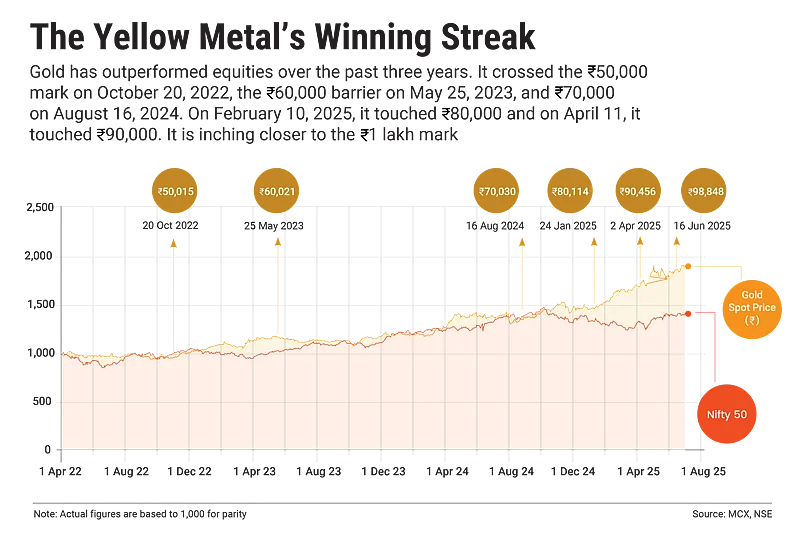

Gold prices are on a record-breaking spree, rewriting history with every surge. Since February 2024, gold prices have been on a spectacular rally, and since the beginning of 2025, they have risen by over 30 per cent. They have also beaten equity returns over the past three years.

On January 24, 2025, the spot gold price on Multi Commodity Exchange (MCX) surpassed the psychological level of Rs 80,000 per 10 gram for the first time, and by the end of March, it breached the Rs 90,000 mark, clocking a gain of a little over 7 per cent in March alone. Now it is on the verge of surpassing Rs 1 lakh. As on June 20, it closed at Rs 98,071.

This robust performance was consistent across major currencies. Spot gold price in the international market crossed the psychological level of $3,000 per ounce on March 18, 2025, and by the beginning of May, it reached $3,392 per ounce, hovering near $3,368 per ounce as on June 20.

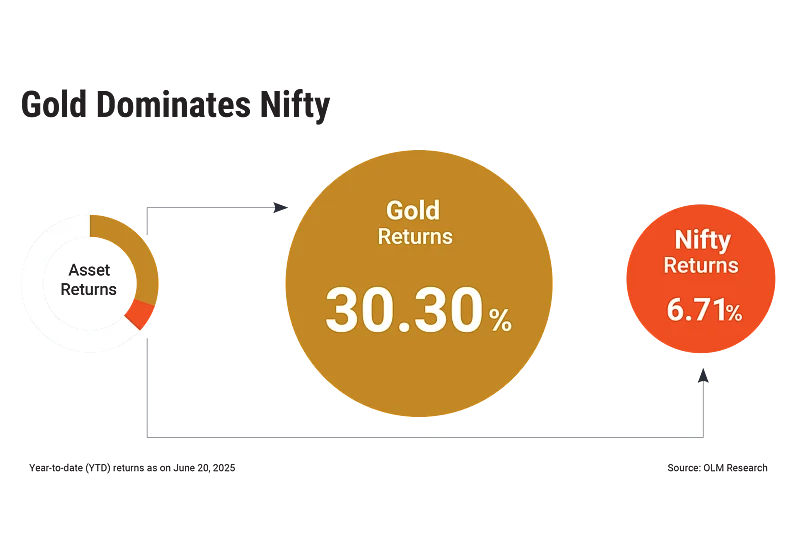

In the race for returns, gold has outpaced the widely-tracked indices Nifty and S&P Sensex by a significant margin in the last three years. The yellow metal has yielded 30.40 per cent returns year-to-date (YTD) as on June 20, 2025, compared to 6.21 per cent returns by India’s benchmark indices Nifty.

What Is Pushing Gold Prices?

The factors that contribute to the rise in gold prices are many. Unlike other commodities, whose prices are primarily driven by demand and supply, the price of gold is influenced by a range of additional factors, such as economic downturns, interest rate trends, and geopolitical tensions. A new factor now impacting gold prices is tariffs.

Ongoing Geopolitical Tension: After four consecutive months of positive returns, gold experienced a slowdown in May 2025, though it remained relatively flat from the April closing figure.

