In financial markets, there are some key tenets of successful investing – setting clear investment goals, having a disciplined approach, investing early & consistently, cost minimization, etc. Many of these can be achieved by investing through a Systematic Investment Plan (SIP)

What is SIP?

A SIP is an investment option wherein an investor can opt for investing a fixed amount at regular intervals in any mutual fund scheme instead of investing a lump sum amount. This enables better access to investments for retail investors as well as flexibility. Moreover, it inculcates the investment discipline needed to sail through market cycles.

Key Principles behind SIP

SIPs work mainly on two key principles – Compounding and Rupee Cost Averaging

Compounding – During an ongoing SIP, the returns generated from each tranche of investment are added back to the principal and the same is reinvested. This can also be called the process of earning ‘interest on interest’. It aids wealth creation and works very well for investors with set long-term goals like buying a house, child education, retirement, etc.

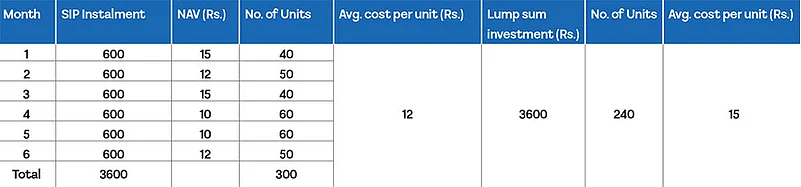

Rupee Cost Averaging – Another interesting feature of an SIP is that investing a fixed amount at regular intervals smoothens out market volatility by way of rupee cost averaging. To understand Rupee Cost Averaging, refer below

As per the above illustration, if markets and NAV rise, investors are allotted fewer units and if the market direction is downwards, investors are allotted more units for the same investment amount. Here in this example, the lump sum investment yielded only 240 units at Rs. 15 whereas the SIP investment yielded 300 units at Rs. 12. Hence the investor gained more units at a lower cost. If invested for long-term or longer market cycles, SIP investing can do wonders for wealth creation.

Additional Advantages –

No need to time the market as a fixed amount is invested at regular intervals

Since the amount and tenure are decided at the beginning of the investment basis set goals, it is easy and straightforward to operate an SIP (Hassle-free)

With many fund houses offering minimum investment amounts as low as below Rs. 100, it offers great flexibility to investors

Various SIP options – In addition to the traditional SIPs, fund houses have upped the game by introducing different options like combo SIPs (mix of equity & debt funds), SIP top-ups i.e. increasing the SIP amount at set intervals which helps manage inflation or topping up SIP amounts only during market dips for rupee cost averaging, etc. This empowers and enables investors further making SIPs more appealing

To sum up, SIPs can be analogized to an old quote – “Little drops of water can make a mighty ocean” meaning small things or contributions can add up to something big over time. The sooner one starts investing through SIP for long-term goals the better. As the number of years of SIP goes up, compounding does wonders for one’s wealth-creation journey.

Disclaimer: The Views are Personal and not a part of the Outlook Money Editorial Feature