Sponsored Content

Highlights:

The offerings will track an index of India’s top 15 large-cap companies

Equal-weighted structure ensures balanced exposure across all constituents, preventing over-concentration in a few stocks

The underlying index comprises companies from diverse sectors including financials, automobiles, FMCG, and IT

Ideal for investors seeking a rules-based, relatively lower-cost solution to provide exposure towards Top 15 stocks

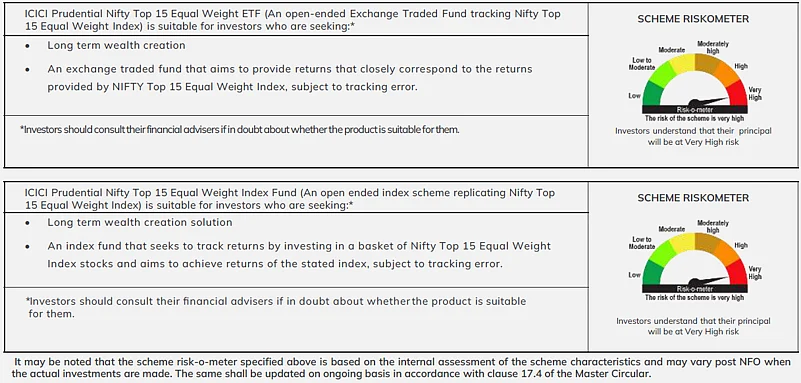

ICICI Prudential Mutual Fund has announced the launch of ICICI Prudential Nifty Top 15 Equal Weight ETF and ICICI Prudential Nifty Top 15 Equal Weight Index Fund, offering investors exposure to a curated list of India’s top 15 companies by free-float market capitalization, selected from the Nifty 50 universe. The New Fund Offer (NFO) will open for subscription from June 10 to June 24, 2025.

The schemes aim to replicate the Nifty Top 15 Equal Weight Index, which assigns equal weight to each constituent stock and is rebalanced quarterly. The underlying index includes large cap companies that are often leaders in their respective sectors, such as financial services, automobiles, FMCG, IT, and telecom. By equally weighting these 15 stocks, the index ensures diversified participation in India's growth story, providing balanced exposure across key sectors and reducing the dominance of any single company or industry.

Abhijit Shah, Chief Marketing and Digital Business Officer at ICICI Prudential AMC said on the launch of these schemes, "With these new offerings, investors gain access to India’s top large caps that are often leaders of their industry, through a simple and cost-effective structure. The equal-weighted approach ensures balanced exposure and helps reduce reliance on a few dominant stocks. This is particularly useful for long-term investors seeking consistency and diversification."

Why Invest in Nifty Top 15 Equal Weight?

The Nifty Top 15 Equal Weight Index offers an equal-weighted portfolio comprising top 15 stocks from blue-chip stocks. By allocating equal weight to each constituent, the index ensures balanced exposure across top-performing companies. It has historically delivered better long-term returns compared to the Nifty 50 and follows a disciplined approach with periodic rebalancing to maintain alignment with its methodology.

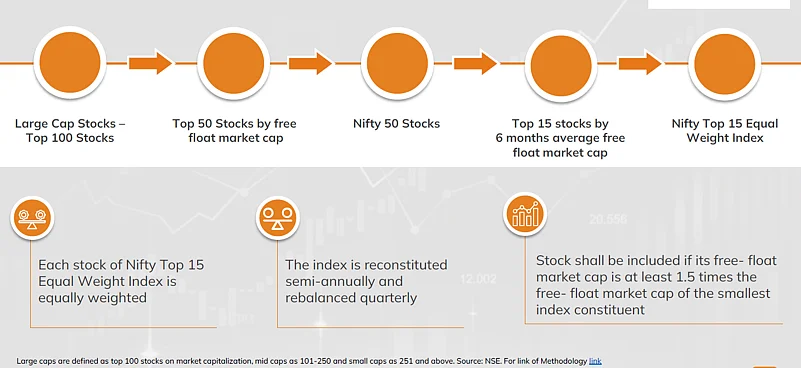

How is this index constructed?

The index follows a transparent, rules-based methodology by selecting the top 15 stocks based on their 6-month average free-float market capitalization. It is rebalanced quarterly and reconstituted semi-annually to ensure the portfolio remains aligned with the most prominent market leaders.

