Do you have a health insurance policy that offers cashless claims and are still worried if it will work if a hospitalisation situation arises? It’s natural to be worried given the recent news of the suspension of settlement of cashless claims related to some prominent insurers, including Bajaj General Insurance, Star Health and Allied Insurance, Niva Bupa Health Insurance and Tata AIG Health Insurance. The measures followed certain disputes between the insurers and hospitals over stagnant reimbursement rates amid rising medical costs.

The issues have been resolved, but during the period, patients were forced to pay large sums upfront and await reimbursements, which usually involves a lengthy process, defeating the purpose of cashless claims.

Under the cashless facility, the insurance company directly settles medical bills with the hospital if the policyholder or their insured family member is admitted for treatment in a hospital that is listed under the insurer’s network. This eliminates the need for upfront payment by the insured, except for non-covered expenses or co-payments. This not only provides financial relief, but also expedites access to healthcare, especially during emergencies.

In January 2024, the Insurance Regulatory Development Authority of India (Irdai) launched the “cashless anywhere” initiative, which allows policyholders to receive cashless treatment at hospitals, including those not in their insurer’s network. However, adoption is slow due to low awareness and operational hurdles.

The crises laid bare the ongoing issues in India’s health insurance system—frequent claim denials, poor patient protection, and the need for fair pricing and stronger regulatory oversight to prevent future disruptions and safeguard policyholders.

In case you face such a situation in the future, we have a guide for you on how to navigate through the crisis.

Do Not Panic

First of all, stay calm. Suspension of cashless facilities does not mean treatment will be denied. Hospitals will proceed with the treatment, but your claim will be processed under the reimbursement mode.

Ask why that is so and take it in writing. “Request a written note/email from the hospital third-party administration (TPA) desk stating the reason for cashless denial/suspension and the last status sent to the insurer as this will become evidence later (in case of a dispute),” says Narendra Bharindwal, president, Insurance Brokers Association of India (IBAI).

Also, you need more information. “Contact your insurer or TPA helpline instantly to clarify the situation and get guidance on the next steps,” says Nochiketa Dixit, managing director (industries), EDME Insurance Brokers.

If the treatment begins, the immediate focus should be on ensuring continuity of care for which you would have to arrange cash. In case the treatment has not begun and the illness is such that you can wait, check nearby alternative hospitals that are equipped to carry out the treatment, are part of your insurer’s network and will provide cashless claims. For instance, for Niva Bupa, the suspension of cashless facilities happened at Max Hospitals across the country.

Manage The Funds

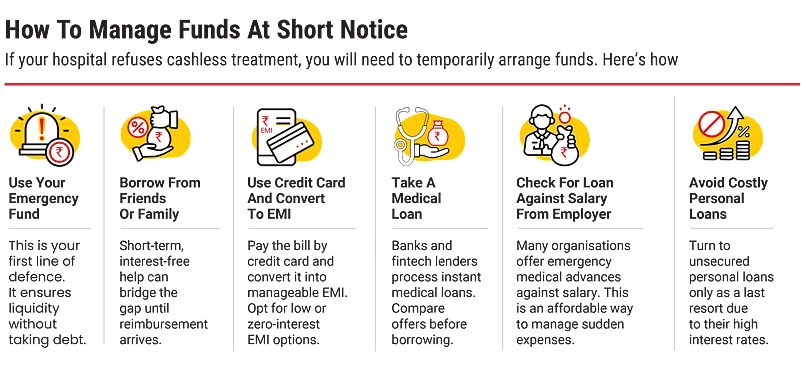

You may arrange funds for payment at discharge through your savings or a loan from friends or family.

Another option is to use a credit card to settle hospital bills, but avail of this option if there’s none other left. Large card transactions can be converted into manageable equated monthly instalments (EMIs), but do check the interest rate.

It is for situations like these that one should have an emergency funds. “One must create an emergency fund specifically to handle unexpected medical expenses that might not be immediately covered by insurance,” says Madhupam Krishna, Securities and Exchange Board of India -registered investment advisor (Sebi RIA) and chief planner, WealthWisher Financial Planner and Advisors. While this will cover any costs not covered by insurance, it can also come in handy during situations when cashless claims are not working.

