By now, you might think the word ‘insurance’ would spark more than just a passing glance from people. Especially after a global pandemic and rising medical costs over the past few years would have affected nearly every Indian family in some way or the other. Yet, a new finding might surprise you: nearly 48 per cent of Indians don’t know what ‘term insurance’ is or what are the benefits of having one.

That’s not just a number; this is an action call when it comes to the financial preparedness of Indian citizens. The finding comes from the newly released ‘How India Buys Insurance 2.0 report by Policybazaar, an online insurance marketplace.

The report, based on responses from around 4,000 people, gauges the picture of a widespread lack of insurance, poor risk perception, and a tendency to fall back on outdated financial crutches, like selling assets or borrowing money during emergencies.

If not Term Insurance, then what?

One of the clearest takeaways from this study is that people are unaware of term plans, which is an insurance that ensures financial coverage for your dependents if something happens to you. It’s not that people are not choosing to buy, they are not aware of it.

The concerning factor is what people think they will do in a crisis. A significant number of respondents said they would sell ancestral property or dip into savings when faced with a medical or life emergency.

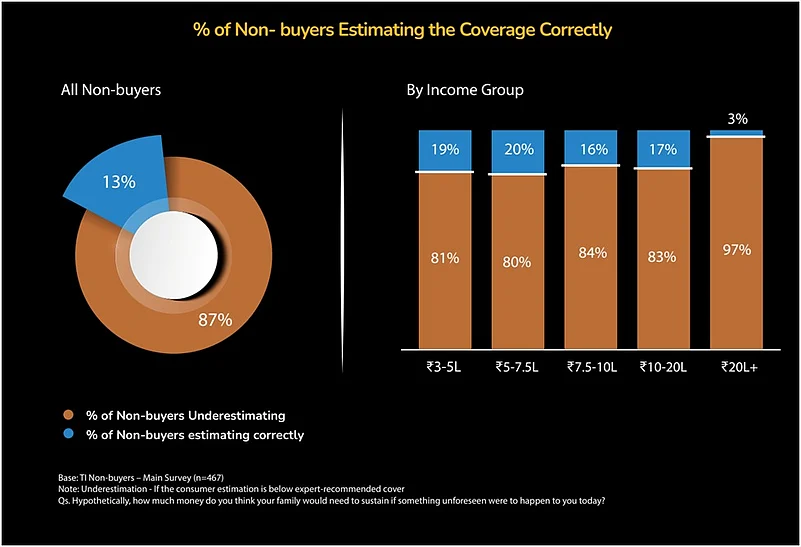

But when you scratch beneath the surface, the reality is different: 87 per cent of those who don’t have term insurance have not even accounted for real financial needs like children’s education, ongoing loans, or the costs a spouse might face later in life.

Health Insurance Coverage: Not Enough

The report finds that people do take health insurance more seriously in comparison to term plans.

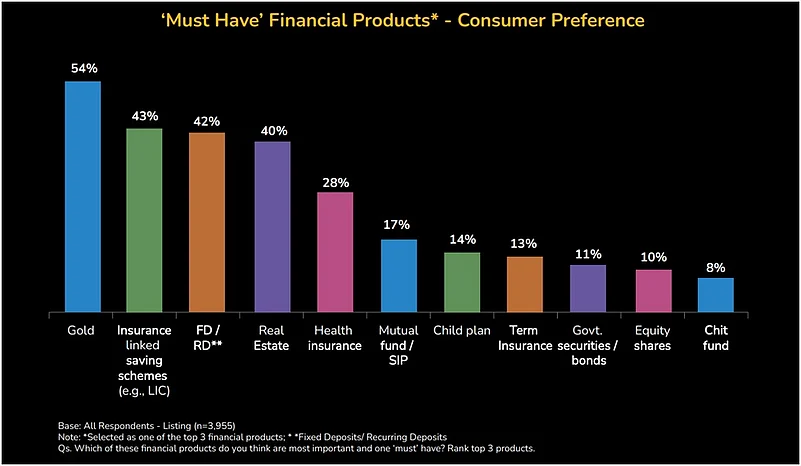

Around 28.3 per cent of respondents now consider it one of their top three must-have financial products, alongside assets like gold, real estate, and fixed deposits.

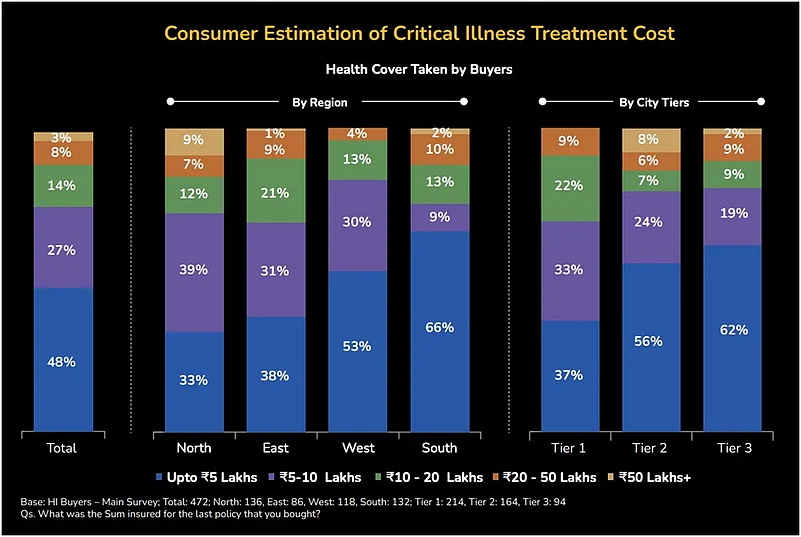

Most buyers opt for modest coverage of Rs 10 lakh or less, which is fine, but enough to cover expensive hospital bills for any critical illnesses.

The underestimation is sharpest in South India, where two-thirds of policyholders have a cover of Rs 5 lakh or less.

Meanwhile, over half of those without insurance believe that treatment for serious diseases like cancer or heart conditions will cost under Rs 5 lakh. Another recent report found that surgery costs in India have increased by 250 to 300 per cent in the past decade. For instance, a heart transplant would cost (approx.) Rs 34 lakh in 2025 as compared to Rs 9.8 lakh a decade ago.

The Awareness Gap

Still, there is a silver lining of good news: awareness is growing. Term insurance saw an 18 per cent jump in adoption in FY24, which is far better than the sluggish 2 per cent annual growth over the past few years.

And among those who are aware of it, 56 per cent say they are open to buying it. However, openness is not the same as action.

Financial experts often recommend that term insurance coverage should be about 15–20 times your annual income. That way, even if something happens to you, your family can maintain their lifestyle and meet future expenses without being financially broken.

The report notes that only 13 per cent of non-buyers surveyed actually estimated their insurance needs in line with this advice.

What is stopping people from taking insurance? Lack of knowledge is topped by a gap in how we talk about financial risk. Typically, for people in India, insurance is not something one plans to buy, rather it’s something one is pushed to buy after a scare or a crisis.

Says Sarbvir Singh, Joint Group CEO, PB Fintect, “A large proportion of consumers plan to sell ancestral assets or borrow money during a crisis rather than opt for simple, accessible solutions like health and life insurance to protect their families. As an industry, it's imperative that we strengthen awareness and improve the overall customer experience to drive broader adoption and ensure financial security for all.”