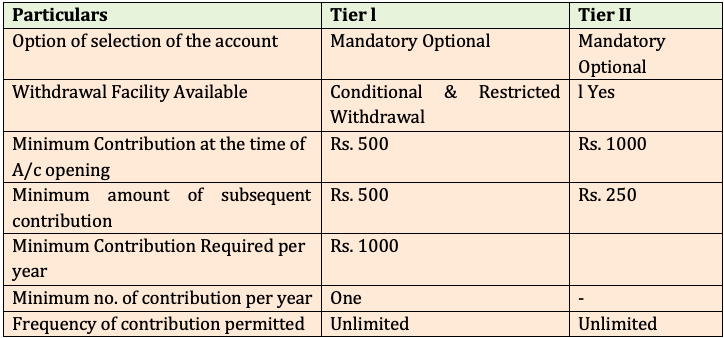

National Pension Scheme (NPS) a voluntarily defined contributory pension systemin India has undoubtedly proved beneficial. Not only does it aims to ensure financial security for the future, it also helps one build a fund for life’s second innings for post- retirement, by investing small amounts periodically during the active period of life. NPS provides a platform to create corpus through regular savings over a span of period that enables subscribers to purchase Annuity post retirement. One of the key advantages of investing in NPS is its income tax benefits which are open for both salaried and self- employed. NPS offers two of accounts; Tier I and Tier II.

NPS Tier-I account is a default, permanent retirement account with withdrawal restrictions where a subscriber can get a tax benefits. It is portable in nature.

NPS Tier-II account is a withdrawal non retirement account that offers voluntary savings facility, where the subscriber can avail fund management facility at very low costs. Subscribers are free to withdraw amount from this account. While self-employed and other private sector employees do not get any tax benefits under NPS Tier II scheme, government employees do get the tax benefits under Section 80C if they keep invested for the period of three years.

Advantages of National Pension Scheme

Tax Savings – NPS tax benefit

- 80CCD (1) covers the self-contribution, which is a part of Section 80C. The maximum deduction one can claim under 80CCD (1) is 10% of the salary, but no more than the stated limit. For the self-employed taxpayer, this limit is 20% of the gross income.

- You can claim any additional self-contribution (up to Rs 50,000) under section 80CCD (1B) as NPS tax benefits.

The scheme, therefore, allows a tax deduction of up to Rs 2 lakh in total, whereas for corporate employees the benefit can be over and above 2 Lacs through:-

- 80CCD (2) covers the employer’s NPS contribution, which will not form a part of Section 80C. This benefit is not available for self-employed taxpayers. The maximum amount eligible for deduction will be lowest of the below: a. Actual NPS contribution by employer b. 10% of Basic + DA c. Gross total income

Premature Withdrawal and Exit rules

In a pension scheme, it is vital for you to continue investing until the age of 60. However, a subscriber can withdraw only upto 25% of his own contributions towards this scheme if you have been investing for at least 3 years. You can make a withdrawal for up to 3 times (with a gap of 5 years) in the entire tenure.

Risk Estimation

At present, there exists a cap in the range of 75% to 50% on equity exposure under the National Pension Scheme. For government employees, this cap is 50%. The equity portion will reduce by 2.5% each year beginning from the year in which the investor turns 50 years of age. However, for an investor, 60 years and above, the cap is fixed at 50%. This stabilises the risk-return equation in the interest of investors, which means the corpus is to some extent safe from the equity market instability. The earning possibility of NPS is higher as compared to other fixed income schemes.

Withdrawal Rules After 60

You cannot withdraw the entire corpus of the NPS scheme after your retirement if your corpus is more than Rs. 2 Lac. For receiving a regular pension from a PFRDA-registered insurance firm you are required to keep aside at least 40% of the corpus for the annuity (Pension), the remaining 60% is withdrawable and tax-free now.

There are five Annuity (Pension) Service Providers registered with PFRDA offering different annuity options to the subscribers. To name few

- Pension (Annuity) payable for life at a uniform rate to the annuitant only.

- Pension (Annuity) payables for 5, 10, 15 or 20 years certain and thereafter as long as you are alive.

- Pension (Annuity) for life with return of purchase price on death of the annuitant (Policy holder).

- Pension (Annuity) for life with a provision of 100% of the annuity payable to spouse during his/her lifetime on death of the annuitant

- Pension (Annuity) for life with a provision of 100% of the annuity payable to spouse during his/her lifetime on death of the annuitant.

Deferment Option

As per PFRDA regulations, if the subscriber does not desire to withdraw the funds on attaining the age of 60 years then the subscriber has an option to opt for Deferment and remains in NPS till he/she attains the age of 70 years. Lump Sum withdrawal amount can be deferred for maximum 10 years and Annuity portion can be deferred for maximum 3 years.

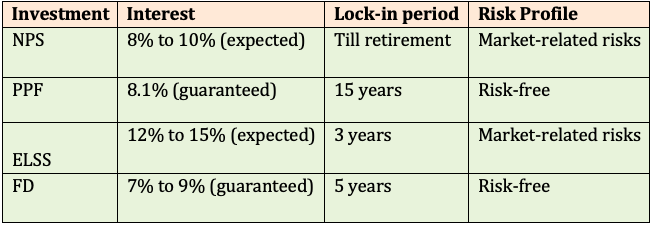

Comparing NPS scheme with other Tax Saving Instruments

Other than the NPS, the other popular tax-saving investment options under Section 80C are Public Provident Fund (PPF), Equity Linked Savings Scheme (ELSS), and Tax-saving Fixed Deposits (FD).

To conclude, NPS is a worth tax saving investment option as it offers a choice of investment options and variety of Pension Fund Manager (PFMs) for planning the growth of your investments and at the same time financially securing one’s future. Subscribers have an option for portability, where they can switch over from one investment options to another or from one fund manager to another, to certain regulatory restrictions.

The author is the Managing Director at Alankit Limited