Change 1: It’s Simpler

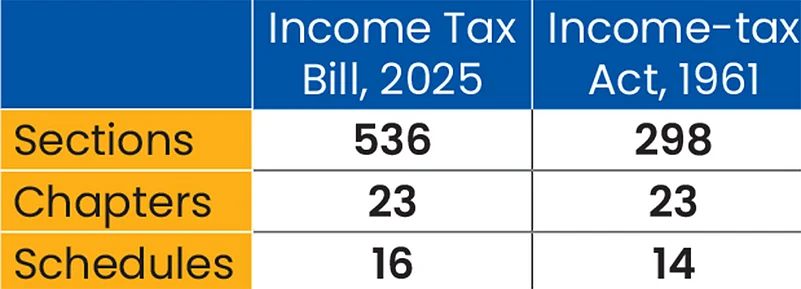

ITB 2025 aims to provide a simpler tax code that is less complex, easier to understand, and easier to interpret. For instance, tax provisions for salary have been consolidated and tax deducted at source (TDS) and tax collected at source (TCS) provisions have been simplified. ITB has also scrapped more than 300 obsolete and redundant laws. However, it has more sections than earlier.

Change 2: Tax Year

ITB has introduced the concept of a tax year, replacing both financial year (FY) and assessment year (AY). The tax year is a 12-month period from April 1 of one year to March 31 of the following year.

Says Gouri Puri, partner, Shardul Amarchand Mangaldas & Co., a law firm, “Multiple concepts of FY, AY and previous year confused taxpayers, which impacted the readability of the tax law. The concept of a tax year is easy to understand and in line with international practice.”

Change 3: Streamlined TDS, TCS

ITB 2025 proposes to simplify the compliance burden by widening the scope of payments covered for obtaining a lower TDS or TCS certificate.

“It is proposed to cover all payments and/or receipts vis-a-vis certain payments and/or receipts covered under the current law. This will reduce the amount of cash locked in tax withholding for such taxpayers who were not covered earlier,” says Aarti Raote, partner, Deloitte India.

Budget 2025 had also made many changes to streamline TDS and TCS rules, which are incorporated in ITB.

Change 4: Clubbing Of Income

At present, under Section 64 of the Income-tax Act, 1961, if an individual has a substantial interest in a concern, income earned by their spouse (salary or commission) from that concern is clubbed with the individual’s income. However, this is not the case if the spouse has technical or professional qualifications and the income is solely from their expertise.

“ITB proposes to modify this provision by removing the explicit requirement of possessing technical or professional qualifications (formal qualifications). Instead, it focuses on whether the income is attributable to the spouse’s technical or professional knowledge, experience, and professional qualification,” says Naveen Wadhwa, vice president, Taxmann, a tax and corporate law firm.

Change 5: Consolidated Tax Provisions For Salary

All provisions regarding salary have been consolidated in one chapter for easier understanding. This will also ensure that the taxpayer does not need to refer to different chapters while filing tax returns. For instance, exemptions under Section 10, such as gratuity, leave encashment, and pension commutation are now included in the salary chapter. Certain allowances, such as house rent allowance (HRA), are now included in Schedule II of ITB, which is referenced in the provisions related to salary.

Change 6: Section 80C Is Now Section 123

The provisions under Section 80C, the most popular Section which allows deduction up to Rs 1.5 lakh under the old tax regime, will now be applicable under Section 123. The deduction limit remains the same.

Change 7: First ITR Filing Offence Decriminalised

The new tax Bill states that a person who fails to file an income tax return (ITR) after a search operation cannot be arrested without prior approval by appropriate authorities.

Clause 480 in ITB 2025, which corresponds to Section 276CCC, states that this will be a non-cognisable offence.

However, if a person is convicted for the same offence under this Section again (repeat offence), there will be rigorous punishment of a minimum period of six months to a maximum of seven years with a fine.

Change 8: More Power To Authorities In Search And Seizure Operations

ITB requires assessees to share their computer ‘access codes’ with tax officials during search and seizure operations. Thus, the Bill requires more cooperation with income tax officials.

The provision expands the scope by empowering the authorities to gain access by overriding the access code to any said computer systems or virtual digital space where the access code thereof is not available.

Change 9: Credit Card Details, Spending Under Lens

The Central Board of Direct Taxes (CBDT) has been given power to seek the details of credit card held by the assessee, expenditure exceeding the threshold, outgoings, particulars of principal place of business and so on. This information can be used for verifying ITR.

Change 10: Specific Conditions For Filing ITR

ITB does not contain a provision corresponding to the seventh ‘proviso’ of the I-T Act, 1961, which specifies the circumstances under which ITR must be filed. These include foreign travel, and turnover or gross receipt exceeding the threshold limit.

However, CBDT has been given the power to specify the conditions upon which filing ITR is mandatory.