As financial awareness deepens across India, investor participation has surged. The past five years, in particular, have marked a turning point with conversations about money moving from living rooms to mobile screens, and equity and innovative investing shifting from being an elite activity to a mainstream habit.

Numbers point to the soaring popularity of financial products among investors. The number of demat accounts in India has skyrocketed, rising from about 4.1 crore in March 2020 to over 21 crore by October 2025. At the same time, mutual fund assets under management (AUM) have surged to Rs 79.9 lakh crore.

Along with the numbers, there’s a mindset shift too. Investors are increasingly moving away from the safety net of guaranteed-return products and adopting market-linked financial products that can help them outpace inflation and build long-term wealth.

Investors today don’t just think of chasing returns but look for smarter strategies, better asset allocation, and innovative investment solutions that can align with their financial goals and risk appetite, while balancing growth and stability. This has opened the doors for several newer investment strategies, from passive and factor-based funds to the latest product on the block: specialised investment funds (SIFs).

Capital market regulator Securities and Exchange Board of India (Sebi) came up with the regulatory framework for SIFs in February 2025. To ensure investors do not confuse the product with mutual funds (MFs), asset management companies (AMCs) have been asked to use a different brand name and logo for SIFs.

As of now, around 15 AMCs have obtained approval for a new brand name and four have already launched their SIF products. These include SBI Mutual Fund (Magnum SIF), Edelweiss Mutual Fund (Altiva SIF), Quant Mutual Fund (qSIF) and ITI Mutual Fund (Divinity SIF).

The Need For SIFs

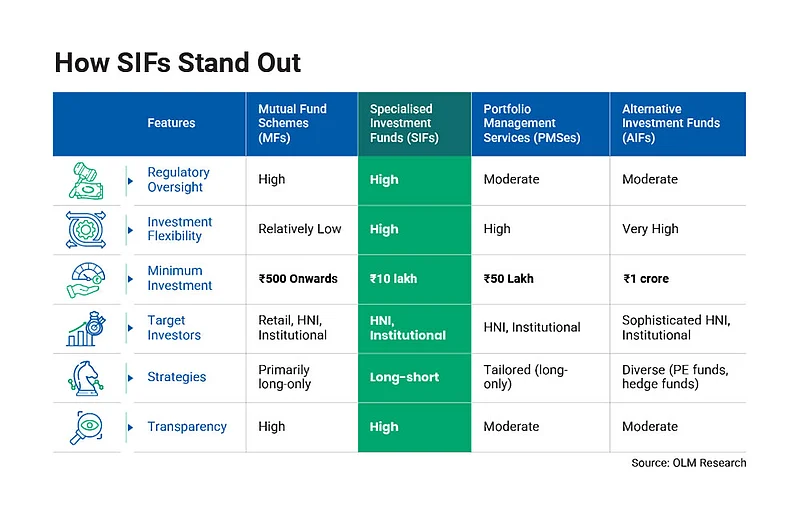

Technically, SIFs bridge the gap between traditional MFs and high-ticket products like portfolio management services (PMS) and alternative investment funds (AIFs).

MFs largely cater to retail investors as they allow small investments that can be as low as Rs 500. However, many high-net worth individuals (HNIs) too invest in MFs. On the other hand, PMSes are largely for HNIs as they require a minimum investment of Rs 50 lakh. Similarly, for AIFs, the minimum threshold is Rs 1 crore.

SIFs bridge this gap, as they allow investments starting from Rs 10 lakh.

“Earlier, there was a gap, you either had to be in mutual funds or in PMSes/AIFs, where you could use derivatives and other tools,” says D. P. Singh, joint CEO and deputy managing director, SBI Mutual Fund. “While many investors gained experience with these instruments, their benefits were not available to a broader base. Additionally, the regulations for PMSes and AIFs are less stringent. The regulator’s intent was to bridge the gap by introducing SIFs within a regulated framework, enabling innovation while ensuring that investors’ interests are protected.”

SIFs are designed for investors who may not be able to commit the minimum investment requirement for AIFs and PMSes, but have enough to meet the SIF threshold and are comfortable taking higher risk for better returns.

