Sponsored Content

Highlights:

The scheme is an open-ended equity scheme focusing on the rural and allied theme.

With a significant portion of India's GDP coming from rural areas and the government's focus on improving rural infrastructure and economy, this theme has the potential to provide growth opportunities.

Diversified across large, mid and small caps, providing the benefits of different market caps.

Has the flexibility to change allocation to sectors within the rural theme based on the market conditions to capitalize on market opportunities.

ICICI Prudential Mutual Fund announces the launch of ICICI Prudential Rural Opportunities Fund, an open-ended equity scheme following Rural and allied theme. The scheme shall predominantly invest in sectors contributing to and benefiting from rural India's growth and development. This scheme aims to generate long-term wealth creation by investing predominantly in equity and equity-related instruments of companies involved in rural and allied sectors.

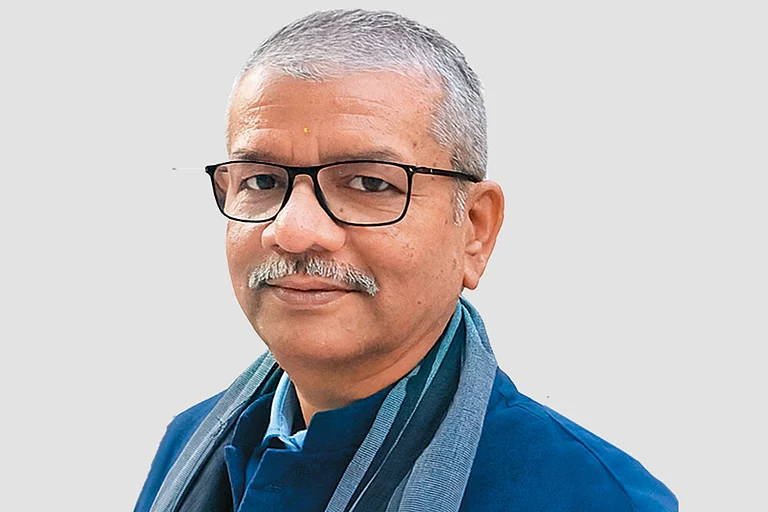

Speaking at the launch, ED & CIO of ICICI Prudential AMC and the fund manager of the offering, Sankaran Naren, observed, “Rural India is the next theme that can have a transformational impact in the next decade. Driven by structural and cyclical economic factors and also due to many state governments’ increased focus on rural development through various initiatives, it is likely going to be the segment that will contribute to economic growth. Therefore, our new scheme aims to leverage these developments, offering investors a chance to partake in India’s rural growth story.”

Source: Economic Survey 2022-23. Govt. of India, Kotak Institutional Equities. PMAY-G: Pradhan Mantri Awaas Yojana – Gramin. JJM: Jal Jeevan Mission. AB-JAY: Ayushman Bharat Pradhan Mantri Jan Arogya Yojana. PMKSY: Pradhan Mantri Krishi Sinchayee Yojana. PMSBY: Pradhan Mantri Suraksha Bima Yojana. MGNREGS: Mahatma Gandhi National Rural Employment Guarantee Act. PMUY: Pradhan Mantri Ujjwala Yojana. DDU-GKY: Deen Dayal Upadhyaya Grameen Kaushalya Yojana (DDU-GKY). LPG: Liquefied petroleum gas.

Why Rural Theme?

India's growth story is intricately tied to its rural development. As the country aspires to become a global manufacturing hub, rural India plays a pivotal role in this transformation. The government has made significant strides in improving basic necessities and the quality of life in rural areas, paving the way for broader developmental efforts. With rural demand rebounding after a decade of stagnation and undergoing positive structural changes, the rural theme holds promise. Its broad scope spans multiple sectors and market-caps, offering flexibility and growth potential across the economy.

Investment Universe of the Scheme

The stock(s)/sector(s) mentioned in this slide do not constitute any recommendation and ICICI Prudential Mutual Fund may or may not have any future position in these stock(s)/sector(s)

Benchmark – Nifty Rural Index

The Nifty Rural Index aims to track the performance of stocks from the Nifty 500 Index, which represent the rural theme. The largest 75 stocks from eligible basic industries are selected based on 6 month average free-float market capitalization.

Data as on November 29, 2024. NSE. Investment strategy will be as per SID The stock(s)/sector(s) mentioned in this slide do not constitute any recommendation and ICICI Prudential Mutual Fund may or may not have any future position in these stock(s)/sector(s). The Scheme can invest in any other Basic industry forming part of the Benchmark index or Companies that have business activities present in rural and/or allied segments.

Sankaran Naren and Priyanka Khandelwal will manage the scheme, which will be benchmarked against the Nifty Rural Index TRI. The fund managers are supported by a capable research team guided by sound investment processes and risk management practices.

For more information, please contact:

Adil Bakhshi, Principal - PR & Corporate Communication

Email: PR@icicipruamc.com

Phone: 91-22-66470274

Riskometer & Disclaimers:

It may be noted that the scheme risk-o-meter specified above is based on the internal assessment of the scheme characteristics and may vary post-NFO when the actual investments are made. The same shall be updated on an ongoing basis in accordance with clause 17.4 of the Master Circular.

Mutual Fund investments are subject to market risks; read all scheme-related documents carefully.

All figures and other data given in this document are dated. The same may or may not be relevant at a future date. The AMC takes no responsibility of updating any data/information in this material from time to time. The information shall not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written consent of ICICI Prudential Asset Management Company Limited. Prospective investors are advised to consult their own legal, tax and financial advisors to determine possible tax, legal and other financial implication or consequence of subscribing to the units of ICICI Prudential Mutual Fund.

Disclaimer: In the preparation of the material contained in this document, ICICI Prudential Asset Management Company Ltd. (the AMC) has used information that is publicly available, including information developed in-house. Some of the material used in the document may have been obtained from members/persons other than the AMC and/or its affiliates and which may have been made available to the AMC and/or to its affiliates. Information gathered and material used in this document is believed to be from reliable sources. The AMC however does not warrant the accuracy, reasonableness and / or completeness of any information. We have included statements / opinions/ recommendations in this document, which contain words, or phrases such as “will”, “expect”, “should”, “believe” and similar expressions or variations of such expressions, that are “forward looking statements”. Actual results may differ materially from those suggested by the forward looking statements due to risk or uncertainties associated with our expectations with respect to, but not limited to, exposure to market risks, general economic and political conditions in India and other countries globally, which have an impact on our services and / or investments, the monetary and interest policies of India, inflation, deflation, unanticipated turbulence in interest rates, foreign exchange rates, equity prices or other rates or prices etc. ICICI Prudential Asset Management Company Limited (including its affiliates), the Mutual Fund, The Trust and any of its officers, directors, personnel and employees, shall not liable for any loss, damage of any nature, including but not limited to direct, indirect, punitive, special, exemplary, consequential, as also any loss of profit in any way arising from the use of this material in any manner. Further, the information contained herein should not be construed as forecast or promise. The recipient alone shall be fully responsible/are liable for any decision taken on this material.

Disclaimer: This is a sponsored article. It is not part of Outlook Money's editorial content and was not created by Outlook Money journalists.