On April 21, 2025, the US imposed high tariffs on solar imports from China, Cambodia, Vietnam, Malaysia, and Thailand. Tariff rates now hit as high as 60 per cent for Chinese solar goods and up to 3,521 per cent for Cambodia, practically banning their modules from the US market.

The Department of Commerce identified final dumping margins of 125.37 per cent for Cambodia, 271.28 per cent for Vietnam, 111.45 per cent for Thailand, and 8.59 per cent for Malaysia. Additionally, companies like JinkoSolar faced duties up to 245 per cent, and Trina Solar over 375 per cent.

Amid this disruption, India finds itself in a rare golden position. Indian solar companies, once peripheral, now stand a chance to take centre stage.

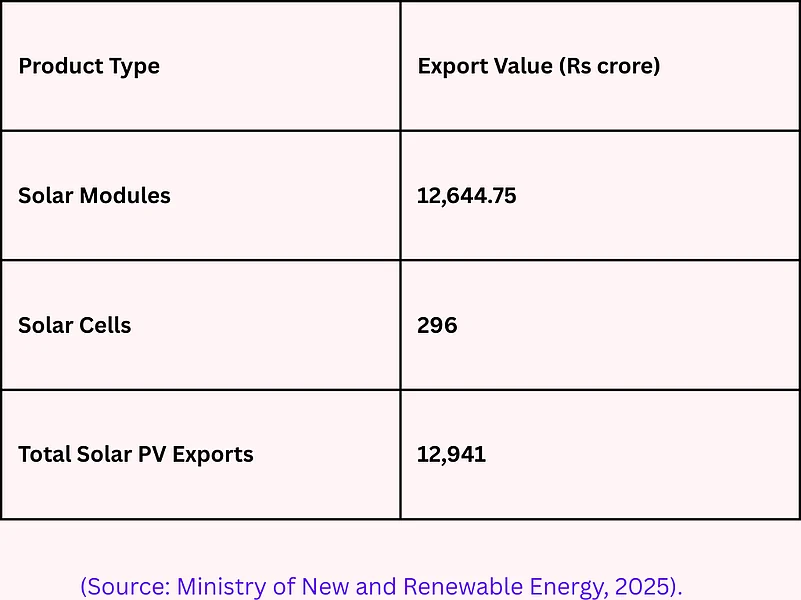

India’s Solar Export Scenario

In FY24, India’s solar PV exports touched Rs 12,940.72 crore (around $1.97 billion), of which modules alone contributed Rs 12,644.75 crore. Solar cells made up another Rs 295.97 crore. In January 2025 alone, solar PV cell exports were Rs 11.49 crore

Vikas Gupta is the CEO and Chief Investment Strategist at OmniScience Capital, says "Over time we will get more and more upstream manufacturers and thus it will become more domestic and eventually at the appropriate scale the cost advantages will flow. This is a multi-year initiative and is being accelerated. We are already seeing solar cells being manufactured locally. Next step will be domestic wafer manufacturing and then producing polysilicon and so on."

At present, over 90 per cent of India’s solar PV exports head to the US, yet India represents just 11 per cent of total US solar imports, according to a report by Hindu BusinessLine, indicating a tremendous growth potential.

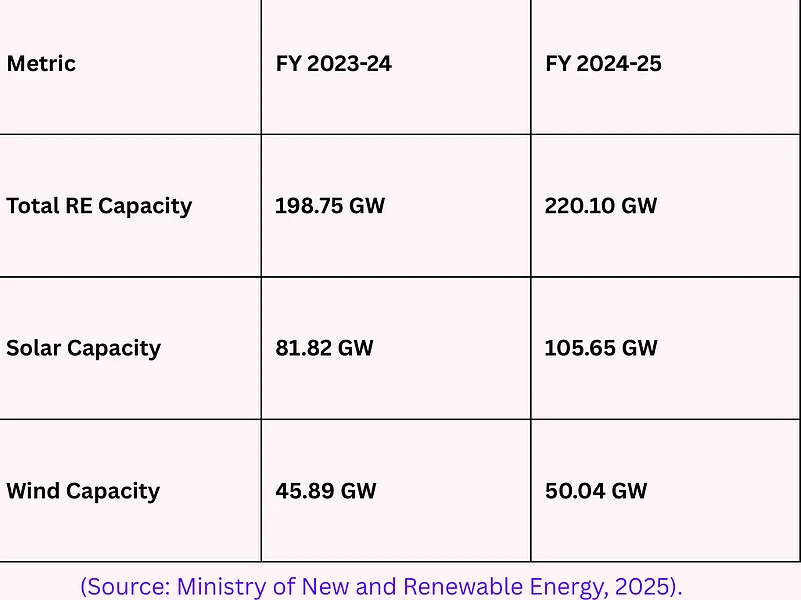

Installed Renewable Capacity Powers Up the Future

As on March 31, 2025, India’s total renewable energy capacity hit a record 220.10 GW, with solar alone contributing 105.65 GW, a jump of 23.83 GW in just one year, according to data from the Ministry of New and Renewable Energy.