“SIFs are an attractive opportunity: they fill the space between traditional equity and debt products, offering a middle ground that caters to evolved investors, HNIs, and ultra-HNIs,” says Singh.

The Offerings

Sebi has permitted seven fund types of SIFs across three broad categories—equity, debt and hybrid. In equity, there are three investment strategies, while debt and hybrid has two each.

Equity: The Equity Long-Short Fund invests at least 80 per cent in equities and equity-related instruments, while allowing up to 25 per cent short exposure through unhedged equity derivatives.

The Equity Ex-Top 100 Long-Short Fund focuses on companies outside the top 100 by market capitalisation, with a minimum 65 per cent allocation to these stocks and up to 25 per cent short exposure in non-large-cap equities.

The Sector Rotation Long-Short Fund concentrates up to 80 per cent of its portfolio in up to four sectors and permits 25 per cent short exposure at the sector level. This means if the fund shorts a sector, all stocks from that sector in the portfolio must be part of the short position.

Debt: The Debt Long-Short Fund invests in a wide range of debt instruments across various durations, while also taking unhedged short positions using exchange-traded debt derivatives.

The Sectoral Debt Long-Short Fund invests in debt instruments from at least two sectors but restricts exposure to ensure that no more than 75 per cent of the portfolio is invested in any single sector. It can take up to 25 per cent short exposure using unhedged positions in debt derivatives. For instance, if the fund takes a short position on a sector, say, auto, all auto-sector debt instruments held in the portfolio must be treated as short positions.

Hybrid: Hybrid options comprise the Active Asset Allocator Long-Short Fund, offering dynamic multi-asset allocation, and the Hybrid Long-Short Fund, which maintains at least 25 per cent each in equity and debt. Both the strategies allow short exposure of up to 25 per cent.

SIFs open the doors to advanced hedging strategies, thematic opportunities, and diversification, once reserved for institutional, HNI and ultra-HNI investors

The Structure

The regulator has given fund houses the flexibility to decide on the structure. All these strategies can be structured as open-ended or interval funds, with daily or more frequent redemption options.

Unlike MFs, from which you can redeem your investment on any working day, if your SIF is structured as an interval scheme, you can redeem your investment only on the stipulated date. For instance, Magnum Hybrid Long Short Fund allows redemptions twice a week on Mondays and Thursdays.

Similar to MFs, SIFs also offer systematic investment plans (SIPs), systematic withdrawal plans (SWPs) and systematic transfer plan (STPs). However, in each of these options, the first step is to meet the threshold of a minimum investment of Rs 10 lakh. Once this requirement is complete, you can start an SIP, STP or SWP of a minimum instalment amount of Rs 10,000.

Should You Invest?

SIFs open the doors for more investors to take exposure to advanced hedging strategies and thematic opportunities that were once reserved for institutional, HNI and ultra-HNI investors. They offer diversification beyond traditional assets, backed by professional managers with deep expertise in complex strategies.

With the added advantage of mutual fund-like tax efficiency depending on the asset class, SIFs offer a blend of diversification, accessibility and advanced investment strategies.

Says Jatinder Pal Singh, CEO, ITI Asset Management: “SIFs offer the sophistication of AIFs and PMSes, combined with the governance, transparency, and tax-efficiency of the MF structure. Its innovation is anchored in responsibility, a balance that aligns with the evolving needs of today’s investors.”

They have the potential to deliver superior long-term returns, albeit with higher risk. This means that SIFs are suited for experienced investors who understand market cycles and have clear financial goals. “SIFs are for investors who are willing to consider a strategy without a long track record, understand the inherent risk-return trade-off, given their ability to take both long and short positions, which can amplify or negatively impact outcomes,” says Vishal Dhawan, founder and CEO, Plan Ahead Wealth Advisors.

“Since the minimum investment is `10 lakh and there is no track record yet, we believe SIFs may not be ideally suited for retail investors at this stage,” he adds.

In any case, the market is yet to test their mettle.