The Reserve Bank of India on February 7 announced a repo rate cut by 25 basis points to 6.25 per cent during its monetary policy committee (MPC) meeting announcement. This development reflected positively on various loans’ interest rates linked with repo rates. This has led to lower home loan interest rates which can bring down EMIs or even lower the loan tenure.

Several banks including Canara Bank, Punjab National Bank, Union Bank of India and Bank of Baroda also slashed their repo-linked lending rate by 0.25 per cent. Home loan borrowers from these banks will now have the option to either reduce their EMIs while retaining the tenure unchanged or reduce their remaining tenure while keeping the EMI amount the same.

Repo Linked Lending Rate (RLLR) is the interest rate at which lenders lend money to customers, based on the repo rate set by RBI. The repo-linked lending rate is the term used when the interest rate is linked to the repo rate. An RBI circular released in October 2019 makes it mandatory for banks to keep their retail loans in sync with the external benchmark lending rates.

The impact of the rate reduction of RLLR will differ for old and new home loan borrowers. The majority of these banks have passed on the reduced rates benefits to new borrowers immediately. Meanwhile, the old borrowers will get the advantage as per their respective interest rate reset cycle.

New Revised Rates of Home Loans Of Different Banks

Canara Bank

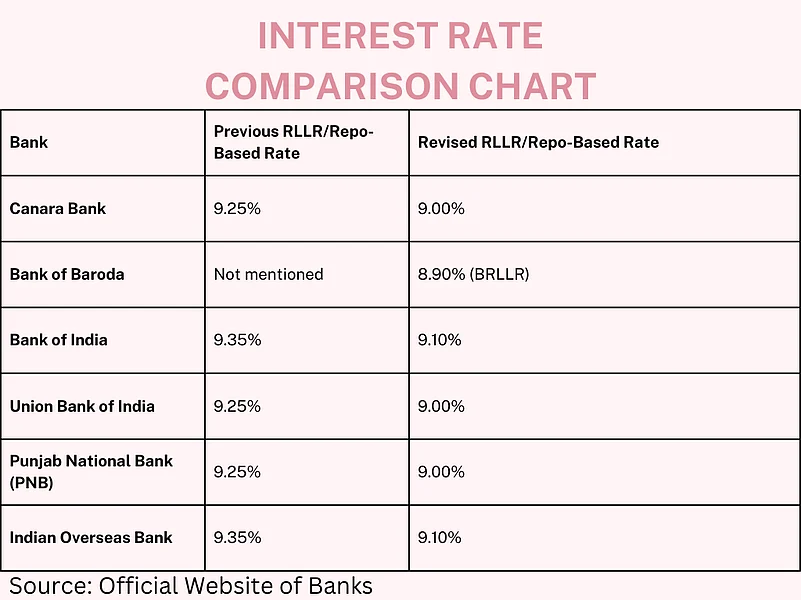

Canara Bank has revisited Repo Linked Lending Rate (RLLR) to 9.00 per cent from 9.25 per cent. It is imperative to understand that this rate will be implemented only on new accounts opened on or after February 12, 2025, and accounts completing 3 years under the RLLR tenure on or after February 12, 2025 (from the date of grant of loan/Advance), as per the Bank’s website.

Bank of Baroda

Interest rates on various loans associated with Baroda repo-linked lending rate (BRLLR).

According to the bank website, “For Retail Loans applicable BRLLR is 8.90 per cent with effect from February 2, 2025 (Current RBI Repo Rate: 6.25 per cent + MarkUp/Base Spread 2.65 per cent)”

Bank of India

The bank’s repo-based lending rate was reduced from 9.35 per cent to 9.10 per cent effective from February 7, 2025.

Union Bank of India

Union Bank of India EBLR (Repo Rate) also slashed the repo rate to 9 per cent from 9.25 per cent effective February 11, 2025.

Indian Overseas Bank

Indian Overseas Bank (IOB) also brought down its RLLR by 25 bps, bringing it down from 9.35 per cent to 9.10 per cent. The updated RLLR will be effective from February 11, 2025.

Punjab National bank

PNB has reduced the RLLR from 9.25 per cent to 9 per cent effective from February 10, 2025.