Summary of this article

Family floater plans work best for young, healthy couples—but strain as dependants and claims increase.

Individual plans protect each member’s cover from being eroded by another’s medical needs.

As families age, health risks diverge—shared pools often fail to reflect this reality.

The right structure isn’t cheaper vs costlier, but whether your cover still holds up when life happens together.

One size never fits all families. When Mr and Mrs Sharma got married, their insurance decision felt straightforward. They were young, healthy, and just starting out. A Rs 10 lakh family floater policy covered both of them for around Rs 12,000 a year. Separate individual policies would have cost closer to Rs 18,000. The floater seemed efficient, practical, even smart. For several years, it was. Then life changed. Their daughter was born with complications that required NICU care, costing Rs 4.2 lakh. A few months later, Mr Sharma needed emergency surgery for appendicitis, adding another Rs 2.8 lakh. In one year, medical bills touched Rs 7 lakh.

The policy paid the claim. But when the family checked the remaining cover, only Rs 3 lakh was left for the rest of the year. That is when many families discover the real difference between family floater and individual health insurance plans - not at the time of purchase, but at the time of claim.

The Structural Difference That Matters

At a basic level, the distinction is simple. A family floater has one shared sum insured that all members draw from. Individual plans allocate a full sum insured to each person separately. In theory, sharing works when claims are infrequent. In practice, healthcare today doesn’t always cooperate.

Sanjiv Bajaj, Chairman & Managing Director, BajajCapital, says, “Health insurance decisions are increasingly about resilience, not just cost. Families need coverage structures that hold up when more than one health event occurs in a year, not just when things go according to plan.”

That resilience depends heavily on the stage of life.

When a Family Floater Works Well

For young couples in their late twenties or early thirties, with no children and no chronic conditions, a family floater often makes sense. The probability of both partners needing hospitalisation in the same year is low. Premiums are efficient, coverage is flexible, and unused sum insured doesn’t go to waste. At this stage, a floater can be a sensible starting point provided it’s reviewed regularly.

The problem begins when families treat it as a permanent structure.

Where Floaters Start to Strain

As soon as children enter the picture, medical needs become less predictable. Maternity, paediatric care, infections, and occasional emergencies can all draw from the same pool. If one member uses a large portion of the cover early in the year, everyone else is left with reduced protection. The policy hasn’t failed but it hasn’t adapted either. This is where many families continue with a floater simply because it’s familiar, not because it still fits.

Why Individual Plans Gain Relevance Over Time

By the time families reach their forties, health profiles often diverge. One partner may develop diabetes or hypertension. Another may remain relatively healthy. Parents may need to be covered separately. Individual plans prevent one person’s medical needs from eroding another’s coverage. Each policy stands on its own, making claims less stressful and planning more predictable.

Bajaj notes, “Insurance works best when it mirrors real life. As families age and medical needs become more individual, coverage structures also need to become more personalised rather than pooled.” Yes, individual plans cost more upfront. But they also offer certainty something shared pools struggle to deliver when multiple claims arise.

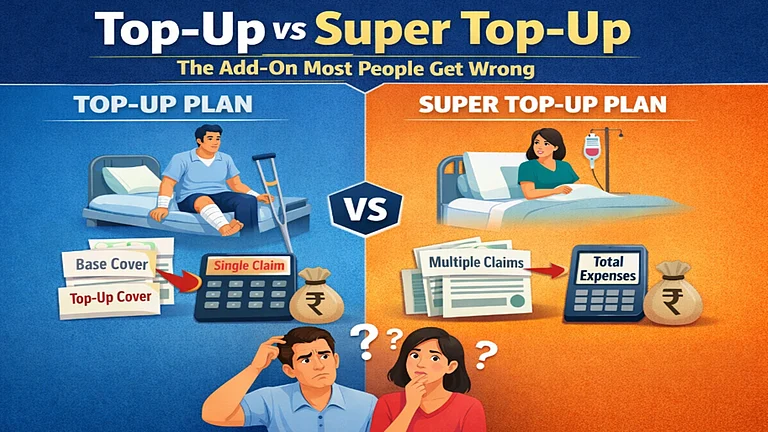

The Hybrid Middle Path

For many Indian families, the answer isn’t floater versus individual, it’s a combination. Individual policies for working adults. A smaller floater for children. Separate senior citizen plans for parents. And a super top-up layered on top to handle large, unexpected expenses. This approach costs more than a single floater, but it avoids the common problem of one claim weakening everyone’s protection.

The Real Question to Ask

Instead of asking, “Which plan is cheaper?” families should ask, “If two members need care in the same year, will this structure still protect us?” If the answer feels uncertain, the policy may be affordable but not adequate. Family floaters aren’t flawed products. They’re just stage-specific. What works at 28 may quietly fail at 38. Health insurance isn’t something you buy once and forget. It needs to evolve as families grow, age, and change. Because in healthcare, adequacy isn’t defined by the premium you pay, but by how well your cover holds up when life happens all at once.