Summary of this article

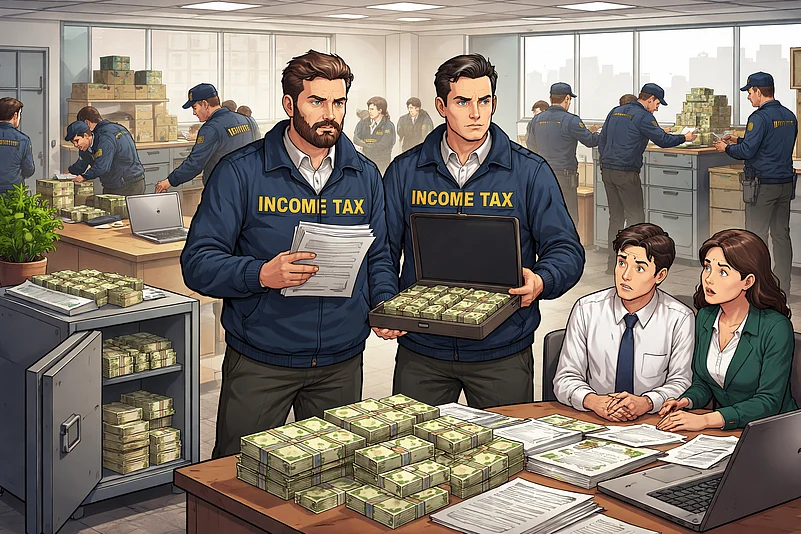

Income tax raids triggered by lifestyle-income gap and undisclosed asset patterns

Insight Portal flags heavy cash deposits above Rs 10–50 lakh thresholds

AIS-ITR mismatches, foreign asset non-disclosure, repeated business losses invite scrutiny

Section 132 raids need written “reason to believe” and senior authorization

Why do income tax raids happen? Specific triggers often stem from a visible "lifestyle-income gap," where luxury acquisitions, such as high-end real estate, foreign travel, or premium vehicles, are disproportionate to the income declared in tax returns.

“The department’s automated insight portal now flags heavy cash transactions, particularly deposits exceeding Rs 10 lakh in savings or Rs 50 lakh in current accounts, which are captured through the Statement of Financial Transactions (SFT),” says Prerna Robin, principal associate, B. Shanker Advocates.

Additionally, persistent reporting of business losses despite high turnover, or non-disclosure of foreign assets and bank accounts, serves as a major catalyst for enforcement actions.

“Systematic discrepancies identified between the Annual Information Statement (AIS) and the Income Tax Returns (ITR) often provide the initial trail. Finally, "tip-offs" from disgruntled associates or verified information from other enforcement agencies like the ED or CBI frequently initiate these high-stakes interventions,” says Robin.

“So, in simple language, any indication of underreported or unreported income or assets upon an assessee triggers the Income Tax Department to conduct a raid,” says Shashank Agarwal, founder, Legum Solis.

Who Can Authorize A Search And Seizure

Under Section 132 of the Income Tax Act, 1961, the power to authorize a search and seizure is vested strictly in senior-level officials, typically the Principal Director General, Director General, or a Principal Commissioner of Income Tax. These authorities must form a "reason to believe," not just a mere suspicion, based on information already in their possession that a taxpayer is concealing assets or income.

The legal threshold is specifically met if it is believed that a person has failed to comply with previous summons or notices, or is in possession of "undisclosed income" in the form of money, bullion, or jewellery. This "reason to believe" must be recorded in writing in a "Satisfaction Note" before the warrant of authorization is signed. Courts have consistently held that while the adequacy of the information cannot be challenged, the existence of the information itself is a mandatory jurisdictional fact.

Credible Evidence As The Basis For Raids

Modern tax administration has significantly shifted toward intelligence-led enforcement rather than purely relying on routine discrepancies found in standard tax filings. “While minor errors in an ITR typically result in a simple scrutiny notice or a request for clarification under Section 143(2), a full-scale raid is almost always driven by deep-rooted intelligence and data triangulation,” says Robin.

Income tax raids usually happen because of specific intelligence inputs, not just because of mistakes or mismatches in regular tax filings. “Differences in returns may lead to routine checks or audits, but a raid is carried out only when authorities have credible evidence or a strong reason to believe that large amounts of income or assets have been hidden,” says Agarwal.