The month of May was marked by significant geopolitical developments, including escalation of tension and a war-like situation between India and Pakistan, potential ceasefire discussions between Russia and Ukraine that are in midst of a prolonged conflict, and the recent ceasefire after days of conflagaration between Israel and Iran. All this added to global volatility, and investors rushed to hold positions in gold, which is considered a haven, helping gold to shine brighter in the investment landscape.

Gold-Buying Spree By Central Banks: As far as demand and supply are concerned, central banks worldwide have been on a gold-buying spree since 2022 to mitigate currency fluctuations in case of adverse situations.

“De-dollarisation is not a new trend; it has been underway for several years, but it has been accelerated from 2022. Central banks are diversifying away from their dollar-heavy portfolios. The motivation behind this shift could be risk management—to mitigate volatility or potential credit rating downgrades of the US—or strategic, to safeguard against sanctions. It’s likely both,” says Vikram Dhawan, head, commodities, and fund manager, Nippon India Mutual Fund.

According to data compiled by WGC, net purchases by central banks around the world reached a record 1,082 tonnes in 2022, more than double the average annual purchase over the previous 10 years. This strong purchase momentum continued in 2024, maintaining 1,086 tonnes. According to the European Central Bank, gold now comprises around 20 per cent of the global central bank reserves.

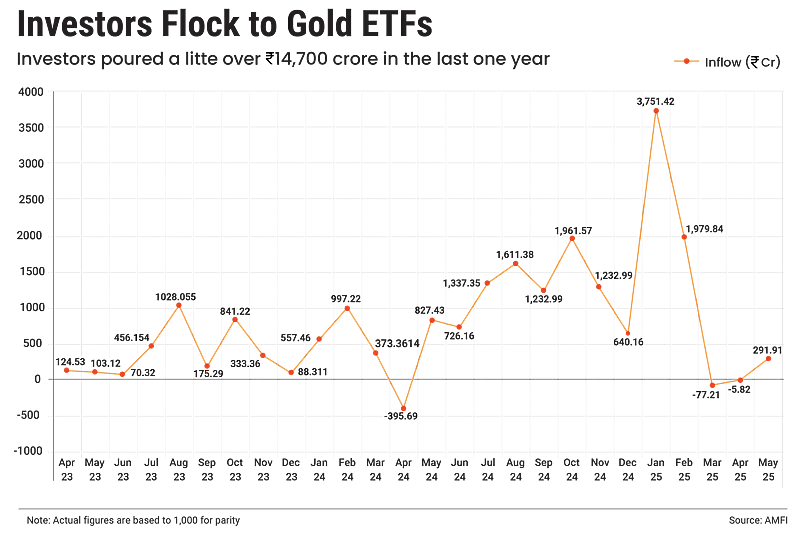

Investors Flocking To Gold ETFs: Along with central banks, investors are also flocking to gold exchange-traded funds (ETFs) amid heightened geopolitical tensions. “Flows into gold ETFs globally have rebounded over the past few quarters after nearly a four-year hiatus,” says Dhawan.

The growing size of gold ETF assets under management (AUM) proves that the gold investing patterns are changing. At present, there are 20 gold ETFs in the market. The asset sizes of gold ETFs have doubled in the last one year. According to the Association of Mutual Funds in India (Amfi), in May 2024, the total AUM in gold ETFs was Rs 31,689.35 crore, which is Rs 62,452.94 crore as of May 2025.

Interestingly, not just in the Global North, investors in China and India have also increased their exposure to ETFs. “Flows into gold and silver ETFs in India have remained net positive in recent years, meaning Indian investors have outperformed many of their global peers by fully participating in the ongoing gold and silver bull market,” says Dhawan. Demand is clearly up.

Traditionally Indians used to invest in gold either in the form of gold jewellery or gold biscuits. But that seems to be changing now. Investors have many more options to choose from, such as digital gold, gold futures, gold ETFs and gold fund of funds.

Trade Tariffs: The tariff situation with the US remains highly fluid, with uncertainty continuing to loom large over global markets. Following the announcement of reciprocal tariffs between major economies, gold prices began to climb, driven by rising economic instability and investor caution. As tariffs fuel concerns over trade disruptions and inflation, investors have increasingly turned to gold. This renewed interest has added upward momentum to prices, already influenced by geopolitical tensions and interest rate volatility.

Will Prices Keep Going North?

Experts say that gold prices will move up further on the back of the ongoing economic and geopolitical scenario. Says Tapan Patel, fund manager-commodity, Tata Mutual Fund: “Gold prices are expected to remain firm in the short term due to global imbalances arising from trade wars and geopolitical tensions. In the medium term, prices are likely to trade within a broad range of $3,200-3,500 per ounce, influenced by trade negotiations and global macroeconomic adjustments.”

