With India being one of the fastest-growing economies in the world with expanding job opportunities, many non-resident Indians (NRIs) are returning to India. Being closer to loved ones is also another reason.

However, moving back to India after years of staying abroad, can be tricky, especially when it comes to managing the finances.

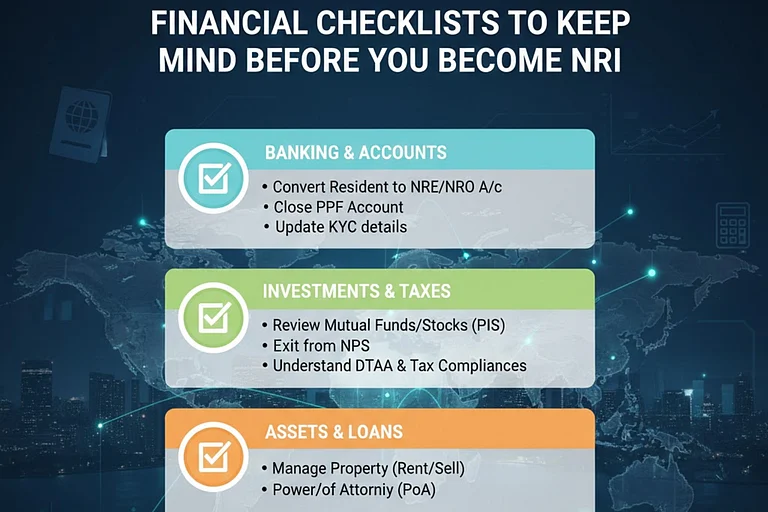

We discuss some important financial things NRIs need to keep in mind when coming back to India.

Sort Out Your Bank Accounts

Returning NRI should convert their Non-Resident External (NRE), Non-Resident Ordinary (NRO) and Foreign Currency Non-Resident (FCNR) accounts into resident accounts, ensuring compliance with Indian banking regulations. The balance of the NRE and FCNR accounts needs to be transferred to the new Resident Foreign Currency (RFC) account.

“If you have been an NRI for a longer period, you might benefit from Resident – But Not Ordinary Resident status (RNOR- subject to certain conditions fulfilled during previous years' status). An individual returning to India can keep their RNOR status for up to three years maximum. The advantage of this will be that your income earned offshore won’t be taxable for up to three years. Also, it allows you to maintain NRE FDs till maturity or expiry of the status,” says Madhupam Krishna, Securities and Exchange Board of India (Sebi) registered investment advisor (RIA) and chief planner, WealthWisher Financial Planner and Advisors.

You may continue to hold your international bank accounts, till you have settled all financial issues in the country you were resident.

A Smooth Transition

Next, NRIs should evaluate their existing international investments and consider repatriating funds or transferring investments to Indian options like mutual funds, stocks, or fixed deposits.

Demat Account: You will have to open a new resident demat account and have your existing securities held in your NRI demat account transferred to this account. You will then also have to close your NRI demat account and the NRE Portfolio Investment Scheme (PINS) account.

Mutual Funds: “You must inform your bank/broker/Asset Management Company (AMC) through whom you have invested in mutual funds. KYC needs to be updated. Then inform them about the change in your residency status, and update resident savings accounts,” says Krishna.

Bank Fixed Deposit (FDs): If you have an FD account, such as an NRE/NRO FD, the account should be converted to a resident FD account. You will still earn interest and the same will be taxable at the applicable tax rates.

As residents, NRIs must report and pay taxes on their worldwide income, including foreign earnings. This includes salaries, rental income, capital gains, and other earnings.

“It is important to note that NRIs must declare their foreign assets and income to the Indian tax authorities. This includes bank accounts, properties, and investments held abroad. Proper documentation and compliance with the Foreign Exchange Management Act (FEMA) regulations are essential,” says Krishna.

Review Insurance And Taxation

It’s also worth reviewing your insurance policies, as foreign health and life insurance may not provide adequate coverage in India. Securing a suitable health plan and a term life policy will offer the necessary protection. “Additionally, once you are a resident, your global income becomes taxable, so understanding tax obligations and reporting foreign assets accurately is crucial. Careful financial planning will help ease the transition back to India,” says Arjun Guha Thakurta, executive director, Anand Rathi Wealth.

To understand taxation, residency status plays an important role.

NRI needs to understand the tax implications of becoming an Indian resident again. “This involves examining the duration of stay and income sources to plan for potential tax liabilities in both India and the previous country of residence,” says Krishna.

For investments held abroad, it's advisable to evaluate them country by country. If you sell these investments within the first two years as an RNOR (Resident but Not Ordinarily Resident), you typically won't incur taxes in India. “However, ensure compliance with the tax rules of the country where the investments are located. If that country has a double taxation avoidance agreement (DTAA) with India, understand the terms to minimize tax implications effectively,” says Guha Thakurta.

A Different Environment

One first point to remember is that inflation, the rate at which the general level of prices for goods and services is rising, in India is generally higher than in many developed markets.

“Therefore, if someone has planned their expenses based on the inflation rates of these developed markets, they should reconsider their approach. While the costs may be somewhat lower in India, the higher inflation must be taken into account when planning a return to the country,” says Anand K Rathi, co-founder, MIRA Money, an investment management platform.

However, on the other hand, investing in India has the advantage of high returns, whether from fixed deposits or equity investments, which often outperform many developed markets. For instance, a standard fixed deposit can yield around 7.25 per cent, while well-diversified mutual funds may provide up to 14 per cent returns.

“When returning to India, keeping about six months’ worth of expenses in a liquid fund is advisable, which typically offers a return of around 6.75 per cent,” says Rathi.

Plan For Retirement

If an NRI has decided to stay in India after, he or she needs to plan for retirement. There are several investment options one can choose from.

National Pension System (NPS)

The NPS is a government-backed retirement savings scheme that allows NRIs to invest in a mix of equities, corporate bonds, and government securities. NRIs can withdraw 60 per cent of the corpus at retirement and invest the remaining 40 per cent in an annuity plan for a regular income.

Pension Plans

Pension plans are long-term financial products that help NRIs save for retirement. These plans can be either immediate or deferred annuity plans, providing regular income post-retirement.

Mutual Funds With SWP

Investing in mutual funds allows NRIs to diversify their portfolio across equities, debt, and money market funds. This can provide high returns over the long term and help build a retirement corpus. NRI can also plan to withdraw a fixed amount periodically to make an annuity using the Systematic Withdrawal Plan (SWP) feature provided by MFs.

Real Estate

Investing in residential property in India can provide rental income and capital appreciation over time. NRIs can also consider commercial real estate for higher returns.

Equity Stocks

NRI can leverage India's growth story by investing in a portfolio of selected shares. However, one must advance using his stock market knowledge and risk appetite to invest in direct equities/companies.

Health Insurance

Having a comprehensive health insurance plan is crucial for NRIs planning to retire in India. It ensures access to quality healthcare without financial strain.

By keeping the above in mind NRIs can effectively manage their foreign income and make informed decisions based on their financial goals and risk tolerance. Consulting with a financial advisor can provide personalized advice tailored to individual circumstances.