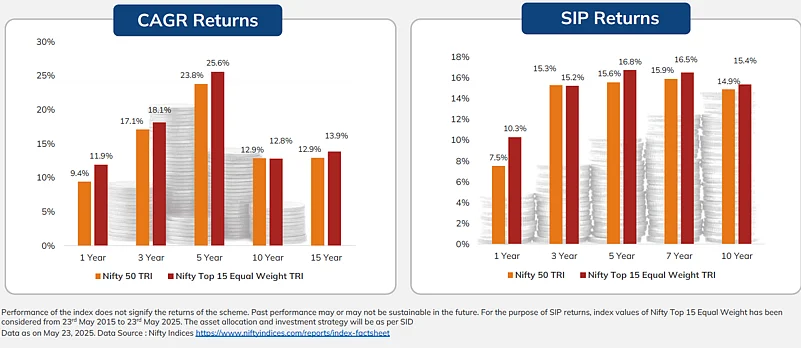

The benchmark index, Nifty Top 15 Equal Weight TRI, when compared to the broader market index like Nifty 50 TRI, demonstrates how the Index has historically generates better long-term returns compared to Nifty 50 TRI. This outperformance is a result of the equal-weighted approach, which provides balanced exposure to all 15 constituents, rather than being skewed toward a few large-cap stocks, thereby enhancing diversification and potential returns over the long term.

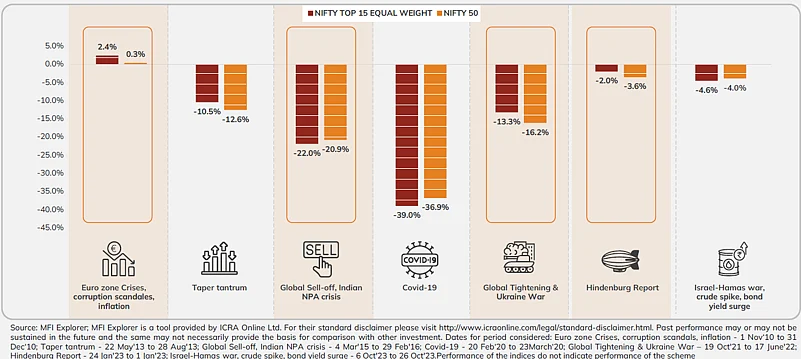

An analysis of the index’s performance during periods of high market volatility reveals that it has outperformed the broader Nifty 50 Index. This resilience can be attributed to its equal-weighted structure, which avoids overdependence on a few large-cap stocks and ensures more balanced participation across sectors.

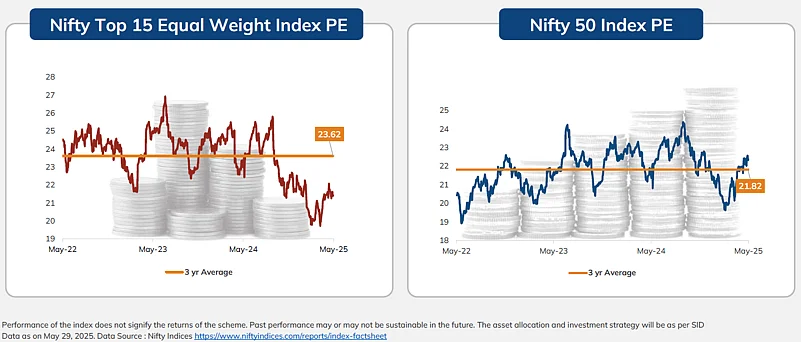

Valuations

As of May 29, 2025, the Nifty Top 15 Equal Weight Index is trading below its three-year average price-to-earnings (P/E) ratio, indicating relatively attractive valuations and potentially offering a favourable entry point for long-term investors.

Benefits of ETF

Benefits of Index Funds

Scheme Details:

Scheme Names: ICICI Prudential Nifty Top 15 Equal Weight ETF and ICICI Prudential Nifty Top 15 Equal Weight Index Fund

NFO Period: June 10 – June 24, 2025

Benchmark: Nifty Top 15 Equal Weight TRI

Fund Managers: Nishit Patel and Ms. Ashwini Shinde

Minimum Application Amount: ₹1,000/- (plus in multiples of Re. 1)

Plans/Options (For Index Fund): Regular & Direct Plans; Growth & IDCW Options

Minimum Additional Application Amount for ETF (Post Allotment): On Stock Exchanges: Investors can buy/sell units of the Scheme in round lot of 1 unit and in multiples thereof

Directly with the Mutual Fund: Authorized Participant(s)/ Investor(s) can buy/sell units of the Scheme in Creation Unit Size viz. 3,70,000 units and in multiples thereof

Rebalancing & Reconstitution: Quarterly rebalancing, semi-annual reconstitution

For media queries, please contact:

Adil Bakhshi

Principal PR & Corporate Communication

Email: PR@icicipruamc.com

Phone: +91-9920010203

Riskometer & Disclaimers:

