With the Reserve Bank of India (RBI) slashing the repo rate twice this year, first to 6.25 per cent in February 2025 and again to 6 per cent in April 2025, borrowers are being handed a rare opportunity.

For homeowners repaying loans, this could be a good opportunity to go in for a home loan balance transfer, a move that can translate to lower monthly equated monthly instalments (EMIs), thus leading to better repayment terms.

Here’s a breakdown of three compelling reasons why switching your home loan now could possibly be the smartest financial decision you make this year.

1] Lower Interest Rates Mean Real EMI Savings: When you transfer your home loan to a lender offering a lower rate of interest, the savings can be significant. Let’s say you have a home loan of Rs 45 lakh loan at 9.5 per cent rate of interest. Shifting it to a lender offering 8.5 per cent can save you over Rs 4.6 lakh in interest over the loan term.

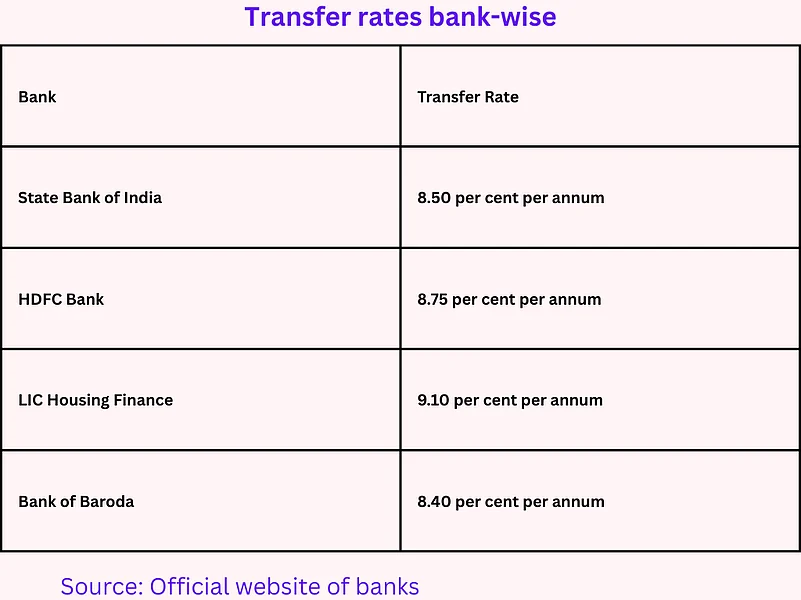

As of April 2025, balance transfer rates are hovering between 8.00 per cent and 9.90 per cent. Here’s a look at some of current rates on home loans:

A lower rate of interest on home loan will translated into reduced EMIs and more money in your pocket each month, which will be especially helpful in managing household finances or investing elsewhere. It’s a good idea to consult a financial advisor to map out how best to use the surplus money you save.

Also, a home loan balance transfer isn’t just about cutting down on interest cost. One reason could be better repayment terms which might attract many borrowers to switch lenders. Most lenders now offer flexible EMIs, longer tenures up to 30 years in some cases, and also the facility to tweak your repayment schedule to match your income pattern.

2] Top-Up Loans: Some lenders also include top-up loans with the transfer, which borrowers can use to take out more money for things, such as home renovations, and other requirements.

3] Better Customer Service: Customer service, or the lack of it, is another primary reason why many borrowers often switch lenders. With hidden fees, muddy documentation and poor customer service, homeowners often consider switching lenders for reasons of transparency and efficient service.

Many lenders have a smoother on-boarding process, and transparent fee structure. For such kinds of borrowers, switching to a new lender is not only a financial upgrade, but also an upgrade to a hassle-free loan service.

Things to Watch Out for Before You Switch

Though a home loan balance transfer may have its advantages, it also comes with its share of demerits. Here are a few things you should consider before you decide to switch your lender.

Processing Fees: This is usually around 0.35-1 per cent of the loan quantum. Some lenders might even levy administrative fees.

Legalese and Administration Work: Switching a lender could involve heavy paperwork.

Prepayment Charges: You might have to pay some prepayment charges for closing your loan with your existing lender.

Fine Print: Be sure to read the complete fee structure of your new lender. Ask for written documentation so that you can avoid surprises later.

Cost-Benefit Analysis: Make sure that the saved amount in the long term is more than the cost of switching your lender.

With the rate of interest on loans, including home loans, on the decline and lenders competing for newer borrowers, this could be a good opportunity for home loan borrowers to switch their existing home loans to a new borrower through a balance transfer. Nevertheless, do your math well before you decide to switch from existing loan from one lender to another.