Says Mohammad Saif, partner, strategy & transactions, EY India: “India’s current cost advantage is driven by lower labour and input costs versus tariff-driven export benefits. India has approximately a 70 per cent cost advantage from labour and a 30 per cent advantage from tariff/policy. This will vary with the technology types and tier level of the module.”

Indian Solar Energy Companies Overview

Waaree Energies: Founded in 2007 with a modest 30 MW capacity, Waaree Energies has grown exponentially to a colossal 50 GW giant. It holds India’s largest solar module capacity and has diversified into green hydrogen, electrolysers, and battery storage.

Waaree has a 56.5 GW order book, split between 54 per cent international and 46 per cent domestic projects. In the last nine months of FY25, Waaree generated revenues of Rs 10,705 crore, with 21 per cent from international sales. Notably, the company’s US plant began operations in January 2025, tapping into the booming American market.

Waaree has targeted the retail segment regarding end application, residential rooftop, and utility-scale solar, which has sharply driven up operational profit margins. Margins further rose, as the industry faced lower input costs and improved order selection, from 11 per cent in December 2023 to 21 per cent in December 2024.

Declining global prices were especially notable for inputs, such as solar cells, aluminium, glass, and adhesives, including the possibility of a sharp decline in cell prices between 2021 and 2024.

Premier Energies: Premier Energies specialises in high-efficiency mono PERC and TopCon solar cells, boasting a 2GW solar cell and 4.13GW solar module capacity. In FY24, Premier exported $31.2 million worth of solar cells to the US, which is its largest international market. Financially, Premier delivered Rs 1,713 crore in sales in Q3 FY25, marking a 140 per cent growth on a year-on-year (y-o-y) basis and a 493 per cent y-o-y increase in net profit.

Tata Power: Tata Power, through its solar arm TP Solar, operates India’s largest single-location integrated solar cell and module manufacturing facility in Tirunelveli, Tamil Nadu, with a total capacity of 4.3GW. A part of the over-a-century-old Tata Group, Tata Power’s solar business has been rapidly expanding, with a recently commissioned 2GW solar cell production line.

In FY 24, Tata Power recorded revenue, and earnings before interest tax depreciation and amortisation (Ebitda) of Rs 61,542 crore and Rs 12,701 crore respectively.

Adani Solar

It is a subsidiary of Adani New Industries, which has been operating in the space since 2016 and has been rapidly expanding since then. It is India's first and largest vertically-integrated solar manufacturing facility, from polysilicon to modules under the same roof, and is located in Ahmedabad. Adani Solar has over 4GW of module and cell manufacturing capacity in Gujarat and is eyeing a jump to 10GW soon. The company’s prudent integration between “polysilicon to module” protects it from global supply chain impairment, placing it in a favourable cost and reliability position globally.

Insolation Energy

The company is headquartered in Jaipur and is a rising star focused on high-efficiency rooftop and commercial solar modules. It posted FY24 revenues of Rs 737.2 crore and net profits of Rs 15.5 crore.

In FY25, provisional numbers suggest a massive jump to Rs 1,338 crore, an 80.5 per cent surge on a yearly basis. Insolation is also setting up a 7GW integrated solar facility in Madhya Pradesh to tap into both the domestic and the US demand.

Acme Solar Holdings

It is one of the major solar project developers based in Gurugram, Haryana, and reported FY24 revenues of Rs 1,319.30 crore and a sharp rebound in profits of Rs 697.8 crore. Acme operates 2.45GW of solar projects and is developing another 1.65GW. Additionally, it is pioneering green hydrogen and green ammonia production, with a notable 100,000-tonne annual ammonia offtake agreement signed with Yara for a facility in Oman.

