Nowadays, we receive a lot of information through the internet. Social media also provides lots of opinions, but it is not regulated by any financial market regulator. There is a trend on social media—by a section of financial planners or advisors—of putting forth an amplified number which is required for your required retirement corpus.

The logic given may be correct: the increased cost of living in today’s world, lifestyle, and future inflation, reduces the purchasing power of money, among others.

However, the inherent message in those social media posts, though not explicit, is that you require “so much” of money to retire peacefully, hence you “come to me” for advice and I will help you create that much required corpus.

Taking advice from a professional financial planner is always desirable and recommended. However, the inducement to do so should not be because of an amplified number propagated on social media, mainly designed to induce fear. The more money you have, the merrier, but the estimate has to be in tune with your future goals, lifestyle choices, level of income and expenses.

Estimation of Expenses

While it is true that people’s lifestyle expenses have moved up, and inflation will eat into your kitty, but ultimately, it is about your own lifestyle and expenses, which is unique to you and will have a bearing on your corpus.

Break down your expenses in terms of components and estimate which would remain similar 10 or 20 years down the line

Even with increased expenses, some families manage their monthly regular expenses with a monthly income of Rs 50,000, whereas some families find it difficult with even Rs 2 lakh. Some families have the burden of equated monthly instalments (EMIs), while some families are free from that. Hence, it is not correct to propagate one particular amount as the required retirement kitty.

This is a function of your current expenses, your estimate of expenses post retirement and inflation for the years remaining up to your retirement. It is a common perception that after retirement, expenses would move up due to medical expenses, apart from inflation. However, certain lifestyle expenses tend to cool down after retirement. Today, you may desire a fancy car or a fancy phone. With maturity, just a car to travel or a less expensive phone would suffice. You may like to visit clubs or eat out today, but in your golden years, you might become more sedate. You may have EMIs today, but that will be repaid in due course.

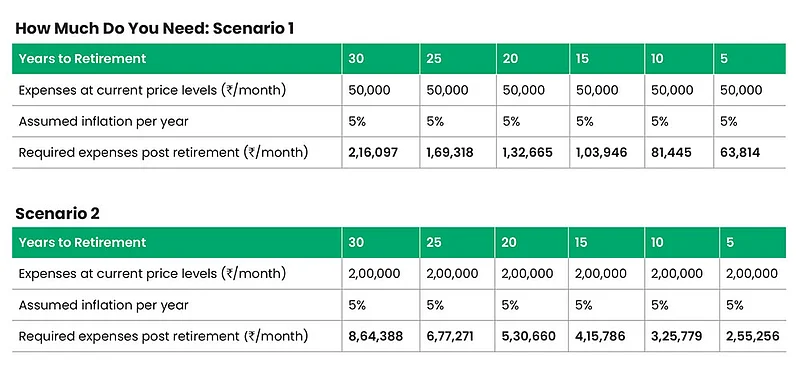

Let us take an example. Your current expenses—the usual, regular expenses and not the EMIs or sudden expenses—are Rs 50,000 per month. Let us assume inflation at 5 per cent per year. If you have 10 years to go for retirement, due to inflation over 10 years, your expenses become Rs 81,445 per month. If you have 20 years to go for retirement, it becomes Rs 1,32,665 per month due to inflation. If your expenses are Rs 2 lakh per month, on the same assumptions, it becomes Rs 3,25,779 after 10 years and Rs 5,30,660 after 20 years.

You have to break down your expenses in terms of components and estimate which are the heads that would remain similar 10 or 20 years down the line, and apart from inflation, which ones may move up (like medical) and which ones may come down (like eating out). On the estimated expenses, you inflate it for the number of years to retirement.

Estimation Of Corpus Required

This is a function of multiple variables and assumptions. This can be best done by a professional financial planner or advisor in accordance with your requirements. But here’s a broad outline.

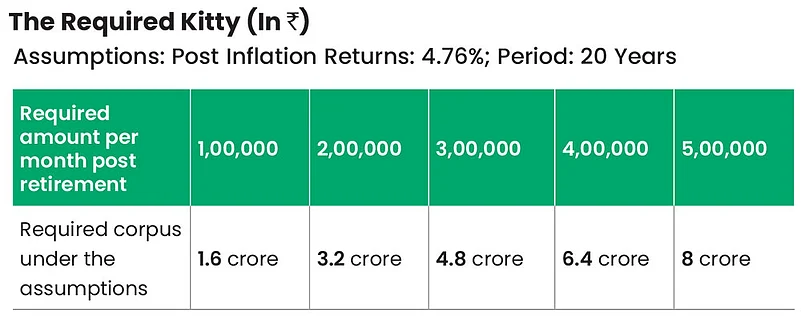

Suppose, you have arrived at an estimate of the expenses per month post retirement. Then the variables are the number of years left, i.e., your life span, where do you want to invest your corpus, how much your portfolio would yield, and inflation. For the sake of illustration, let us say that you would retire at age 60 and will live till 80, which means you have 20 years to go after retirement.

Taking inputs from your surrounding is good, it gives you different perspectives. However, you have to figure out what works for you

The investment of your corpus for those 20 years would yield a return of 10 per cent per year, and inflation is assumed at 5 per cent per year. According to the financial planning formula, net of inflation, your kitty will earn 4.76 per cent per year. Your expenses per month, at that stage of life, are `3 lakh per month. You do not want to leave any legacy out of this amount, which means, it may become nil after those 20 years.

The estimation of corpus is the amount that would give you Rs 3 lakh per month, for 20 years, when the amount invested earns 4.76 per cent per year. Under these assumptions, that corpus is around Rs 4.80 crore. For a requirement of Rs 1 lakh per month during your retired life, the corpus is around Rs 1.60 crore and for Rs 5 lakh per month, it is nearly Rs 8 crore.

Conclusion

Taking inputs from your surrounding is good, it broadens your horizon and gives you different perspectives. However, you have to figure out what works best for you. Otherwise, you would get lost in the multiplicity of views and opinions.

To use an analogy, if you want to lose weight, you will get a plethora of advice and videos on social media, which may be correct in their own way. Somebody would advise running, somebody would advise walking or dieting. May be they got their results that way. However, you have to figure out what suits your own conditions.

Similarly, the expenses you incur currently and expect to incur in your golden years, is unique and exclusive to your requirements.

By Joydeep Sen, Corporate Trainer and Author