Some hospitals accept staggered bill payments when requested in writing. Also, check if your organisation offers emergency medical advances against your salary. The idea is to avoid high-interest personal loans, as far as possible.

You can also consider other sources of funds if you can’t manage any of the above. Says Dixit: “Many private hospitals now partner with financiers to offer zero-cost EMIs on medical bills. Also, banks and fintech lenders often process instant medical loans at competitive rates.”

File The Claim Promptly

File a reimbursement claim immediately after discharge. Under Irdai’s mandate, insurers must settle such claims within 30 days, and in the current circumstances, many are prioritising faster payouts.

Also, inform your insurer’s customer care right away. “Most insurers are giving priority to such cases and processing reimbursement claims faster when cashless services are unexpectedly withdrawn,” says Shilpa Arora, co-founder and chief operating officer (COO), Insurance Samadhan, an insurance grievance redressal platform.

To file the claim, collect prescriptions, case notes, laboratory reports, pharmacy slips, original bills and invoices of all the expenses, discharge summaries, and ID proofs. Ensure the claim forms are filled accurately with comprehensive medical details.

You must remember to keep detailed records of every document, in case the insurer asks you to resubmit these later. “Always retain photocopies or scanned copies for your own records,” says Arora.

Cross-check and corroborate everything. Says Dixit: “Check for duplicate charges or unjustified high billing—discrepancies can cause disputes. Align prescriptions and discharge notes with the stated diagnosis. Use the insurer’s website or mobile app to upload scanned documents for faster processing.”

“If the insurer asks a query, reply in writing within 48-72 hours and mention the claim number in the subject line; and attach the exact page/image of the requested document,” says Bharindwal.

Grievance Redressal Path

In case your claim is not being reimbursed, you can always ask for redressal through proper channels.

“First, approach the insurance company’s grievance redressal cell. If unresolved, escalate to the Irdai grievance cell or register a complaint through the Irdai Grievance Management System (IGMS). Finally, approach the insurance ombudsman for free resolution,” says Sarita Joshi, head of health and life insurance, Probus Insurance Broker, an insuretech platform.

Here’s a breakdown of the process.

Contact The Internal Grievance Cell: Lodge a complaint directly with the grievance redressal Officer (GRO) of your insurance company or TPA. The insurer or TPA is required to acknowledge your complaint within three days and provide a resolution within 15 days of receipt of your complaint.

Complain On The IGMS Portal: If you do not receive a response within 15 days or if you are dissatisfied with the resolution provided by the insurer/TPA, escalate your complaint.

“File your complaint online through the IGMS portal (www.igms.irda.gov.in), maintained by Irdai,” says Surinder Bhagat, head-employee benefits, large account practices, Prudent Insurance Brokers, an insurance broking firm.

This centralised platform tracks and manages complaints against insurers.

Approach The Insurance Ombudsman: You may approach the Insurance Ombudsman if your complaint is rejected by the insurer. You can also approach the Ombudsman if no action has been taken for 30 days, or if you are unsatisfied with the insurer’s resolution. “The Ombudsman handles disputes involving claim amounts up to `30 lakh, thus providing a quick and cost-effective resolution through conciliation or binding awards,” says Bhagat.

Consumer Courts: If the claim or dispute value exceeds the Ombudsman’s jurisdiction or involves complex legal issues, you can approach the Consumer Disputes Redressal Commissions at the district, state, or national level.

“The choice of forum depends on the value of the claim and the nature of the dispute,” says Bhagat.

Remember, financial preparedness, and not panic, will protect you in case of a medical emergency.

How To Raise Cashless Claim

Seek a network hospital, that is part of insurer’s list.

Go through exclusions and sub-limits in the policy.

For planned procedures, submit a pre-authorisation request to insurer 48-72 hours before admission.

In case of emergencies, submit this request within 24 hours of admission.

Upon admission, present your health card and personal ID at the hospital’s insurance desk.

The insurer will review the hospital estimate and then approve or question it.

After approval, the insured pays for expenses not covered by the policy, such as consumables, registration fees, and so on.

Upon discharge, the hospital bills the insurer; the policyholder pays for the uncovered expenses.

If the hospital isn’t part of the network or the claim is denied, the policyholder pays expenses and later files for reimbursement.

meghna@outlookindia.com