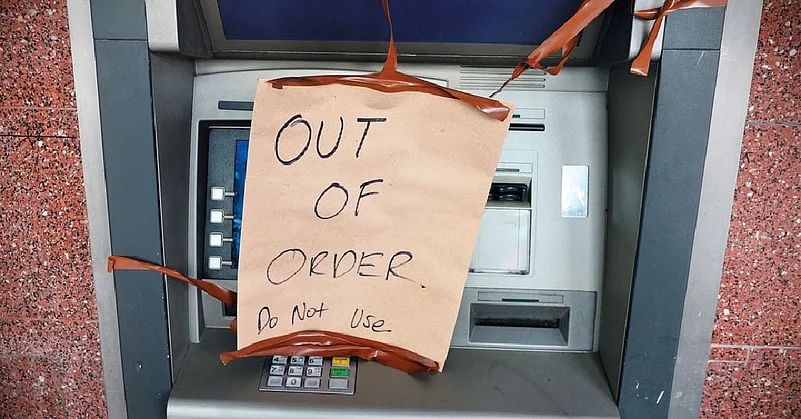

The breakdown of ATM service provider AGS Transact has created widespread disruptions in India's financial system, affecting major lenders such as the State Bank of India (SBI), ICICI Bank, and Axis Bank. The company that operated and re-filled cash in ATMs countrywide in thousands is under financial strain, leading to service outages and possible insolvency proceedings.

SBI is among the worst affected, with nearly 14,000 of its ATMs becoming non-functional. Of these, 7,000-8,000 were fully run by AGS Transact, and the rest depended on the company for cash replenishment. Hence, customers cannot withdraw cash, which leads to frustration and operational inconvenience to the bank.

ICICI Bank, which had been experiencing service issues with AGS Transact for some time, was one of the first to begin relocating its ATMs to other service providers. It has successfully migrated a significant number of its machines to CMS Infosystems and Hitachi India. The bank had complained of the shoddy service of AGS Transact to the company's board as early as December, anticipating further disruption. Axis Bank itself is also badly hit, with up to 5,000 of its own ATMs operated wholly by AGS Transact facing shutdown due to the latter's financial troubles.

AGS Transact has a debt of Rs 726 crore on its hands and credit rating agencies such as Crisil and India Ratings have graded it with high default probability risk.

The failure of the company to make timely payments has resulted in an operational creditor, Maxwell Aircon India, considering filing insolvency proceedings against the company. AGS Transact has defaulted on multiple payments over the past few months, and this has added to further issues about its stability. Four independent directors of the company have also resigned, citing personal reasons, further fuelling the issues about its stability. Apart from SBI, ICICI Bank, and Axis Bank, some other banks have been affected, though not as severely. India Post Payments Bank has seen issues with about 1,000 ATMs, and Yes Bank has seen issues with over 500 machines.

HDFC Bank, Federal Bank, Union Bank of India, IDFC First Bank, Kotak Mahindra Bank, Punjab National Bank, Bank of Maharashtra, and Bank of India also have been affected. Their dependence on AGS Transact is lesser, which has limited the degree of disruptions. With AGS Transact on the brink of bankruptcy, banks are now racing against time to shift their ATM business to other service providers in a bid to return to normalcy. While some, like ICICI Bank, have already made significant progress in this direction, others are still to find and onboard new partners.

The sudden disruption has also indicated the risks of sole reliance on one provider for critical banking infrastructure.As banks struggle to correct the situation, customers continue to be denied cash at ATMs, emphasising the need for stronger backup alternatives to ensure uninterrupted banking service.