Sponsored Content

Highlights:

The Scheme is an equity scheme focusing on the Conglomerate theme.

The Scheme will invest in promoter-led groups with minimum 2 listed companies across multiple sectors/industries.

Conglomerates tend to have deep pockets, lower capital costs, and has the ability to expand into sunrise sectors, helping them manage down cycles and navigate global volatility.

Investment universe comprises of around 71* conglomerate groups comprising roughly 240* companies across diverse sectors.

The Scheme has the flexibility to invest across the market capitalisations.

ICICI Prudential Mutual Fund has announced the launch of ICICI Prudential Conglomerate Fund, an open-ended equity scheme following conglomerate theme. Conglomerates are promoter-led groups domiciled in India with two or more listed entities across diverse sectors/industries. Backed by strong promoters and diversified operations, these business groups are well positioned to manage down cycles, pursue expansion into sunrise sectors, and capture opportunities across sectors/industries.

Speaking on the launch, Sankaran Naren, ED & CIO, ICICI Prudential AMC, said, “India’s leading business groups have shown remarkable ability to reinvent themselves across decades, whether it is pioneering organized retail, transforming telecom, or entering future-ready areas like renewable energy and semiconductors. They combine scale with vision, and resilience with adaptability. Through this fund, we aim to capture that strength and offer investors a theme that mirrors India’s evolving growth story.”

Why Conglomerates?

Conglomerates enjoy structural advantages that combine resilience and growth.

Deep pockets and strong balance sheets: Relatively high operating cash flows support capital expenditure and working capital needs.

Lower cost of capital: Strong credit ratings can help in volatile times.

Economies of scale: Shared resources, technology partnerships, and large customer bases enable cost efficiency, and talent retention.

Forward, backward & adjacent integration: Many groups expand across the value chain—for example, into logistics, energy, financing arms, or design—thereby stabilizing supplies, lowering costs, and creating new revenue streams.

Ability to manage downcycles: Diversified revenue streams across sectors help them navigate challenging business cycles, acquire weaker rivals, and expand during downturns.

Expansion into sunrise sectors: Conglomerates have presence in areas such as renewable energy, semiconductors, electric mobility, etc.

Why Conglomerates Now?

The current global and domestic environment makes the case for conglomerates stronger than ever:

Global challenges: Reciprocal tariffs, supply chain disruptions, and high borrowing costs are pressuring growth and fuelling inflation. Diversified business groups are better placed to navigate this volatility.

Steady rise in market share: Data shows conglomerates’ share in the Nifty 100 has been rising, reflecting their growing importance in India’s corporate landscape. Source: Nuvama, Data as on July 31, 2025.

Resilient earnings: In periods of weak profitability, diversified business groups have demonstrated relatively more stable cash flows.

Growth across cycles: Whether during infrastructure downcycles, liquidity crises, or telecom disruptions, conglomerates have consistently consolidated market share while smaller players struggled.

ICICI Prudential Conglomerate Fund

The Scheme has the flexibility to invest across market caps—large, mid, and small cap companies—providing a wide canvas of opportunities. The portfolio construction approach will combine structural strength with cyclical opportunities, enabling participation across different phases of the economic cycle. The investment universe comprises 71* conglomerate groups covering approximately 240* companies across multiple sectors.

The Scheme will be managed by Mr. Lalit Kumar and the benchmark for this offering is the BSE Select Business Groups Index. The minimum application amount during the NFO is Rs. 1000

In today’s globally and domestically uncertain environment, conglomerates are better placed not only to protect capital but also to capture long-term wealth creation opportunities. ICICI Prudential Conglomerate Fund enables investors to participate in this opportunity with flexibility across sectors and market caps.

For more information, please contact:

Adil Bakhshi, Principal - PR & Corporate Communication

Email: PR@icicipruamc.com

Phone: 022-66470274

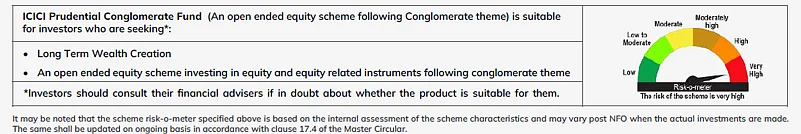

Riskometer & Disclaimers:

It may be noted that the scheme risk-o-meter specified above is based on the internal assessment of the scheme characteristics and may vary post-NFO when the actual investments are made. The same shall be updated on an ongoing basis in accordance with clause 17.4 of the Master Circular.

The asset allocation and investment strategy will be as per the scheme's SID.

* The universe of 240 companies is as per the internal classification which may change in future. For classification of the sectors, AMFI Industry Classification is used. The stock(s)/sector(s) mentioned here do not constitute any recommendation and ICICI Prudential Mutual Fund may or may not have any future position in these stock(s)/sector(s).

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Disclaimer: This is a sponsored article. It is not part of Outlook Money's editorial content and was not created by Outlook Money journalists.