Non-resident Indians (NRIs) have many options when it comes to choosing options to trade or invest in India. NRIs can invest in real estate, mutual funds, and listed securities traded on recognised stock exchanges in the country such as the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE). However, they face specific restrictions, limitations, and requirements to comply when it comes to trading and maintaining bank accounts.

Who is an NRI?

An individual who stays in India for less than 182 days during any given fiscal year is considered a non-residential Indian.

NRIs Need Different Bank Accounts For Specific Investments

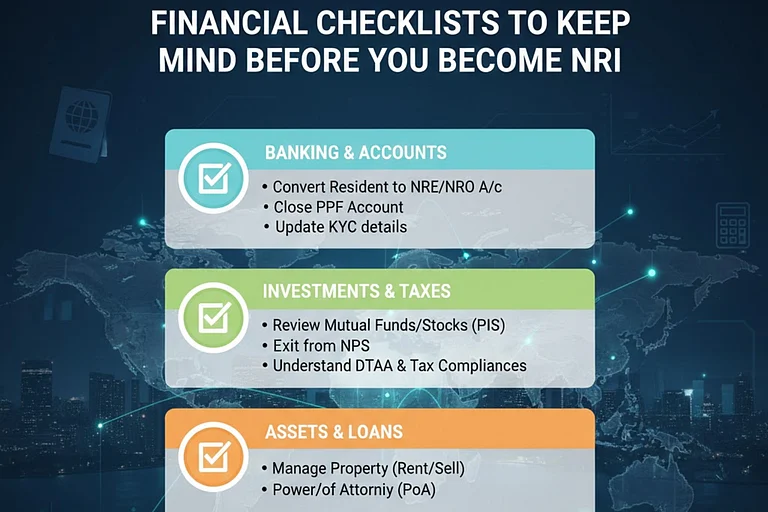

An NRI has to maintain two kinds of accounts when he/she moves abroad. According to the Foreign Exchange Management Act (FEMA) rules, an NRI cannot have a savings account in his/ her name in India. They need to convert all their savings (money earned abroad) to a Non-Resident External Account (NRE) or Non-Resident Ordinary (NRO) account.

What is the difference between NRE & NRO accounts?

NRO account: This is used as a bank account to transfer foreign earnings to India in Indian currency (rupees).

NRE Account: This is used as a savings account to manage the income earned in India by an NRI in Indian currency (rupees).

NRIs also maintain a Foreign Currency Non-Resident (FCNR) Account which is maintained in foreign currency and protects against exchange rate fluctuations.

For Investments:

To make investments in India (listed securities) the NRIs need to open a NRE account under the Portfolio Investment NRI Scheme (PINS) or use their Non-Resident Ordinary (NRO) account to route their investments.

Certain banks authorised by the Reserve Bank of India issue the Portfolio Investment Scheme (PIS) letter to NRIs. Additionally, all transactions conducted through the NRI PIS account are reported to the RBI.

“However, NRIs also have the flexibility to invest in India using a non-PIS NRO trading account, making PIS optional, and allowing trading without Portfolio Management Services (PMS),” says Varad Bhandari (PrimeWealth).

What are the trading restrictions for NRIs?

Stock Market Trading:

NRIs are allowed to invest in the Indian stock market through RBI’s PIS. However, there are certain restrictions and rules they must adhere to. They are subject to specific limitations on the ownership of shares in Indian companies to maintain a balanced and regulated market.

Says Bhandari, “NRIs are allowed to invest up to 5 per cent of the paid-up capital of listed Indian company in recognized Stock exchange on a repatriation or non-repatriation basis.”

In addition to this, they are allowed to invest up to 5 per cent of the paid-up value of each series of debentures of listed Indian companies on a repatriation or non-repatriation basis.

“For individual NRIs, the limit is generally set at 10 per cent of the paid-up capital of the company. However, this cap can be extended if the company's board of directors passes a special resolution, allowing aggregate investments by all NRIs to reach up to 24 per cent of the paid-up capital,” says CA Swapnil Patni.

Sectoral Caps: Patni further elaborated that these sector-specific caps are particularly stringent in sensitive sectors like defence, telecom, and banking, where foreign ownership is closely monitored to ensure national security and economic stability.

The detailed regulatory framework ensures that while NRIs can actively participate in the Indian stock market, their influence remains within defined limits to maintain market integrity and fairness.

No Intraday Trading: NRIs are not allowed to engage in intraday trading.

Mutual Funds

NRIs are allowed to invest in Indian mutual funds without significant restrictions, however, those based in the US face certain particular limitations. “This differentiation arises due to the compliance obligations imposed by the Foreign Account Tax Compliance Act (FATCA),” says Bhandari.

It is important to note that, not all Asset Management Companies (AMCs) permit investments from NRIs based in the US. Moreover, their policies for dealing with US clients may also vary.

Whilst investing in mutual funds:

Tax Implications: NRIs should consider the tax implications in both India and their country of residence.

KYC Compliance: NRIs must comply with Know Your Customer (KYC) norms, which include providing proof of identity, address, and other relevant documents.

Bhandari lists some key restrictions and limitations that NRIs should know about:

NRIs are not allowed to:

- Invest in currency and commodity-based ETFs in India.

- Buy Today Sell Tomorrow (BTST) is not available for NRIs.

- Sovereign Gold Bonds (SGBs) cannot be bought by them. However, existing units can be sold or held until maturity.

- Trade in the currency and commodity segments.

- NRIs cannot pledge securities as collateral to trade in F&O.

NRIs can trade under these conditions:

- If an NRE account is mapped, only equity trading would be allowed.

- If an NRO account is mapped, either equity delivery or F&O would be allowed.

- They can invest in equity delivery and trade in F&O via NRO Non-PIS accounts. However, to trade in F&O, a custodian must be appointed and a Custodian Participant (CP) code is required.

- Intraday trading in F&O is allowed if the client has a CP code (Custodial Participant).

Key limitations for NRIs:

- US Based NRIs can only invest in a select few AMC schemes

- Investments by all NRIs clubbed together cannot exceed 10 per cent of the paid-up capital of the Indian listed company or the paid-up value of each series of debentures of the company.

- The above aggregate ceiling can be raised to 24 per cent if the Indian company passes a special resolution to that effect.

Navigating the complexities of NRI trading rules, restrictions, and bank account management can be challenging. However, with a clear understanding of the regulations and careful planning, NRIs can effectively invest in the Indian market.