Traditionally, a lot of Indians hold off big-ticket purchases like a house or a vehicle for the Diwali season to rake in festive discounts and to align with the auspicious period. Vehicle sales tend to peak in the festive season around October-November each year. This year, the reduction in the goods and services tax (GST) on smaller vehicles is an additional Diwali bonus for many buyers.

Data from the Federation of Automobile Dealers Associations (FADA), the apex national body of automobile retail in India, shows a significant uptick in vehicle sales in October 2024, with 483,159 units sold, more than any other month of the year. A similar buying spree is anticipated for this year as well.

This year, vehicle buyers need to keep in mind two major changes: the GST revision and the broad-based adoption of ethanol-blended E20 fuel, which leads to lower fuel efficiency, according to experts. All vehicles manufactured post 2023 are compatible with E20 fuel, which was rolled out in April 2025.

The two changes are set to change the total cost of ownership (TCO) of the vehicles. TCO is a comprehensive metric which takes into account all the major expenses linked to the vehicle throughout its life cycle, right from the day of the purchase to the day it’s sold or disposed of.

While the GST revision is likely to lower the TCO for many buyers, the addition of E20 into the matrix has left many buyers confused. Let’s break it down to understand more, to help you make the right decision.

The GST Impact

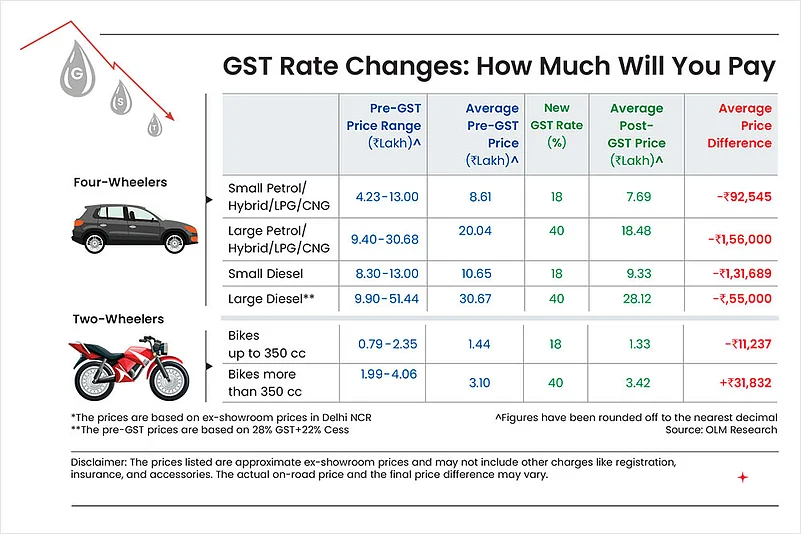

The GST rate on personal vehicles has now been restricted to two slabs from September 22—18 per cent and 28 per cent. This is expected to stimulate demand in the automobile sector.

Several companies have already announced new prices after factoring in the new GST rates. These include Tata Motors, Mahindra & Mahindra, Hyundai Motor India, Kia India, Toyota Kirloskar Motor, Skoda Auto India and luxury car-makers, such as BMW and Mercedes-Benz.

Small Petrol Cars: GST on small petrol cars, petrol-hybrid cars, CNG-powered cars, and LPG powered cars with a length less than 4,000 mm and an engine size of up to 1,200 cc has been reduced from 28 per cent to 18 per cent. Additionally, a compensation cess, which was charged on top of 28 per cent GST, has also been removed.

Some of the most sold cars in this category include Alto K10, Swift, and WagonR from the Maruti Suzuki stable; Altroz and Punch from Tata Motors, and Hyundai i20. The prices for such cars typically ranged between Rs 4.23 lakh and Rs 13 lakh (ex-showroom, Delhi), prior to the changes in GST slabs. While the price ultimately depends on the trim of the car selected, the average price for vehicles in this category was around Rs 8.61 lakh. Following the reduction in GST rates, the average price in this category has reduced by an average Rs 92,545, according to calculations based on existing and revised GST rates (see GST Rate Changes: How Much Will You Pay?). Prices are likely to reduce by Rs 45,000 for entry-level cars and by nearly Rs 1.31 lakh for the higher-end models.

Small Diesel Cars: GST on popular diesel cars, such as Tata Altroz, Kia Sonet and Hyundai Venue, which do not exceed 4,000 mm in length and 1,500 cc in engine capacity has also been reduced from 28 per cent to 18 per cent. These cars were priced between Rs 8.3 lakh and Rs 13 lakh (ex-showroom, Delhi), earlier and are likely to see a price reduction in the range of Rs 84,000-1.30 lakh depending on the model.

Large Cars And SUVs: GST rates for cars with an engine capacity above 1,500 cc and length exceeding 4,000 mm has been revised to 40 per cent from 28 per cent. However, the additional cess of 22 per cent has been waived off, leading to an overall reduction in tax of 10 per cent. The ex-showroom price for large petrol cars and SUVs are likely to reduce by Rs 95,000-3.10 lakh.

Some of the popular petrol models include Hyundai Creta, Kia Seltos, Maruti Suzuki Grand Vitara and Toyota Urban Cruiser Hyryder. Popular diesel vehicles in this category, such as Tata Harrier and Safari, Mahindra XUV700, and Toyota Fortuner, are likely to see a price reduction between Rs 1 lakh and Rs 5.20 lakh depending on the model.