Over the long term, buying by central banks and the US Fed rate decision are expected to contine supporting gold as a key component of strategic asset allocation

Over the long term, buying by central banks and the US Federal Reserve’s interest rate decision are expected to continue supporting gold as a key component of strategic asset allocation. Patel adds: “We see limited downside risk, and any price decline may present a good buying opportunity.”

However, experts don’t predict any major decline in the short term. “Gold demand as a portfolio diversifier for both investors and central banks is expected to remain steady in the foreseeable future. That said, we are witnessing some demand destruction in the gold jewellery segment, which is a common consequence of price spikes,” says Dhawan. While some volatility may persist in the coming months leading into India’s festive and wedding season, a significant correction may not materialise if trade tensions escalate or geopolitical risks deepen, he adds.

The price of gold corrected close to 9 per cent from the peak levels seen in April to hit a recent low of $3,178. Says Chirag Mehta, chief investment officer, Quantum Mutual Fund: “Given the unfolding situation on tariffs and geopolitical developments, there was a fair chance of unwinding some of the premium from gold price to extend the correction.”

Mehta, however, adds, that with US President Donald Trump at the helm, it could be the lull before the storm. Trump reinvigorating tariffs on aluminium and steel and challenging the verdict on the legality of tariffs is making his intentions clear. Also, with the conflict escalation, though temporarily paused, between Russia and Ukraine and Israel and Iran, one can’t completely rule out further gains.

Shifting Priorities

With the price of gold soaring to record highs in the recent past, the age-old tradition of gifting gold on auspicious occasions, especially weddings, has become a source of financial strain for many families.

Weddings in India are often grand affairs, and gold plays a central role in these celebrations. For generations, it has been customary for parents to gift their daughters gold jewellery as part of the wedding gifts and trousseau. It is not only a status symbol, but also ensures financial security for the bride. That’s why gold is often called Streedhan traditionally. Close relatives and family friends often gift gold ornaments, coins, or jewellery to bless the couple. According to World Gold Council (WGC) data, weddings generate approximately 50 per cent of the annual gold demand in India.

The rising cost of gold is a growing concern, especially for parents of to-be-brides, who often feel societal pressure to meet certain expectations regarding the amount and type of gold given during weddings. Even relatives who traditionally gift gold are finding themselves reconsidering the quantity or opting for alternatives.

Consider gold as an investment diversification tool. The optimal allocation will depend on your portfolio’s risk profile, but ideally keep it in the 5-15 per range

“Many still prioritise buying gold, but those with financial constraints turn to gold-plated or imitation jewellery that mimics the real thing, just to uphold the tradition without bearing the full financial burden,” says Prashant Jadhav, a Nashik-based jeweller.

Data supports this trend. According to WGC data, the demand for gold jewellery in India has been on a gradual decline since 2021, falling from 610.90 tonnes to 563.40 tonnes by 2024, indicating a shift in consumer sentiment amid rising prices.

Is This The Right Time To Buy?

Since gold prices have gone up by over 30 per cent since the beginning of the year, investors are finding themselves at a crucial crossroad—should they invest now, expecting further rally in gold, or wait for a correction?

There is no clear cut answer to this question. We at Outlook Money usually recommend that you use gold as an investment diversification tool in your portfolio; we do not recommend investing in gold with the aim of fulfilling a financial goal. Ideally, gold should constitute 5-10 per cent of your portfolio.

If the current allocation of gold in your overall portfolios has decreased substantially or you are new to the yellow metal, you may consider realigning your portfolio by investing in it.

Says Dhawan, “When it comes to portfolio diversification, the percentage allocation to gold is more critical than its price. The optimal allocation depends on the portfolio’s risk profile—higher risk may warrant a higher gold allocation. However, allocations below 5 per cent or above 15 per cent are typically considered sub-optimal.”

It is also recommended that one should invest in gold in a staggered manner to take advantage of rupee-cost averaging.

Patel says that considering the current market conditions, gold prices could potentially experience a sharp upturn in the medium term if the current geopolitical situation persists and the US Fed cuts rates.

There are phases when a particular asset class outperforms all others but, typically, this happens with all the assets. Just like gold is outshining other assets at the moment, other instruments like equities have had their days in the sun. These movements are cyclical and over-investing in a single asset can derail you from reaching your financial goal.

So, following the diversification strategy when it comes to buying gold for investment purpose would be the best course of action.

kundan@outlookindia.com