Summary of this article

PMJJBY fraud exposed using forged deaths and bogus micro-claims

Investigators flagged 49 of 50 claims; Rs 10 lakh paid to living persons

Municipal and banking collusion probed as inquiry widens across districts

Case may trigger tighter digital verification for government-backed insurance

A sprawling fraud in Madhya Pradesh has revealed how money from a government-backed life insurance scheme intended for low-income families quietly slipped into the hands of an organised network, according to a recent report by NDTV. The case concerns the Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), a low-cost policy designed to provide a Rs 2 lakh safety cushion for families who lose their primary breadwinner.

A Welfare Scheme Bent Out Of Shape

The PMJJBY was meant to be simple: small annual premiums, modest paperwork, quick settlement in the event of death. Over time, those very features appear to have been turned against the system. Investigators found that several living individuals were declared dead on official records, while deceased persons were occasionally revived on paper if it helped the fraudsters stitch together a claim. Forged death certificates, altered bank slips, and made-to-order application forms formed the backbone of the racket.

The Economic Offences Wing began digging after inconsistencies surfaced in Sheopur. Out of fifty claims routed through a single insurer, only one held up to scrutiny. Five payouts worth a total of Rs 10 lakh went through despite the so-called deceased being very much alive. Similar irregularities later appeared in neighbouring districts in the Gwalior-Chambal belt, suggesting the operation had been running for years rather than months.

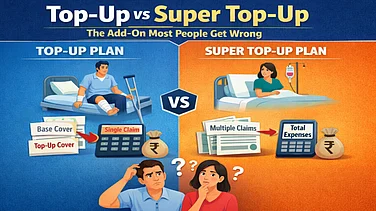

The picture that emerges is not of a lone opportunist but of a loose consortium that understood how small-ticket insurance can be milked without attracting early attention. Because each claim was of a fixed, modest value, the racket spread its net wide, filing many small wrongful claims instead of fewer large ones.

The Circle Of Collusion And The Road Ahead

Names of suspected operators have come up, and the investigation has broadened to include municipal officers responsible for registering births and deaths, as well as staff in banks tasked with verifying claim paperwork. Multiple insurers, both public and private, are now reviewing past settlements to identify anomalies.

Police have invoked sections of the Indian Penal Code dealing with cheating, forgery, conspiracy, and criminal breach of trust. Officials believe more arrests are likely once the financial trails are fully reconstructed and claim documents are cross-checked with civil records.

A Reminder For The Insurance Market

For the insurance sector, the case is a reminder that schemes intended for financial inclusion sit on delicate ground. If the verification layer is thin, the programme becomes vulnerable to predation, and genuine beneficiaries end up facing more hurdles later. The expectation is that the episode will push insurers and government departments toward tighter digital verification of death records, quicker authentication loops, and closer monitoring of micro-claims.

But the larger story sits elsewhere: that a scheme created to protect families with no buffer against tragedy can so easily be warped into a revenue source for those willing to bend the rules.