Small Two-Wheelers: The GST slab revision has brought in good news for entry-level buyers, as the GST on two-wheelers with engine displacement below 350 cc has been reduced from 28 per cent to 18 per cent. Popular models, such as Hero Splendor Plus, Hero HF Deluxe, Honda Shine (125cc), TVS Apache 160 and scooters, such as the Honda Activa 110 cc, Honda Activa 125 cc, TVS Jupiter 110 and TVS Jupiter 125 cc, typically cost between Rs 79,096 and Rs 2.35 lakh (ex-showroom Delhi). This category will see an average price reduction in the ex-showroom price in the range of Rs 7,989-23,729, depending on the model, once the new GST rates kick in.

Large Two-Wheelers: GST rate on premium motorcycles (those with engine sizes above 350cc has been increased to 40 per cent from 28 per cent. Some of the popular models, such as Himalayan 450, Super Meteor 650, and Interceptor 650 from Royal Enfield; Speed 400 and Scrambler 400 X from Triumph will likely see a price uptick in the range of Rs 21,862-44,952 depending on the model after September 22.

The E20 Impact

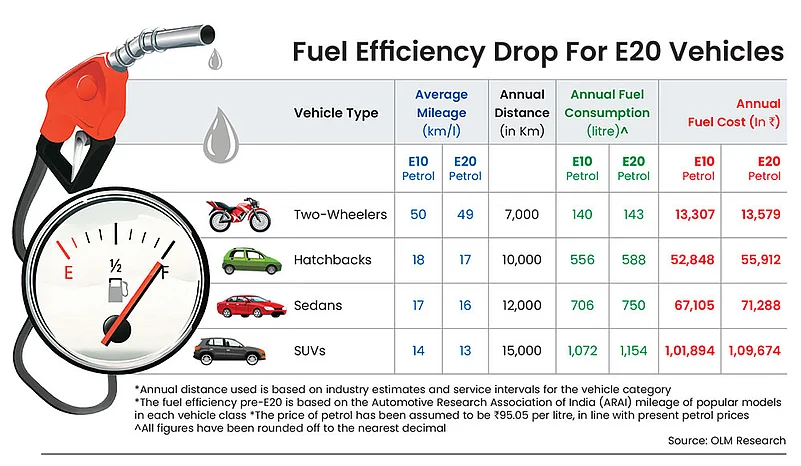

The adoption of the E20 flex fuel, a blend of 20 per cent ethanol and 80 per cent petrol leads to lower fuel efficiency and a bigger fuel bill for most cars, new and old. The drop in efficiency occurs due to the chemical properties of ethanol. For new car buyers, whose earlier vehicles were E10 compliant, running cost will likely increase. A few petrol pumps have still not transitioned to E20.

The drop in mileage could be around 1-2 per cent, according to estimates by automotive industry experts and the Ministry of Petroleum and Natural Gas.

While the rise in the annual fuel bill for two-wheeler owners will be smaller, four-wheeler owners may already be looking at an annual increase in the range of Rs 3,064-7,780 (see Fuel Efficiency Drop for E20 Vehicles).

While this amount may seem marginal, it translates to higher fuel consumption over the lifespan of the vehicle. Given the kilometres which a car is expected to run throughout its lifespan, buyers should be ready to spend up to Rs 1 lakh over the course of their vehicle ownership.

What Should You Do?

The GST rate revisions are a positive development, but vehicle buyers should not get carried away and take rash decisions only taking into account that and festive discounts.

Says Abhishek Roychowdhury a certified financial planner (CFP) and associate partner at Mumbai-based portfolio manager Jain Investing: “Instead of letting a GST rate reduction or a festive offer push you into a rash decision, do a simple budgeting exercise to make a clear and personalised plan. You will know exactly how much you can allocate for your equated monthly instalment (EMI), fuel, and annual costs, and how to become debt-free faster.”

The EMIs and other costs are a long-term commitment, so it is advisable to plan beforehand. Here are some ways you can do so.

The 50% Rule: Roychowdhury says the first step is to determine how much EMI you can afford to pay by taking into account all the monthly expenses. “Start by listing and categorising all your expenses, including rent, groceries, utility bills, subscriptions and entertainment. Once you have a clear picture of all your outflows, you will know your true monthly surplus,” he adds.

Roychowdhury advises following a rule of thumb: cap your EMI and other monthly running costs to 50 per cent of your monthly surplus. “Use the remainder of the surplus for use as a safety net to take care of annual costs, such as insurance payments and servicing,” he says.

The 20:4:10 Rule: This is a popular thumb rule for purchasing vehicles that suggests that individuals should make a down payment of 20 per cent of the price of the vehicle they wish to buy, pay off the loan within four years and ensure that their total monthly vehicle-related expenses do not go beyond 10 per cent of their gross monthly income, according to various experts, prior to the deduction of other expenses.

Harshit Patel, CFP, and independent qualified financial advisor at 1 Finance, believes that a standard thumb rule may not be apt for everyone but it’s a good starting point to begin with.

“The four year limit actually nudges the buyer to choose cars within their means rather than stretching for aspirational models that will involve longer repayment durations,” says Patel, adding the lower the loan tenure, the better.

ayush.khar@outlookindia.com