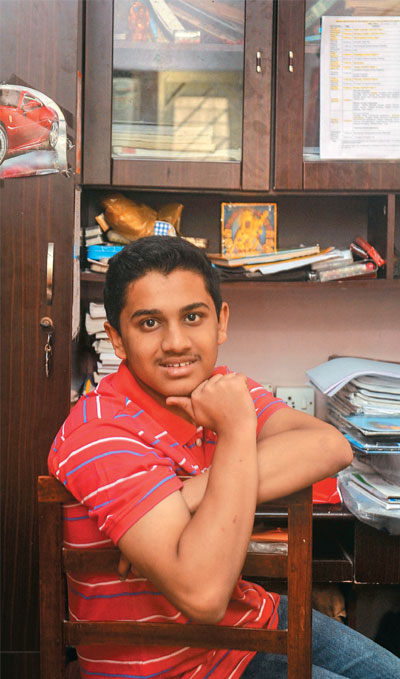

Come January, and scores of families with children appearing for annual examinations get into a huddle mode. If it’s class 12 board exams, concerns are expressed over admission into college and the numerous competitive exams that need to be taken. If the child is appearing for class 10 exams, it is even more crucial, as it more or less decides which way the child’s education and professional career would go in future. The Ghosh family, based in SaltLake township, on the eastern fringes of Kolkata, is anxious as to which way fate will take their 16-year-old son Prajeet Ghosh’s career, as he prepares for ICSE exams that will take place in a few months.

Prajeet is studying in Don Bosco, Kolkata, and understands that it is a crucial phase in his career. Not only has he to score well in exams, he would also need to decide what subjects to take up in class 11. At a career counseling session at his school, consisting of interactive classes and a test, it was suggested that Prajeet, whose reasoning power is strong, opt for medicine, computer science and mass communication, in this order.

A carefree world

Although Physics is his favourite subject and he is good at it, the counselors also suggested mass communication as he loves to talk and interact with people. But Prajeet’s interests lie elsewhere. Like many of his friends, he wants to become an engineer but not in one of the popular streams like electronics or software. He wants to become an automobile engineer, being bitten by the love for cars and anything mobile. He spends considerable time following his passion by researching about cars and even subscribes to auto magazines, which has only fuelled his interest further in car designs and safety features.

Prajeet is also into music. He likes listening to songs and knows how to play the synthesizer, having learnt it from a Kolkata-based branch of TrinityCollege, London. He also played the synthesizer in his school band ‘Half Octate’. Prajeet is also an avid gamer, who loves to frequent gaming parlours and enjoys playing FIFA with his friends. In all, like any other teenager of his age, it is too much of a strain for him to decide and plan for a future that seems so far ahead at this moment.

“My son is a dreamer. He has various ideas and tells me about new things he learns every day,” says Prajeet’s mother Rita. So, if one day he hears about nuclear physics and how destructive the atom bomb is, he tells his mother how this energy can be used for the benefit of mankind. “His teachers tell us that he has the potential, but hard work is also needed,” says Kalyanbrata, his father.

Kalyanbrata is into outdoor advertising business, which he started about nine years ago with a partner, after working for a few advertising firms. Rita, a teacher, has left her full-time job and now takes parttime teaching sessions at coaching centres. The idea is to spend more time with Prajeet. Like any other parent, Kalyanbrata and Rita want the best for their son and know how important the next few months are for him; and so will be the next few years, depending on how the next few months turn out to be.

Funding Prajeet’s dreams

To make their son’s dreams come true, the Ghoshs have invested in two LIC policies, with Prajeet as a nominee, that will mature when he turns 18 and pay out Rs.3 lakh. This sum has been earmarked for Prajeet’s college education and the couple plan to review it the moment the ICSE exams get over and there is a clear handle on which education stream Prajeet will pursue.

Their current income takes care of his education needs, by way of school fee and anything else that he needs. The couple is confident that they will be able to meet his education expenses with existing savings and future income. At the same time, they are also thinking about their own financial goals, especially retirement. In the absence of any clearly defined retirement goal, most of the surplus that Kalyanbrata earns at present is invested back into the business. “I am confident that my share in the business will be adequate to fund our retirement,” he says.

To ensure that medical emergencies are met easily, the couples have taken a floater insurance cover with a Rs.2 lakh cover for each of them and a Rs.1 lakh cover for Prajeet. They definitely need to increase this cover, going by the rising healthcare costs. A cause of concern is that the family does not have any investment in equity or mutual funds. Rita had once put her money in a mutual fund scheme that promised high returns but did not materialise as expected. “Now, we do not want to take risks and prefer investing in safe instruments,” she says. For their retirement, they will need to put money into equities to build wealth, to be able to manage their sunset years well.

Changing priorities

For the family, the focus has shifted to studies, with Prajeet’s exams just around the corner. Currently, he is putting in more hours to prepare for his exams—tuitions, syllabus revisions, etc. “After coming back from school in the afternoon, he usually attends his tuition classes. On days he does not have tuitions, he goes out to play with his friends and then puts in a couple of hours to study,” says Rita. After dinner, he watches TV to unwind from a hectic day. “We realise that he needs breaks in between his studies to keep his mind fresh,” says Rita.

For the family, the focus has shifted to studies, with Prajeet’s exams just around the corner. Currently, he is putting in more hours to prepare for his exams—tuitions, syllabus revisions, etc. “After coming back from school in the afternoon, he usually attends his tuition classes. On days he does not have tuitions, he goes out to play with his friends and then puts in a couple of hours to study,” says Rita. After dinner, he watches TV to unwind from a hectic day. “We realise that he needs breaks in between his studies to keep his mind fresh,” says Rita.

For Prajeet, it has been very different after entering 10th standard. “Earlier, we used to go for family get-togethers on weekends. We also used to visit the mall and go to the club every weekend, and I would go out to swim and play tennis with my father on Sundays. Summer holidays were a lot of fun and I used to play cricket with my friends throughout the day. All that has changed immensely,” says Prajeet. The family has not been travelling as much as they were in the past. “The education system is such that a lot depends on how well you score in the board exams. So this time is very crucial for him,” says Kalyanbrata.

The senior Ghoshs’ dreams rest on their son Prajeet. In an environment where competition is very high, a few marks here and there could make all the difference for him; it is about making the most of the time that is left before the exams start. For Prajeet, it is just the beginning of an exciting life ahead and we wish him good luck!

If like the Ghosh family, you too would like to get your financial plan done free of cost, write in to nk@outlookindia.com with your details.