The Income Tax Department has issued a reminder for taxpayers to pay

advance tax on June 15, 2025, if they have an estimated annual tax liability of Rs 10,000 or more. This "pay-as-you-earn" system ensures tax is paid in installments throughout the financial year by avoiding penalties and interest. The department emphasises timely compliance and offers online payment options. Understanding and fulfilling advance tax obligations is crucial for financial planning and legal compliance. Paying now can save you from financial strain and legal issues later.

What is Advance Tax?

Advance tax is the income tax you pay in parts throughout the financial year instead of paying it all at once at the end. It is also called the "pay-as-you-earn" tax system.

If your total tax liability for the year is expected to be more than Rs 10,000, you need to pay this tax in installments as prescribed by the Income Tax Department. These payments are due in June, September, December, and March.

Who Should Pay Advance Tax?

According to the alert issued, you must pay advance tax if you meet the following conditions:

• You are a salaried individual, freelancer, or business owner

• Your total tax liability for the year is Rs 10,000 or more

• You do not fall under the senior citizen exemption (Senior citizens without business income are not required to pay advance tax)

This means that even if your employer deducts TDS (Tax Deducted at Source) pr if your total income from other sources (like interest, rental income, capital gains, etc.) leads to a tax liability beyond Rs 10,000 then you are required to pay advance tax.

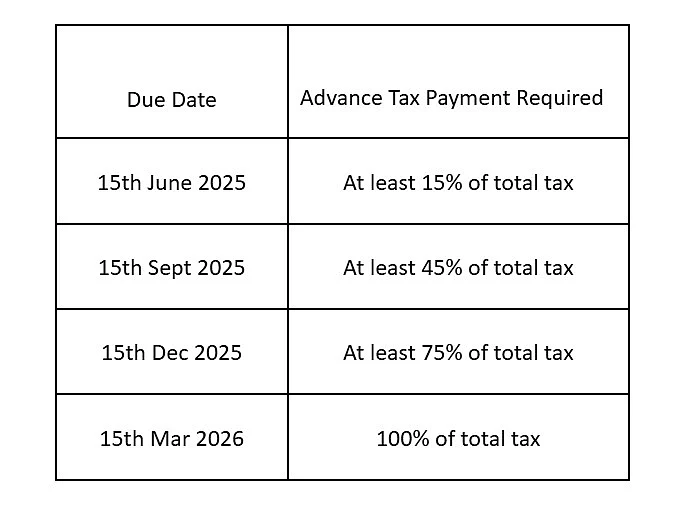

Due Dates for Advance Tax in FY 2025–26

Here are the payment deadlines for advance tax in this financial year:

Late payment of the advance tax may result in penalties for violating sections 23B and 234C of the Income Tax Act.

How to Pay Advance Tax?

Paying advance tax can be done online. Here's the guideline for the same:

1. Visit Government's official tax filing website incometax.gov.in

2. Find the 'e-Pay Tax' section on the first page of the portal

3. It will require your PAN details for login

4. Select Challan 280 for income tax

5. Fill in other necessary details like assessment year, type of payment (Advance Tax), bank, and amount of payment

6. Make the payment through your preferred mode such as debit card, UPI or net banking

Taxpayer can also scan the QR code in the alert image to go be directed to the payment page instead of going through choosing a payment mode

Penalties for Missing Advance Tax Deadlines

If you fail to pay advance tax on time or underpay it, you will have to pay interest under the following sections:

• Section 234B: 1 per cent interest per month if 90 per cent of tax is not paid by the end of the year

• Section 234C: 1 per cent interest per month for the shortfall in each installment

These charges increase your overall tax burden. Hence, timely payment of advance tax is always beneficial.

Why It Matters: Stay Compliant and Save Money

Paying advanced tax matters as it not only allows you to avoid penalties but is also seen as tax-compliant. Timely payments reflects positively on you as a a responsible citizen and saves you from a big financial burden.

The Income Tax Department is encouraging all eligible individuals to make their payments before June 15, 2025. As the alert states:

"You must pay Advance Tax to avoid Penalties. Stay compliant and avoid Interest Charges!"

Final Reminder: Make Your Advance Tax Payment Today

Advance tax should not be neglected or taken lightly due to the added burden of penalties. If your income is liable for advance tax, do not wait until the deadline. Use the Government's e-filing portal or scan the QR code to make a quick and easy payment. Whether you're a salaried employee with additional income, a freelancer managing your own finances, or a business owner with taxable profits—June 15 is the date to remember.