Driven by the shift to remote work and the increased need for digital and trackable expense solutions, the use of corporate credit cards has accelerated in India post-COVID. Companies are also demanding smarter dashboards and tighter controls to adapt to hybrid work models.

What Is A Corporate Credit Card?

A corporate credit card is a payment tool issued to employees by their organisation, explicitly designed for business-related expenses. Here's how it stands apart from personal and business credit cards:

Corporate credit cards are used strictly for organisational spending, such as travel, business supplies, or client entertainment, helping companies streamline and monitor their expenses. In contrast, personal credit cards are for individual use, while business credit cards are for small or medium businesses, often under a proprietor or partnership model.

"With corporate cards, the primary liability typically rests with the company, unlike personal and most business cards, where individuals remain responsible for payments. Corporate cards offer advanced expense controls, customisable limits, and consolidated reporting to simplify accounting and compliance for larger organisations," says Saurabh Puri, Chief Business Officer - Credit Cards and Lending Products, Zaggle.

Who Can Apply For A Corporate Credit Card?

Generally, mid-sized to large companies, registered in India and meeting the issuer's eligibility criteria, can apply for corporate credit cards. "The process is typically initiated by a company's finance or HR department rather than by individuals," says Puri.

Eligibility Criteria

While specifics vary by provider, some standard eligibility requirements for companies looking for corporate credit cards include:

A minimum turnover threshold (for example, annual revenue of Rs 5 crore or more)

A certain number of years of operation (usually at least 2–3 years)

A satisfactory credit history and good corporate credit score

Legal registration (as a private limited, public limited, LLP, or large partnership)

Audited financial statements

Typical Rewards And Benefits

Corporate credit cards often offer:

Reward Points: Earned on every business purchase, which can be redeemed for travel, gifts, or cashback.

Exclusive Business Deals: Discounts on travel bookings, office supplies, or partner services.

Travel Perks: Concierge services, Airport lounge access, complimentary insurance, and travel assistance.

Expense Management Tools: Centralised dashboards for monitoring spend.

For Businesses:

Streamlined expense tracking.

Access to consolidated statements.

Improved compliance and policy adherence.

For Employees:

Hassle-free business travel and purchases.

No need to pay out-of-pocket and wait for reimbursements.

How Do They Simplify Employee Expense Tracking and Reimbursements?

Corporate cards automatically record transaction details, making expense reporting simpler and more transparent. Integrations with expense management software allow for real-time submissions, policy checks, and quicker approvals, cutting down manual paperwork and errors.

Can Corporate Cards Be Used Internationally?

Most corporate credit cards can be used globally, supporting foreign currency transactions. "However, there's typically a foreign currency service fee, depending on the bank and card program," says Puri.

Risks and Limitations

The common risks companies face when issuing corporate credit cards to employees include:

Misuse/Unauthorised Spending: The available credit limit can lead to unapproved personal spending.

Reconciliation Delays: If not tracked well, the company's cash flow and accounting can be disrupted.

Pitfalls To Avoid

Here are some pitfalls to avoid by employees using a corporate credit card:

Using the card for personal purchases (even accidentally) could breach company policy.

Failing to submit adequate documentation or timely expense reports.

Not adhering to spending limits, possibly resulting in out-of-pocket payments.

Caps Or Limits On Spending

Most issuers allow companies to:

Set individual card limits for each employee role or hierarchy.

Restrict spending by merchant category.

Enable or disable international spending.

These controls are highly customisable and can be tailored according to the organisation's needs.

Choosing the Right Card

When choosing a provider, companies should consider:

Accepted network (Mastercard, Visa, Amex, Rupay)

Customisable spend controls

Robust expense reporting

Analytics of corporate card spends

Integration with accounting/ERP tools

24/7 customer support

Security features (fraud alerts, transaction monitoring)

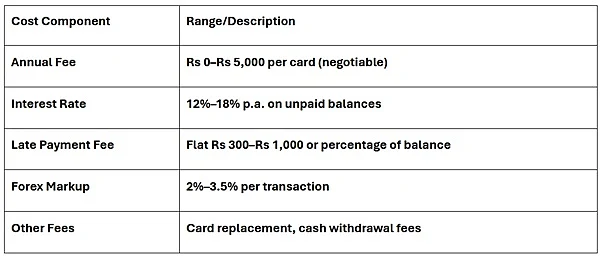

What are the costs involved

Typical charges include:

“It's also important to compare these costs against the potential rewards and management tools offered by the card issuer,” says Puri.