Diversification is one of the fundamental principles of investment strategy. The adage “Don’t put all your eggs in one basket” has stood the test of time — it helps to spread risk and increase the potential for long-term returns.

Investors are concerned with accumulating and maintaining the wealth needed to meet their needs and aspirations. In that endeavor, Asset Allocation plays a very important role. In the context of investment, asset allocation helps in achieving diversification through multi-asset allocation, which involves spreading investments across different asset classes such as equities, fixed income, commodities (like gold and silver), and Real Estate Investment Trusts (REITs) and Infrastructure Investment Trusts (InvITs).

Multi-Asset Allocation Strategy: A Holistic Approach

An investor can gain exposure to these asset classes through multiple funds or by using a single fund that implements a strategic asset allocation approach. A strategic asset allocation strategy sets the framework for long-term investment based on an investor’s risk tolerance, financial objectives, and time horizon. The main advantage of a strategic asset allocation is that it emphasizes long-term growth and stability, reducing the need for frequent adjustments or rebalancing. Different asset classes perform during different economic phases. By allocating investments across various asset classes, this strategy inherently hedges against risks. For instance, combining equities with fixed income and commodities such as gold and silver can help counteract market volatility, as these asset classes often perform differently under various economic conditions. During phases of high economic growth usually performance of ‘Equity’ surpasses any other asset class by significant margin, in periods of uncertainty precious metals tend to do well, as macro parameters stabilise & interest rates peak out, fixed income becomes quite rewarding. However, the external factors which work for each of these asset classes may not be synchronous all the time & hence these asset classes can act as a natural hedge against one another.

Key Benefits of Strategic Asset Allocation

Risk Mitigation: Diversification across asset classes reduces portfolio volatility.

Consistency of Returns: Varied performance smooths overall returns.

Reduced Monitoring: Long-term focus decreases the need for constant adjustments.

Long-Term Growth: Strategic allocation fosters sustained wealth accumulation.

Efficient Tax-Adjusted Returns: Optimised portfolio structure enhances after-tax returns.

Understanding Asset Classes and Their Performance

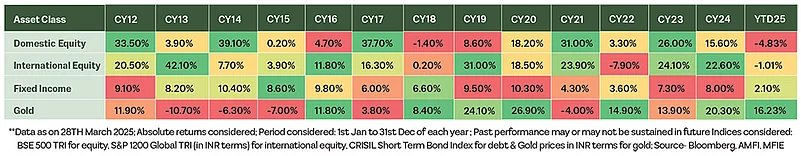

To illustrate the effectiveness of multi-asset allocation, let’s look at the historical performance of different asset classes:

From the table, we can observe the varied returns across these asset classes over time. For instance, domestic equity saw significant gains in CY12, but experienced a decline in CY23, while gold showed resilience, particularly during market downturns in years like CY13, CY15, CY 24 & this year too. International equities also demonstrated strong growth in CY13 and CY19, providing a good diversification tool when domestic markets were underperforming.

Conclusion

A well-structured multi-asset allocation strategy is a powerful tool for investors seeking both growth and stability. By diversifying across asset classes like equities, fixed income, and commodities, investors can reduce overall portfolio risk while enhancing long-term returns. The historical data highlights how different asset classes perform in different market environments, reinforcing the importance of diversification in mitigating risk and smoothing returns.

Whether an investor chooses to implement strategic asset allocation through a variety of funds or opts for a single fund like Multi Asset Allocation Fund offering exposure to multiple asset classes, the key to success lies in balancing risk and reward in line with one’s financial goals and risk tolerance.

HDFC Life Simplifies Claims Submission Process for Families Affected by the Terror Attack in Jammu & Kashmir

HDFC Life, one of India’s largest life insurers, has announced a simplified process for claim submission for family members/nominees of policyholders who lost their lives in the terror attack in Jammu & Kashmir’s Pahalgam on April 22, 2025.

For submitting a death claim against a policy held with HDFC Life, the nominee/ legal heir to provide proof of death caused due to the terror attack, from the Local Government, Police, Hospital or relevant authorities.

Nominees can contact HDFC Life via: Call centre number: 022-68446530, email at service@hdfclife.com or by a visit to any of its branch offices. The Company’s local branch staff, across all locations, will be readily available to offer on-the-ground assistance and support to the affected families. Sameer Yogishwar – Chief Operating Officer, HDFC Life said, “We extend our deepest condolences to families who have lost their loved ones in this attack. While nothing can make up for the loss they have suffered, we hope to minimise the effort needed towards claim submission through this simplified process.”

About HDFC Life

Founded in 2000, HDFC Life Insurance Company Limited (‘HDFC Life’ or the ‘Company’) is a leading provider of long-term life insurance solutions in India. It offers a broad range of individual and group plans across the Protection, Pension, Savings, Investment, Annuity, and Health categories, with a portfolio of products and optional riders designed to meet the diverse needs of its customers.

HDFC Life is a subsidiary of HDFC Bank Limited, one of India’s leading private banks. The Company has a nationwide presence, operating through its own branches and a network of over 300 distribution partners, including banks, NBFCs, MFIs, SFBs, brokers, and emerging ecosystem partners. HDFC Life also maintains a strong base of financial consultants.

Recognised as a great place to work, HDFC Life is deeply committed to governance and sustainability, ensuring responsible business practices that align with its long-term objectives.

For more information, visit www.hdfclife.com or follow us on Facebook, X (formerly Twitter), YouTube, and LinkedIn.

Media Contacts: For HDFC Life: Lopah Mudra Bhattacharrya

Email:lopahmudrab@hdfclife.com

Disclaimer: An Investor education and Awareness initiative of Aditya Birla Sun Life Mutual Fund

All investors have to go through a one-time KYC (Know Your Customer) process. Investors to invest only with SEBI registered Mutual Funds. For further information on KYC, list of SEBI registered Mutual Funds and redressal of complaints including details about SEBI SCORES portal, visit link : https://mutualfund.adityabirlacapital.com/Investor-Education/education/kyc-and-redressal for further details.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully