Summary of this article

HDFC Bank cuts MCLR up to 0.10 per cent in January 2026.

Overnight MCLR drops 10 bps to 8.25 per cent.

when MCLR lowers, interest rate for loans based on MCLR reduces, such as home loan, personal loan, etc.

HDFC Bank reduced the Marginal Cost of Fund-Based Lending Rates (MCLR) by up to 0.10 per cent effective January 7, 2026. This may reduce interest rates on home loans and other MCLR-based loans offered by the bank. The Bank has been reducing MCLR by 0.05 per cent every month for the last couple of months amid a declining interest rate environment. In October 2025, the three-year interest rate was 8.65, which has now reduced to 8.55 per cent. The bank last revised the rates in November 2025. The reduction means lower interest rates for home loans, personal loans, business loans, etc.

In the financial year 2024-25, the Reserve Bank of India (RBI) has so far reduced the repo rate by 1.25 per cent or 125 basis points. In line with this, banks have been adjusting their lending and borrowing rates. As MCLR includes repo rate in the calculation, a repo rate cut means a downward movement in MCLR. And when the MCLR is lowered, the lending rates are also reduced.

HDFC Bank

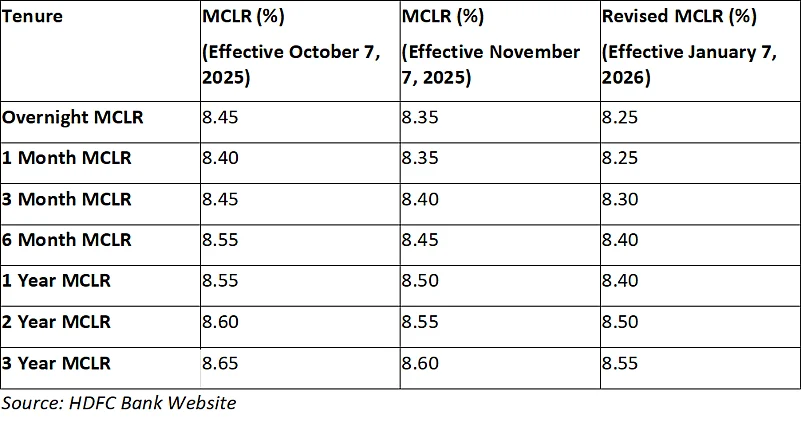

Effective January 7, 2026, HDFC Bank MCLR for overnight borrowing is fixed at 8.25 per cent, a 10 basis points down from the last revision. The reduction in MCLR ranged from 5 to 10 basis points across tenures.

Here is the detail.

How Is MCLR Determined?

MCLR is the minimum rate at which banks can lend money to borrowers. In determining the MCLR, banks consider various components. Repo rate is one of them.

The factors taken into consideration to determine MCLR include:

Marginal Cost of Funds – This is the cost at which banks source funds for lending. Repo rate comes under this component. It is the rate at which banks can borrow funds from the RBI. So, the marginal cost of funds means the average rate at which banks borrow funds for similar maturities.

Cash Reserve Ratio (CRR) – Per the RBI regulation, banks need to maintain a certain portion of funds as a cash reserve with the RBI. They cannot lend this money and lose out on interest on this portion. So, the cost is also taken into consideration while deciding MCLR.

Operating Expenses – These include the administrative costs, office expenses, rentals, utility bills, etc., which are also considered in determining MCLR.

Tenure Premium – It is the premium banks charge to cover the risk associated with the loan period, as the longer the period of the loan, the higher the risk involved.

The final lending rate for borrowers is offered after adding a spread over MCLR, and thus, can differ for different loans. Its home loan interest rate is starting from 7.90 per cent at present, per the bank website.