Summary of this article

The festival season brings irresistible offers, easy credit, and social pressure to spend. To avoid falling into a debt trap, set a clear budget, plan credit card use wisely, and make a shopping list to avoid impulse buys. Look for discounts on essentials, save in advance, and keep some liquid funds for unexpected expenses. Careful planning and disciplined spending ensure you enjoy the celebrations without financial stress.

The festival season in India is when people make some of their biggest purchases, with visitor numbers and transaction volumes increasing by as much as 25 per cent. This season begins around late August–September with Ganapati Mahotsava and Onam, and continues all the way through Christmas and New Year.

The season peaks during the Dussehra-Diwali period, which is when most annual bonuses are paid out, boosting disposable income. It is also the time people spend with their family, with many travelling back to their hometowns for the festival. The combination of these factors means people often feel compelled to spend more on gifts, decorations, clothes, and celebrations to keep up with family expectations or social norms.

“Both merchants and lenders capitalize on this festive spirit and come up with special and exclusive offers and easy credit (EMIs, BNPL, credit cards), and make it easy for them to realize their aspirations. So, around the Dussehra-Diwali period, not just the number of applications but the number of approvals are also correspondingly higher,” says Adhil Shetty, CEO, BankBazaar.com.

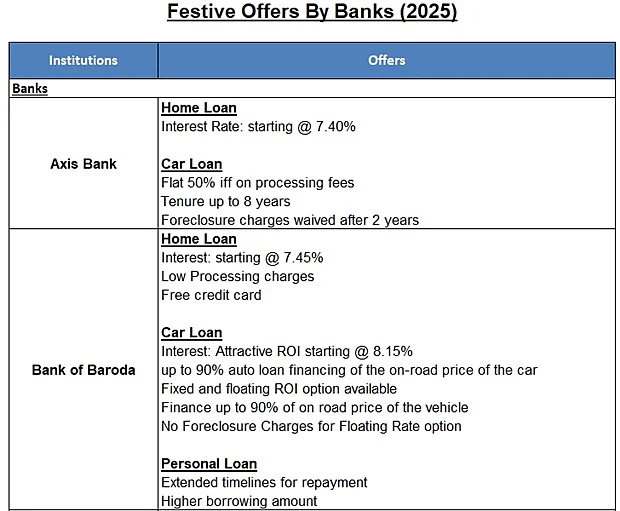

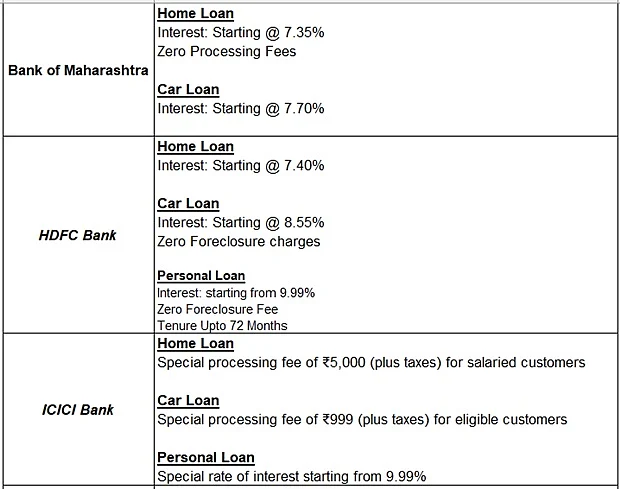

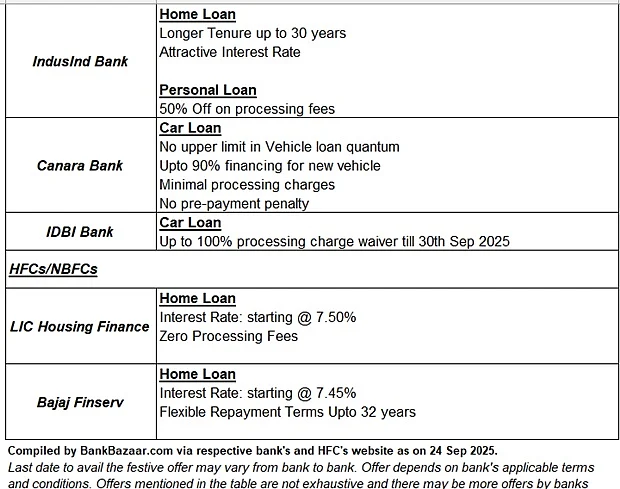

Festive Offers

Many banks and NBFCs come out with festive offers during this time to woo customers and increase their sales. Here’s a look at some of them:

Avoiding Debt Traps

The festive season may be an auspicious time for big-ticket purchases like a home, car, or jewellery, but it’s important to ensure you steer clear of any debt traps. The surest way to avoid falling into debt is by keeping your spending in check and not going overboard.

“The first step to ensure that this doesn’t happen is to make a budget and stick to it. Plan your credit card expenditure too based on how much credit card debt you can manage in future. Once you have zeroed in on an amount that you can spare for your festival shopping, stick to that budget. For times that you overshoot your budget for whatever reasons, have liquid funds at hand. So, start saving up well in time so that you do not have to cut corners,” advises Shetty.

The next important thing that goes hand in hand with saving is planning. Make an exhaustive list of everything you would like to spend on—cloths, accessories, consumer durables, crackers, furniture, gifts for friends and relatives, and more.

Once you are done with the shopping list, start purchasing only the items mentioned in the list and refrain from impulsive buying.

“If you stick to your shopping list, the chances of overshooting your shopping budget will be smaller. Also, keep your eyes open for all the deals, discounts and offers on items on your shopping list. This will help you get the best deals, and even small savings add up in the long run,” advises Shetty.

Managing Spends 101

1. Do not go overboard with the spending.

2. Plan your Credit Card expenditure too based on how much Credit Card debt you can manage in future.

3. Once you have zeroed in on an amount that you can spare for your festival shopping, stick to that budget.

4. Make an exhaustive list of everything you would like to spend on

5. Purchase only the items mentioned in the list and refrain from impulsive buying

6. Keep your eyes open for all the deals, discounts and offers on items on your shopping list

7. For times that you overshoot your budget for whatever reasons, have liquid funds at hand.