Disclaimer by the National Stock Exchange of India Limited: The Product(s) are not sponsored, endorsed, sold or promoted by NSE Indices Limited (" NSE Indices"). NSE Indices does not make any representation or warranty, express or implied, to the owners of the Product(s) or any member of the public regarding the advisability of investing in securities generally or in the Product(s) particularly or the ability of the Nifty Top 15 Equal Weight Index to track general stock market performance in India. The relationship of NSE Indices to the Issuer is only in respect of the licensing of certain trademarks and trade names of its Index which is determined, composed and calculated by NSE Indices without regard to the Issuer or the Product(s). NSE Indices does not have any obligation to take the needs of the Issuer or the owners of the Product(s) into consideration in determining, composing or calculating the Nifty Top 15 Equal Weight Index. NSE Indices is not responsible for or has participated in the determination of the timing of, prices at, or quantities of the Product(s) to be issued or in the determination or calculation of the equation by which the Product(s) is to be converted into cash. NSE Indices has no obligation or liability in connection with the administration, marketing or trading of the Product(s).

NSE Indices do not guarantee the accuracy and/or the completeness of the Nifty Top 15 Equal Weight Index or any data included therein and they shall have no liability for any errors, omissions, or interruptions therein. NSE Indices does not make any warranty, express or implied, as to results to be obtained by the Issuer, owners of the product(s), or any other person or entity from the use of the Nifty Top 15 Equal Weight Index or any data included therein. NSE Indices makes no express or implied warranties, and expressly disclaim all warranties of merchantability or fitness for a particular purpose or use with respect to the index or any data included therein. Without limiting any of the foregoing, NSE Indices expressly disclaim any and all liability for any damages or losses arising out of or related to the Products, including any and all direct, special, punitive, indirect, or consequential damages (including lost profits), even if notified of the possibility of such damages.

Any application by investors, other than Market Makers, must be for an amount exceeding INR 25 crores. However, the aforementioned threshold of INR 25 crores shall not apply to investors falling under the following categories (until such time as may be specified by SEBI/AMFI):

Schemes managed by Employee Provident Fund Organization, India;

Recognized Provident Funds, approved Gratuity funds and approved superannuation funds under Income Tax Act, 1961.

Disclaimer of BSE Limited: It is to be distinctly understood that the permission given by BSE Limited should now in any way be deemed or construed that the SID has been cleared or approved by BSE Limited nor does it certify the correctness or completeness of any of the contents of the SID. The investors are advised to refer to the SID for the full text of the disclaimer clause of the BSE Limited.

Disclaimer of National Stock Exchange of India Limited: It is to be distinctly understood that the permission given by NSE should not in any way be deemed or construed that the Scheme Information Document has been cleared or approved by NSE nor does it certify the correctness or completeness of any of the contents of the Scheme Information Document. The investors are advised to refer to the Scheme Information Document for the full text of the 'Disclaimer Clause of NSE“

ICICI ETF is part of ICICI Prudential Mutual Fund and is used for exchange traded funds managed by ICICI Prudential Asset Management Company Limited

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Disclaimer: All figures and other data given in this document are dated as of May 31, 2025 unless stated otherwise. The same may or may not be relevant at a future date. The information shall not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written consent of ICICI Prudential Asset Management Company Limited (the AMC). Prospective investors are advised to consult their own legal, tax and financial advisors to determine possible tax, legal and other financial implication or consequence of subscribing to the units of ICICI Prudential Mutual Fund.

Disclaimer: In the preparation of the material contained in this document, the AMC has used information that is publicly available, including information developed in-house. Some of the material(s) used in the document may have been obtained from members/persons other than the AMC and/or its affiliates and which may have been made available to the AMC and/or to its affiliates. Information gathered and material used in this document is believed to be from reliable sources. The AMC however does not warrant the accuracy, reasonableness and / or completeness of any information. We have included statements / opinions / recommendations in this document, which contain words, or phrases such as “will”, “expect”, “should”, “believe” and similar expressions or variations of such expressions, that are “forward looking statements”. Actual results may differ materially from those suggested by the forward looking statements due to risk or uncertainties associated with our expectations with respect to, but not limited to, exposure to market risks, general economic and political conditions in India and other countries globally, which have an impact on our services and / or investments, the monetary and interest policies of India, inflation, deflation, unanticipated turbulence in interest rates, foreign exchange rates, equity prices or other rates or prices etc. ICICI Prudential Asset Management Company Limited (including its affiliates), the Mutual Fund, The Trust and any of its officers, directors, personnel and employees, shall not liable for any loss, damage of any nature, including but not limited to direct, indirect, punitive, special, exemplary, consequential, as also any loss of profit in any way arising from the use of this material in any manner. Further, the information contained herein should not be construed as forecast or promise. The recipient alone shall be fully responsible/are liable for any decision taken on this material.

Disclaimer: This is a sponsored article. It is not part of Outlook Money's editorial content and was not created by Outlook Money journalists.