Sponsored Content

Sundaram Mutual today marks the 23rd anniversary of its flagship equity offering — the Sundaram Midcap Fund, one of India’s longest-running and most consistent midcap mutual funds. Since its launch in July 2002, the fund has delivered sustained long-term performance by staying true to its core philosophy: bottom-up stock picking, strong valuation discipline, and risk-aware portfolio construction.

Over this 23-year journey, the fund has emerged as a strong compounder:

A ₹1 lakh lump-sum investment at inception has grown to approximately ₹1.4 crore, delivering a CAGR of 24.1%

A monthly SIP of ₹10,000, totalling ₹27.5 lakh over the same period, would now be worth around ₹4.71 crore — an XIRR of 20.7%

“At the heart of the fund’s success is a consistent focus on businesses with scalable growth, passionate leadership, and strong financials. We aim to stay invested in companies that can outpace their industries through cycles,” said Mr. Bharath S, Head – Equities, Sundaram Mutual.

Over the years, while strategy has evolved to reflect India’s formalising and consolidating economy, the fund’s core belief in identifying high-growth midcap businesses early has remained unchanged. A balanced blend of near-term visibility and long-term structural levers — backed by appropriate position sizing — has been key to navigating volatility.

Risk controls remain a hallmark of the strategy, with active monitoring of liquidity, stock exposure limits, and portfolio concentration. This has helped the fund manage downside effectively during uncertain market conditions.

As it enters its 24th year, Sundaram Midcap Fund stands as a proven choice for investors seeking to build long-term wealth through India’s midcap growth story.

About Sundaram Asset Management Company:

Sundaram Asset Management Company, a major player in the fund management space with retail focus has assets under management (AUM) of INR. 73,405 crores and along with its subsidiary Sundaram Alternate Assets Ltd (SAAL) the AUM stood at INR. 80,463 crores as on June 30, 2025.

For more information on Sundaram Mutual and its products, please visit: www.sundarammutual.com.

For Media Enquiries:

Harit S. Tank

Tel.Nos.: 022 – 30100215

Mobile: +91 98194 55607.

Email: harittank@sundarammutual.com or harit.smf@gmail.com

Fund Synopsis:

Scheme Name: Sundaram Mid Cap Fund.

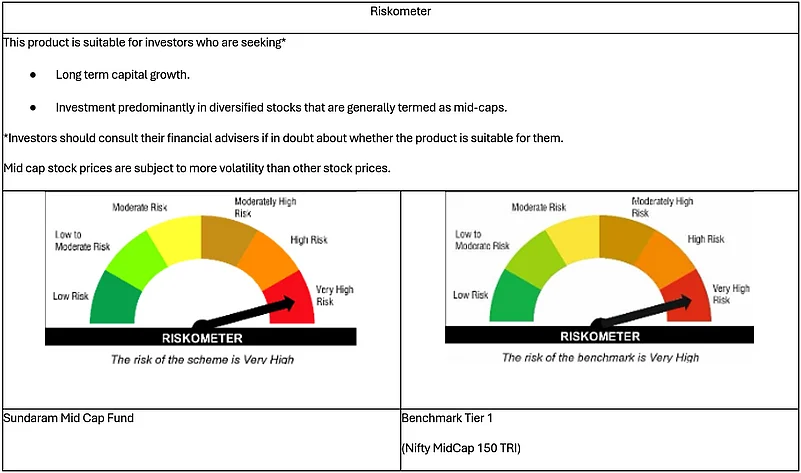

Scheme Type: An open-ended equity scheme predominantly investing in mid cap stocks

Category of the Scheme: Mid Cap Fund

Investment Objective: The objective of the scheme is to achieve capital appreciation by investing predominantly in stocks that are termed as mid-cap.

No Guarantee: Investors are neither being offered any guaranteed/indicated returns nor any guarantee on repayment of capital by the Scheme. There is also no guarantee of capital or return either by the mutual fund or by the sponsor or Trustees by the Asset Management Company.

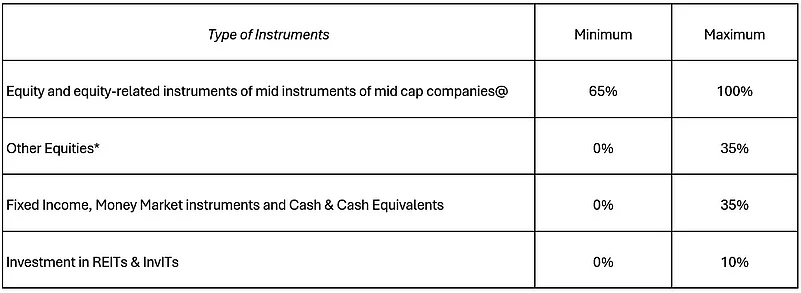

Asset Allocation:

Benchmark: Nifty Mid Cap 150 TRI

Fund Managers: S Bharath, Ratish B Varier

Minimum Application Amount: Minimum Application:

During NFO: NA

Ongoing -

New Investor: ₹100/- for both IDCW and Growth option and any amount thereafter under each plan/option.

Systematic Investment Plan: ₹100/- per day (minimum 3 months), ₹100/- per month (6 installments), ₹750/- per quarter (6 installments), ₹1,000/- per week (6 installments)

SIP Dates: Any day (1st to 31st); Weekly SIP will be processed on Wednesdays

Systematic Transfer Plan: ₹1,000/- daily/weekly (6 installments), ₹100/- monthly (6 installments), ₹750/- quarterly (6 installments); STP Dates: Any day (monthly/quarterly only for Any Day STP)

Systematic Withdrawal Plan: ₹100/- monthly/quarterly (6 installments);

SWP Dates: Any day

SIP Top-up: INR 500 and in multiples of ₹500/- – Half-yearly/Annually

Load Structure

Entry Load: Nil.

Exit Load: Nil - If up to 25% of the units invested are redeemed or withdrawn by way of SWP/STP within 365 days from the date of allotment. Any redemptions or withdrawals by way of SWP in excess of the above mentioned limit would be subject to an exit load of 1 %, if the units are redeemed within 365 days from the date of allotment of units. Further, exit load will be waived on Intra-scheme and Inter scheme Switch-outs/STP.

Disclaimer:

Mutual Fund Investments are subject to market risks, read all scheme related documents carefully.

Disclaimer: This is a sponsored article. It is not part of Outlook Money's editorial content and was not created by Outlook Money journalists.