Solar Economics

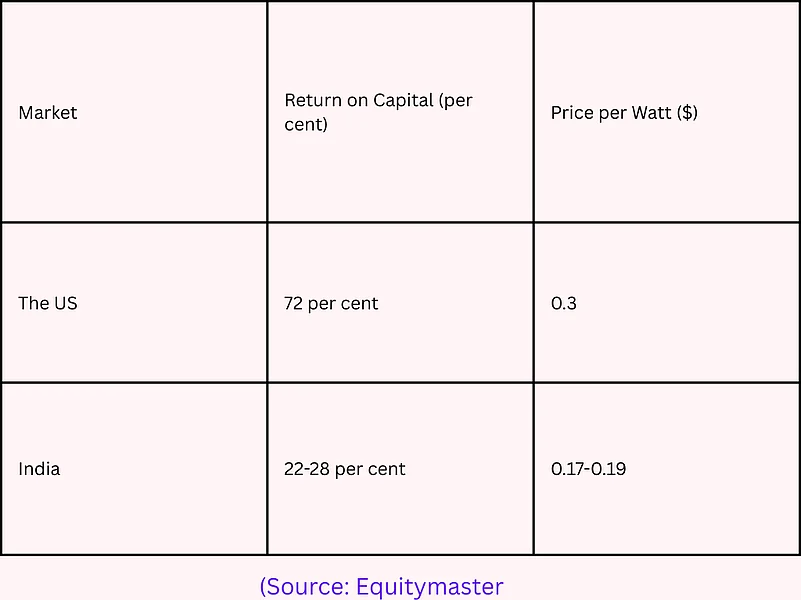

Exporting solar panels to the US is three times more profitable than domestic sales.

Indian companies earn 72 per cent returns on US exports compared to 22-28 per cent on domestic sales, according to Equitymaster. Moreover, Indian modules fetch around $0.30 per watt-peak in the US, significantly higher than the domestic price of $0.17-0.19.

Says Pankaj Kumar, vice-president, Fundamental Research, Kotak Securities: “In our view, the current valuation of Indian solar manufacturing companies implies that the sector will continue to see exponential growth over the medium term, but sustenance of unit economics at current levels is unlikely, given the increasing competitive intensity. We expect heightened competitive intensity to start impacting margins from 2028.”

US-China Trade Tensions: An Opportunity For India

China controls 80 per cent of the world’s solar supply chains. Countries globally are desperate to diversify with “China Plus One” strategies. India’s rapid expansion, from 50GW module capacity in 2024 to a projected 150GW by 2026, puts it in a prime position to exploit this opportunity.

Says Utkarsh Sinha, managing director, Bexley Advisors, a boutique investment firm: “India is increasingly seen as a geopolitical counterweight to China, and that positioning works in our favour. The US tariff policy is currently about decoupling from China, not broadly reducing imports. India is currently seen as part of the solution, not the problem. Tariff exposure exists, but it’s low for now.”

While India is still one of the favoured countries with a baseline tariff of 10 per cent, it is only applicable till the 90-day pause on the tariff ends. The updated tariff rates may or may not change for India, leaving the scope of increased exports on a cliffhanger.

Sinha adds: “Unlike ASEAN exporters, India is not seen as undercutting the market with subsidies or dumping. Post the 90-day 10 per cent window, we may see some tightening, but the US is likely to view India as a stable, rule-abiding energy security partner in building resilient clean energy supply chains.”

“The Indian ones are considered less efficient than many mature production establishments in the ASEAN region. Also less durable, though improving with new product lines offering a warranty for 30 years, because ASEAN has most original equipment manufacturer (OEM) factories. While tier-1 Indian modules comply with international standards, ASEAN ones are still considered technologically more mature due to OEM backing. ASEAN modules are perceived as more premium than Indian ones,” he further said.

Praveen Golash, Associate Director, BCG, says: "From a cost structure point view, India’s manufacturing is atleast 150-20% higher than China. Hence, any advantage that India will have will be due to tariff barriers. As the matter of fact, US tariffs for cell and module were already above 200% and hence, direct imports were negligible. Chinese companies were supplying largely through their manufacturing facilities in South East Asian countries like Vietnam, Cambodia, Thailand etc. with SEA countries also getting under tariff restriction, India will have higher share of US imports. Having said that we must be vary of the fact, intention behind US Government’s tariff restriction is to increase domestic manufacturing base and hence, India may also end-up facing similar tariffs in long term."

Bhanu Patni, Associate Director, India Ratings & Research, says: “If you look at the cost benefit, our structure shows we have large module capacity but limited cell capacity. So we’re largely dependent on importing cells and modules, which are currently priced lower than historical levels. That’s mainly due to the high capacity built up in China. The pricing we see on the import side becomes the benchmark, and compared to that, Indian exports are competitive. In fact, some exporters have reported slightly higher margins on overseas sales than in the domestic market.”