Summary of this article

EPF wage ceiling revision under active review.

Unions say current limit under-protects workers.

Proposed hike may widen mandatory coverage.

The government is examining the wage ceiling for the mandatory Employees’ Provident Fund (EPF), whether it needs to be revised in sync with today’s wage scale. EPF is a government-backed retirement scheme managed by the Employees’ Provident Fund Organisation (EPFO). It is a cornerstone for workers from the organised sectors for long-term financial planning. Working individuals have to contribute a portion of their income into their EPF, which earns interest over time and provides financial security and stability when the employee retires.

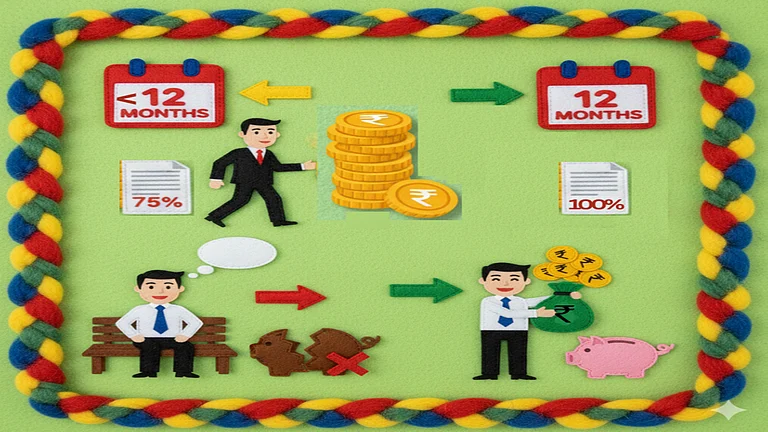

The last revision in EPF was made in 2014, when the ceiling was raised from Rs 6,500 to Rs 15,000 per month. Since then, salaries in the urban areas have risen rapidly.

This decision on whether to raise the wage ceiling for EPF resurfaced after several queries were raised on the issue in Parliament, upon which Labour and Employment Minister Mansukh Mandavia issued a clarification on the matter. Mandavia said the proposal is under active consideration, but it is not yet approved.

Incidentally, while salaries have risen significantly, the prevailing ceiling does not cater to the growing inflation and costs of living. Employee bodies and unions have argued that the current threshold of Rs 15,000 is quite outdated for the present workforce; it also leaves too many workers under-protected and does not reflect current wage structures. Mandatory EPF coverage can ensure that workers save consistently and regularly towards their long-term retirement savings, they say.

According to the employee bodies, if the government approves the suggested increase of the EPF ceiling to Rs 30,000, it would safeguard a larger pool of people. Employees earning up to Rs 30,000 automatically come under the compulsory EPF coverage. This would also strengthen retirement security for people because higher pay will allow them to invest a larger amount towards their retirement funds, ultimately making a bigger retirement corpus.

It is important to note that the new revision will not apply to gig workers, platform workers, freelancers or independent contractors. The Labour Ministry has clarified that these professions fall under the Social Security Code, 2020, which has a separate framework of insurance and welfare benefits other than the mandatory provident fund. Another clause is that employees earning above Rs 30,000 will not be automatically enrolled under this; they will have to voluntarily opt in if they want EPF benefits.