while Mumbai, NCR and Pune each grew by 4% YoY in H1 2024. Chennai and Hyderabad saw a 5% YoY growth. H1 2024 marked the fifth consecutive half-year of price growth. Although affordability has improved since 2019, prices have risen across the top eight markets, from 5% in Ahmedabad to 26% in Hyderabad. Mumbai experienced the most significant improvement in affordability recovering by 15 percentage points since 2019. Kolkata's affordability improved from 32% in 2019 to 24% in H1 2024 while NCR and Bengaluru saw a 6-percentage point improvement in the same period.