Investing is not just about picking the hot stocks or timing the market. It is also about how you allocate your money to different asset classes. Diversification across different assets helps in maintaining the right balance between risk and reward. Irrespective of your financial goals, such as saving for retirement or your child’s education, asset allocation ensures your money works smarter. If you wish to automate your asset allocation, ICICI Prudential Multi-Asset Fund could be a decent choice, given its long track record.

Portfolio

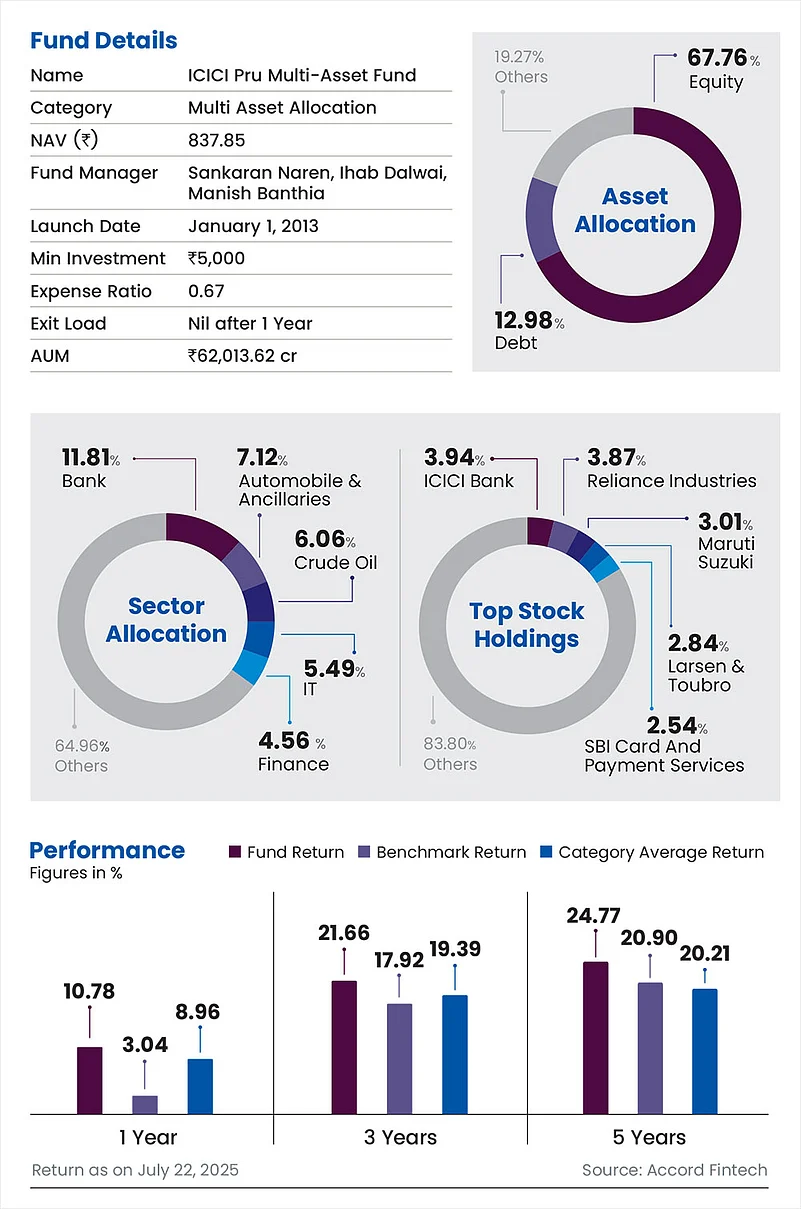

The fund owes its success to two key strategies: smart asset allocation and active management across asset classes. This approach has helped the fund to generate superior risk-adjusted return. In terms of portfolio, the equity part is highly active.

“We regularly review and rebalance our portfolio moving from stocks that have done well to those we believe could do well next. This is part of a well-defined process where we take a different view from the broader market. We also follow a sector rotation strategy, shifting between sectors based on where we see the next opportunity,” says Ihab Dalwai, senior fund manager, ICICI Pru Mutual Fund.

Also, the portfolio is more tilted towards equity, with the equity component being maintained in the 47-70 per cent range in the past three years, with commodities typically in the range of 10-16 per cent.

Performance

The fund has performed well both in terms of delivering superior returns and limiting the downside during market downturns. It has delivered compounded annual growth rate (CAGR) of 16.06 per cent and has outperformed its peers with a comfortable margin on 10-year basis.

OLM Take

This could be a decent choice in the multi-asset allocation category, given its sound fund management, process-driven approach, and superior track record across market cycles.

kundan@outlookindia.com