Sponsored Content

Bitcoin’s move below $80,000 triggered another round of heavy selling across the crypto market, with large holders contributing to the pressure. More than $1.6 billion in leveraged positions were liquidated over the past 24 hours, including roughly $110 million in Bitcoin longs, as low liquidity intensified margin calls.

As whales trim exposure at higher Bitcoin levels, some are reallocating toward early-stage projects with clearer financial use cases and stable footing.

Payment-focused platforms and banking-related infrastructure like Digitap ($TAP) are increasingly part of that conversation, particularly as investors search for the best crypto presale opportunities beyond established altcoins to buy.

Bitcoin’s $80K Break Forces a Reset in Risk Appetite

Bitcoin’s latest pullback was hard to miss. Prices slipped below the 78.6% Fibonacci retracement around $80,400, and momentum indicators like the RSI sank to their weakest levels since early 2025.

While those readings could point to a short-term bounce, the bigger issue is that Bitcoin has now lost a level that held for months. That has pushed the near-term focus away from chasing upside and toward managing risk.

When macro uncertainty drains liquidity from markets, even assets with strong conviction behind them can struggle. That’s often when investors start spreading capital around, looking for opportunities that don’t move in lockstep with broader risk sentiment.

In past cycles, those conditions have tended to favor projects with real-world use cases, especially ones still early in their growth and adoption.

Payments Remain Crypto’s Most Durable Use Case

For all the cycles crypto has been through, payments keep coming back as one of the few use cases with steady, real-world demand. Sending money across borders is still slow and costly through traditional banks, especially for freelancers, remote workers, and small businesses that rely on frequent international transfers.

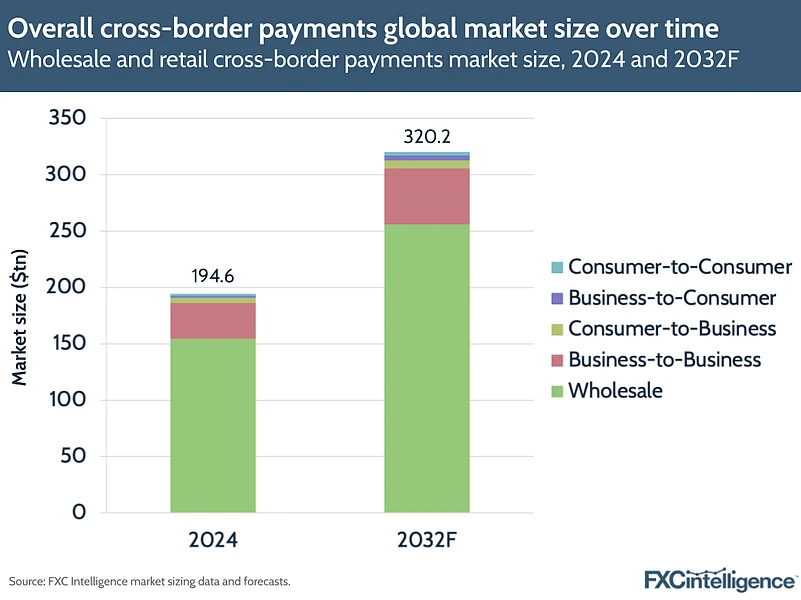

Cross-border payments are on track to surpass $250 trillion a year by 2027, while global remittances already exceed $860 billion annually, often weighed down by high fees.

The global freelance economy, estimated at around $12 billion, only adds to the momentum. At the same time, crypto adoption continues to grow, with more than 560 million users worldwide, and financial behavior is shifting toward mobile-first solutions. In fact, over 70% of Gen Z and Millennials prefer managing money through apps.

That combination of scale, inefficiency, and changing user habits is the area where Digitap is aiming to operate.

Best Banking Crypto: Why Digitap Is Gaining Interest

Digitap is being built as a crypto-banking app that can handle everyday financial activity. It focuses on cross-border transfers, stablecoin payments, and making crypto usable through familiar, easy-to-navigate interfaces.

The product is already live. Digitap offers Visa cards, supports both iOS and Android, and reports more than 120,000 connected wallets currently moving funds across different regions.

The platform recently expanded its infrastructure by adding Solana deposits. Accounts can now be funded with SOL, USDC, and USDT on Solana, alongside existing support for Polygon. For frequent payments, Solana’s faster settlement times and lower fees help reduce friction compared with traditional banking rails.

The team has also confirmed that integrations with Ethereum and Bitcoin are underway, positioning Solana as the first step in a broader network rollout rather than a one-off update.

Why Digitap’s Token Design Matters in a Choppy Crypto Market

In volatile markets, token supply can become a problem. When prices swing and liquidity tightens, inflationary reward models often add extra selling pressure. Digitap is built differently. The project caps supply and ties $TAP directly to platform revenue. Half of Digitap’s profits are used to buy back and permanently burn tokens, while the other half is paid to stakers.

That structure puts more emphasis on real usage. Tokens burned through early unstaking reduce supply further, and staking rewards are funded from a fixed pool rather than inflation.

During the presale, returns can reach up to 124% APR, with yields expected to reach as high as 100% after launch. Higher rewards are tied to longer lockups, encouraging longer-term participation rather than short-term trading.

Digitap Presale Moves Higher as Stages Fill Quickly

The fact that Digitap is still in the presale has helped it stand out during a volatile stretch for the broader crypto market. The token launched at $0.0125 and is currently priced at $0.0467, leaving early participants up nearly 274% so far. With the next presale stage set to move the price to $0.0478 (a roughly 2.4% increase), momentum has continued as available allocations fill.

So far, the project has raised about $5 million and sold approximately 212 million tokens. Digitap has also confirmed a listing price of $0.14, giving investors a clear benchmark. From current levels, that would imply close to 200% upside at listing, which explains why some market participants are beginning to include $TAP among the altcoins to buy lists.

USE THE CODE “BIGWALLET35” FOR 35% OFF $TAP TOKENS. LIMITED OFFER

Best Altcoins to Buy Now: Where Capital Is Rotating

What’s happening now doesn’t look like a flight from crypto. It looks more like a rebalancing. As Bitcoin digests volatility around $80,000, some capital is moving toward projects that focus on everyday use and are still early in their growth cycle.

Digitap fits that pattern: it targets a massive payments market, focuses on mobile-first access, and is rolling out functionality while still in presale. For investors looking for the best crypto presales with actual utility and future, that combination is starting to matter.

Discover how Digitap is unifying cash and crypto by checking out their project here:

Presale: https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

Disclaimer: This is a sponsored article. It is not part of Outlook Money's editorial content and was not created by Outlook Money journalists.