To earn returns from the market, the most common practice is to buy low and sell high. However, timing the market is very difficult for investors. It simply means that when the market goes up, an investor will buy fewer units. And when the market is at a lower level, then they can buy more.

However, on a few occasions, amateur investors may end up doing the opposite due to the fact they tried to time the market. Since timing the market is almost impossible, there is a different investment strategy called rupee cost averaging.

What is Rupee Cost Averaging?

“Rupee cost averaging is a disciplined investment strategy wherein an investor invests a fixed amount of money at regular intervals. This means you buy at different price levels over time. When the market goes up, you buy fewer units. When the market goes down, you buy more units with the same investment amount,” said, D P Singh, Deputy Managing Director & Joint Chief Executive Officer, SBI Mutual Fund while speaking with Outlook Money.

“As a result, the per-unit cost averages out over time. In a bear market, you accumulate more units, and when the market recovers, your returns improve. This approach ensures that you are consistently investing at various levels rather than trying to time the market,” Singh explained.

Rupee cost averaging requires an investor to invest a fixed amount of money at predefined, periodic intervals, irrespective of the market movement or asset price. This means when the market falls they can buy more units around that time, and when the market rises, they will buy fewer units. With time, the purchase price or cost of buying mutual fund units will average out, which is known as rupee cost averaging. Regular investment spread across a period means that the cost of purchasing reduces, increasing individual gains.

This method is also used by mutual fund systematic investment plans (SIPs). “SIP is a way of implementing rupee cost averaging,” Singh added. By investing through SIPs, you automatically benefit from cost averaging.

If the NAV At The Time Of Entry Stood at Rs 34.92

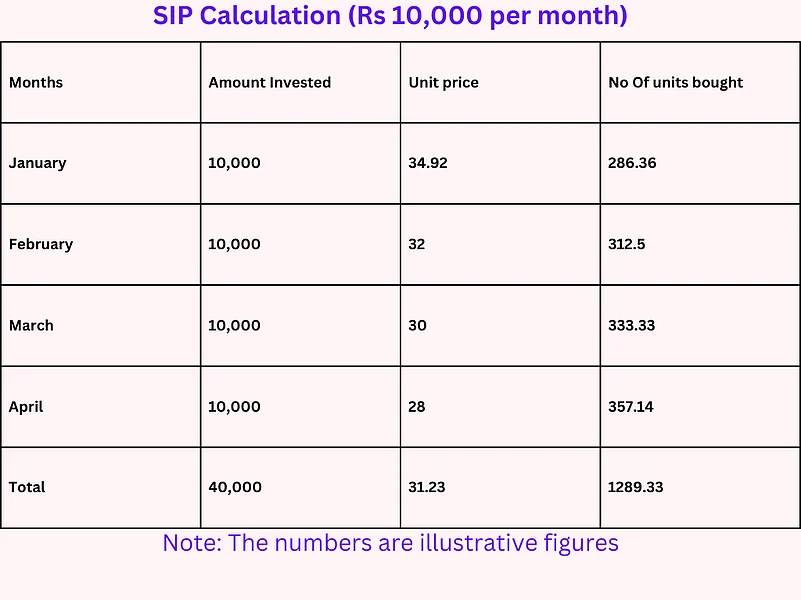

Assuming a person X invested Rs 40,000 in mutual funds in four months, which was spread as Rs 10,000 every month using the rupee cost averaging method during the period, as shown in the illustrative table.

Estimating the net asset value (NAV) may have seen fluctuations during the same period. Their average cost per unit would come to Rs 31.23 towards the end of the fourth month, despite market fluctuations, with around 1289.33 units, as shown in the illustrative table

Meanwhile, if someone took entry at the same time, but invested everything in one go i.e. Rs 40,000 in January with the same NAV. They will not be getting the benefit of the reduced average cost. Additionally, the units they will be able to buy will be slightly less at 1,145.4.

Calculation:

Rupee Cost Average = Rs31.23 (Total Investment ÷ Total Units = Rs 40,000 ÷ 1289.33)

Lump-sum per unit cost = Rs 34.92 (Rs 40,000 ÷ 1289.33)

Benefits of Rupee Cost Averaging

Handles Market Volatility

Rupee cost averaging can help in dealing with market volatility because a fixed amount is invested at regular intervals irrespective of market highs and lows.

Reduces Cost

When invested for a longer period, the cost of units is brought down, increasing the gains.

Ease of Investing

An investor picks the amount based on their investment capacity regularly instead of putting in a lump sum amount.

Discipline

It omits the impulsive exit and entry strategy. Thus, inculcating disciplined investing for the longer term.