We cannot control what others say or do, or what trap they lay for us, but we can definitely control our responses and actions to those, and therein lies the key to decisions that you may not regret making

- EDITOR'S NOTE

Tight on budget? Dump the popular European destinations for the little-known wonders that are equally attractive

Smart travellers must know that insurance is a must-have. From essential health coverage to theft protection and trip interruptions, know what you need for a worry-free Europe trip

Donald Trump has been re-elected as the 47th President of the US after a gap of four years. Here’s how it will affect the Indian markets and how it will benefit sectors such as IT, pharma, export-oriented sectors and others

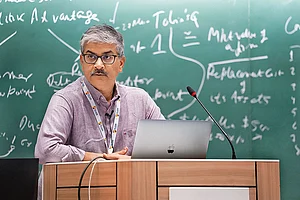

Professor Sanjay Bakshi, a value investor, behavioural economist and adjunct professor at Flame University, Pune, gives his unique perspective on how to choose a stock, in an interview with Nidhi Sinha, editor, Outlook Money, as part of the Wealth Wizards series. He also shares his learnings from role models Warren Buffett, Charlie Munger, Benjamin Graham and others, and how being a chartered accountant, economist, investor and teacher make him into what he is today. Edited excerpts from the interview

A review of Parag Parikh Flexi Cap Fund

This scheme initially aimed to provide heath insurance only to the underprivileged targeted

AI has become an integral part of our lives, right from customer service at banks to insurance claims. But it has now become a powerful arsenal for the fraudsters too who are increasingly using AI to scam individuals and corporations alike to commit fraud. The key is to stay vigilant

Listing books of her choice, among the ones she reads during the year, is ace investor Devina Mehra’s favourite year-end activity. She says it’s a daunting task to pick around 12 books from a list of 50. “This has a year of rereading, ranging from old favourites, Bertrand Russell, Sudha Murthy and Mahadevi Verma to Robert Fulgum, Agatha Christie and even Enid Blyton,” she writes. She also read P.G. Wodehouse’s autobiographical works, and was fascinated at how much effort, thought and craft went into what look like easy breezy, off-the-cuff books. “To write the first 25,000-30,000 words of a book, he often wrote 100,000 words! From thinking of his characters as actors in a play and therefore giving big scenes to each, the craft of how to handle major and minor characters, the discipline of writing even in a Nazi prison with gun-toting guards literally breathing down his neck and so much more,” she writes about his autobiographical works. It’s a treasure-trove for his fans and for those who want to write fiction.

Tight on budget? Dump the popular European destinations for the little-known wonders that are equally attractive

Smart travellers must know that insurance is a must-have. From essential health coverage to theft protection and trip interruptions, know what you need for a worry-free Europe trip

Donald Trump has been re-elected as the 47th President of the US after a gap of four years. Here’s how it will affect the Indian markets and how it will benefit sectors such as IT, pharma, export-oriented sectors and others

Professor Sanjay Bakshi, a value investor, behavioural economist and adjunct professor at Flame University, Pune, gives his unique perspective on how to choose a stock, in an interview with Nidhi Sinha, editor, Outlook Money, as part of the Wealth Wizards series. He also shares his learnings from role models Warren Buffett, Charlie Munger, Benjamin Graham and others, and how being a chartered accountant, economist, investor and teacher make him into what he is today. Edited excerpts from the interview

A review of Parag Parikh Flexi Cap Fund

This scheme initially aimed to provide heath insurance only to the underprivileged targeted

AI has become an integral part of our lives, right from customer service at banks to insurance claims. But it has now become a powerful arsenal for the fraudsters too who are increasingly using AI to scam individuals and corporations alike to commit fraud. The key is to stay vigilant

A few regulatory changes in November 2024, and how they will impact you

Listing books of her choice, among the ones she reads during the year, is ace investor Devina Mehra’s favourite year-end activity. She says it’s a daunting task to pick around 12 books from a list of 50. “This has a year of rereading, ranging from old favourites, Bertrand Russell, Sudha Murthy and Mahadevi Verma to Robert Fulgum, Agatha Christie and even Enid Blyton,” she writes. She also read P.G. Wodehouse’s autobiographical works, and was fascinated at how much effort, thought and craft went into what look like easy breezy, off-the-cuff books. “To write the first 25,000-30,000 words of a book, he often wrote 100,000 words! From thinking of his characters as actors in a play and therefore giving big scenes to each, the craft of how to handle major and minor characters, the discipline of writing even in a Nazi prison with gun-toting guards literally breathing down his neck and so much more,” she writes about his autobiographical works. It’s a treasure-trove for his fans and for those who want to write fiction.

OTHER STORIES

We all spend during the year-end. But the trick is not to overspend or borrow, either from friends, or your own investment, to fund your indulgence. Maintaining balance is the key

Add Own Cover To Employer’s Plan

Top-Up Loans Offer Longer Tenure

An explanation of what travel now pay later schemes are and why one should not opt for them blindly

Fight yourself to ensure you remain disciplined and don’t stray from the path of organised financial planning

Thematic investing through passive funds like index funds and ETFs may help you leverage India’s growth story

Moving between equity and debt, these funds offer relative stability and growth potential for an investor’s journey.

As 2024 comes to a close, let us reflect on the lessons learnt and the way forward for 2025 in our financial journey to ‘Viksit Bharat 2047’

Planning for children’s higher education is one of the primary goals for most families. Starting early, being reasonable about choices of institutes and not giving in to peer pressure can help a lot

Mutual funds are a good investment option for those wanting to create wealth over the long term without timing the market. Here’s how different categories of funds have performed over time and why they score over traditional investment options

Systematic investment plans go a long way in creating wealth in a disciplined manner as you invest consistently and do not make the mistake of timing the market

Multi-asset funds provide a disciplined approach to investors seeking to balance risk with reward, thereby offering stability and growth in times of uncertainty

Thematic funds can help you invest in specific themes or sectors without having the need to micro monitor specific sectors during market ups and downs