If you want to stay away from the constant game of chasing outperformance or worrying about underperformance, exchange-traded funds (ETFs) can be a smart option. They provide broad market exposure, are cost-efficient, and eliminate the need to time the market. An index ETF allows you to invest in sectors and stocks of the underlying benchmark in the same proportion as the benchmark. If you want to invest in Nifty 50 companies, Nippon India Nifty 50 BeES could be a decent choice.

The Scheme

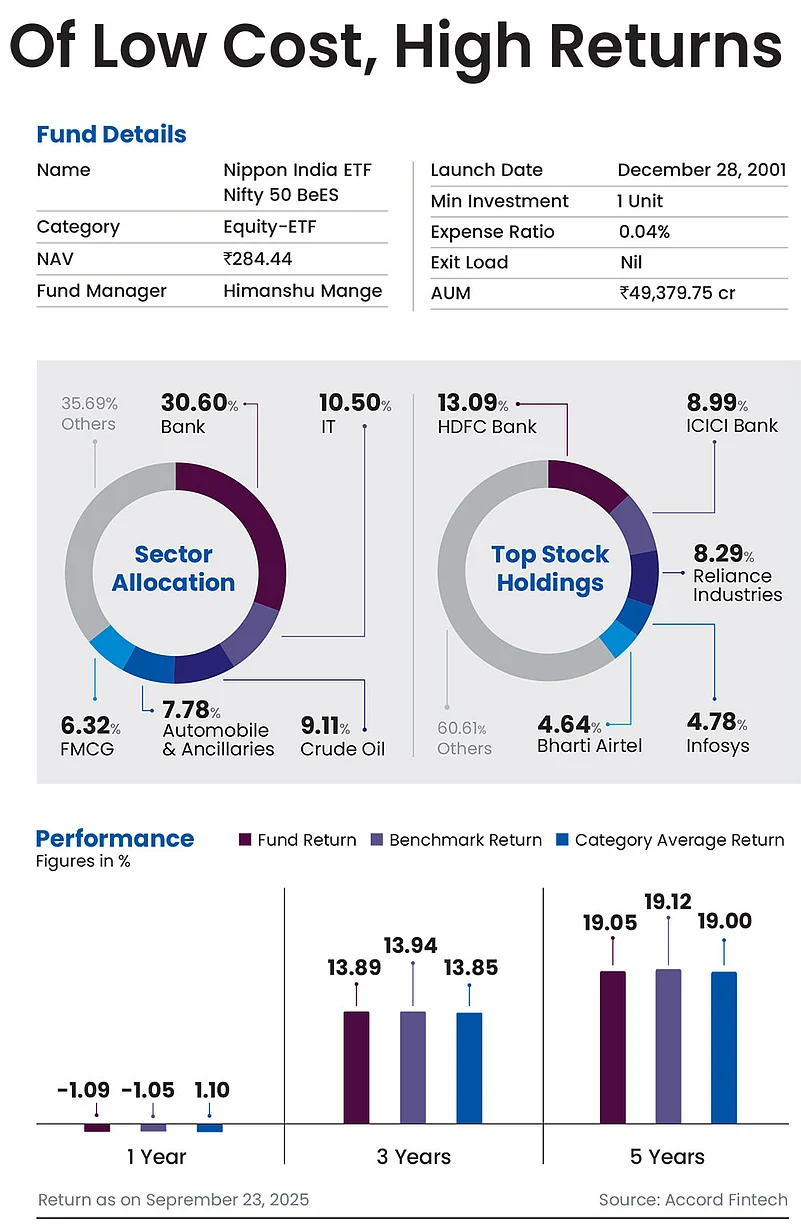

Launched in December 2001, it is India’s first ETF and passively tracks the Nifty. It is also among the top five ETFs in terms of asset size. It is a large-cap fund since its underlying index is Nifty 50, which has the 50 most liquid stocks on the National Stock Exchange (NSE). In the past one year, the difference between its net asset value (NAV) and market price has been 0.04 per cent on an average. One unit of Nifty BeES is around one-tenth the value of Nifty.

Low-Cost Investing

ETFs are better than index funds on various counts. One of their hallmarks is low cost. While index funds are allowed to charge up to 1.50 per cent as expense ratio, ETFs charge much less on account of their structure. Higher expense ratio, leads to relatively lower returns from the index funds. At 0.04 per cent expense ratio, Nippon India Nifty 50 BeES takes the cake and is one of the cheapest among all passively managed diversified funds.

A low expense ratio and an ETF’s structure are responsible for a low TE for Nippon India Nifty 50 BeES (0.036 per cent as on August 30,2025). The scheme has the lowest TE among all diversified passive funds.

The tracking error (TE) of a passive fund is essentially the difference between the returns generated by it and its benchmark index. The lower the TE, the better the fund because of less deviation in return.

OLM Take

This could be a good starting option for new investors looking to enter the equity market. For existing investors who are content with market-linked returns and are not driven by a desire to outperform the market, this is a suitable option to invest for the long term given its track record.

kundan@outlookindia.com