The Securities and Exchange Board of India (Sebi) has issued new guidelines for research analysts (RAs) and investment advisors (IAs) to comply with. According to the new guidelines issued on January 8, 2025, the RAs and IAs need to follow these instructions. The regulatory authority issued the RAs and IAs norms in December 2024, but the new rules are regarding qualification standards, fee structures, deposit requirements, and client segregation protocols.

What's New?

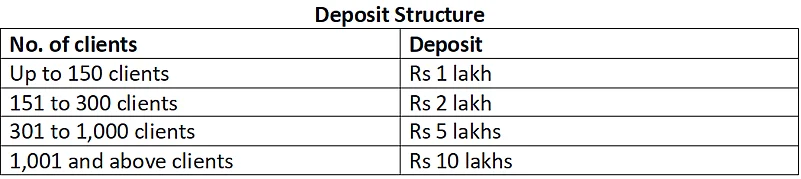

Deposits Requirement:

As per the new guidelines the RAs need to maintain certain deposits based on the maximum number of clients on any day of the previous year. The minimum is Rs 1 lakh and the maximum is Rs 10 lakh.

Source: Securities and Exchange Board of India (Sebi)

The maximum amount needs to be revised by April 30 every year for the previous financial year. The aim is to provide more security to investors.

The deadline to comply with this requirement is set on April 30, 2025, for the existing RAs, whereas the new RAs are required to comply with it with immediate effect. For the existing IAs the deadline is until June 30, 2025, and for new IAs, it is applicable with immediate effect for the new applicants.

Dual Registration:

One of the important changes is the ‘Dual registration’, where Sebi has permitted individuals and entities to have dual registration to offer research services as well as advisory services. However, service providers need to comply with the requirements separately. Most importantly, RAs and IAs need to segregate clients based on the services they are availing from the service provider. A person availing advisory services cannot access the distribution services within the same group.

Artificial Intelligence (AI) Usage:

Sebi has mandated that RAs and IAs disclose to what extent they are leveraging AI in their offerings. Amid the influx of technological development, AI usage is growing fast, and thus to ensure data security, the entities are mandated to comply with this rule. They are also required to disclose the fee structures and show the conflict-of-interest declaration.

Compliance Audit:

The RAs and IAs are also mandated annual compliance audits and submit reports to the Research Analyst Administration and Supervisory Body (RAASB) and Investment Adviser Administration and Supervisory Body (IAASB) within a month. Also, they need to submit the report of any adverse finding and the action taken thereof within a month from the date of the audit report but not later than October 31, every year.

Functional Websites:

The new rules also require entities to publish any adverse findings, and other mandatory disclosures on their websites, and thus establish a functional website.

Provisions Introduced For Part-Time RAs And IAs:

The authority has also introduced provisions for part-time RAs and IAs, such as teachers, chartered accountants, lawyers, doctors, or others whose occupations do not conflict with the rules specified. However, for imparting advisory services, they are also required to seek registration as part-time RA and part-time IA.

Rules Extend To Model Portfolio Recommendation:

The new rules apply to the model portfolio recommendation as well. Sebi defines a model portfolio as “A basket of securities for which a research report is issued by a RA recommending the relevant weightages for one or more securities mentioned therein”.

Also, for a complaint lodged, as per the rules the RAs are required to resolve it within seven business working days.