Summary of this article

- The next generation reforms in Goods and Services Tax (GST) will be unveiled by Diwali, which will provide 'substantial' tax relief to common man

- PM Viksit Bharat Rozgar Yojana will ensure one-month EPF wages up to Rs 15,000 in two installments

- GST, which subsumed a host of taxes and local levies, was rolled out on July 1, 2017

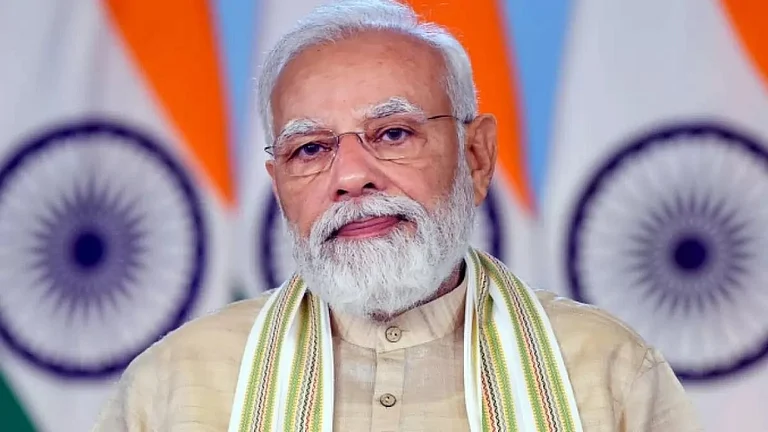

Addressing the nation on the occasion of the 79th Independence Day from the ramparts of historic Red Fort in Delhi, PM Narendra Modi made several money-related announcements in his speech. Lasting 103 minutes, this was the longest ever speech by any Prime Minister. In his address to the nation, Modi said the government has undertaken many steps to ease the tax burden on citizens. We take a look at his top money-related announcements:

PM Viksit Bharat Rozgar Yojana

Prime Minister Narendra Modi on Friday announced the launch of PM Viksit Bharat Rozgar Yojana which is expected to create 3.5 crore job in next two years. On July 1, 2025, the Union Cabinet chaired by Prime Minister Modi had approved the scheme aimed at incentivising job creation in the country. "Today is August 15 and we are launching Rs 1 lakh crore scheme for the youth of this country. It is good news for you that PM Viksit Bharat Rozgar Yojana is being rolled out from Today," Modi said in his Independence Day speech. He said that under this scheme the youth getting first job in the private sector will get Rs 15,000 and the companies (employing them) will get incentive amounts.

PM Viksit Bharat Rozgar Yojana will provide employment opportunities to 3.5 cr youths. The benefits of the scheme would be applicable to jobs created between August 1, 2025, and July 31, 2027.

Diwali GST Bonanza

Prime Minister Narendra Modi on Friday said the next generation reforms in Goods and Services Tax (GST) will be unveiled by Diwali, which will provide 'substantial' tax relief to common man and benefit small and medium enterprises. Addressing the nation on 79th Independence Day, Modi said the time has come to undertake reforms in GST as the indirect tax regime has completed 8 years. GST, which subsumed a host of taxes and local levies, was rolled out on July 1, 2017.

"We have discussed with states and we will usher in next generation GST reforms by Diwali, which will be a Diwali gift for citizens. Tax on items of common man will be reduced substantially. Our MSMEs will benefit hugely. Daily use items will become cheaper, which will also strengthen our economy," Modi said in his speech from the ramparts of the Red Fort. A Group of Ministers (GoM) comprising state finance ministers is already discussing the rate rationalisation and pruning of slabs in GST.

One Month EPF Wage

Targeting first-time employees registered with retirement fund body EPFO, Part-A of the PM Viksit Bharat Rozgar Yojana will ensure one-month EPF wages up to Rs 15,000 in two installments. Employees with salaries up to Rs 1 lakh will be eligible. The 1st installment will be payable after 6 months of service and the 2nd installment after 12 months of service and completion of a financial literacy programme by the employee.

The employers will get incentives in respect of employees with salaries up to Rs 1 lakh. The government will incentivise employers, up to Rs 3000 per month, for two years, for each additional employee with sustained employment for at least six months. For the employers of the manufacturing sector, incentives will be extended to the 3rd and 4th years as well.

Payments to the employers under Part B will be made directly into their PAN-linked bank accounts.

Tax Benefits

Prime Minister Narendra Modi on Friday said the government has undertaken tax reforms to make life easier for citizens, and improved capabilities has aided in raising the tax-free income limit of an individual to Rs 12 lakh per annum. In his address to the nation on the 79th Independence Day, Modi said the government has undertaken reforms to fast-track income tax refunds and also implement faceless assessment.

"We have also undertaken reforms to make life easier for citizens. Income tax refund, faceless assessment, raising tax-free income limit to Rs 12 lakh per annum are all result of tax reforms. No one ever imagined that tax relief on income up to Rs 12 lakh is possible. When a nation's capability increases, its citizens benefit," Modi said.

Trade and Commerce

Prime Minister Narendra Modi on Friday said India will not compromise on the interests of farmers, livestock rearers and fishermen, asserting that he is standing like a wall to protect them. The remarks are important as the US is seeking duty concessions from India in agriculture and dairy sectors in the proposed bilateral trade agreement (BTA), being negotiated between the two countries.

The US has also imposed steep tariffs on India. Trump has ratcheted up tariffs on Indian goods to 50 per cent, which will come into effect from August 27. At present, an additional 25 per cent tariffs are there on Indian goods entering American market. "Modi is standing like a wall against any harmful policy related to the farmers, fishermen and cattle rearers of India. India will never accept any compromise regarding its farmers, its livestock rearers, its fishermen," he said while addressing the nation on the 79th Independence Day.

In the proposed BTA, the US is seeking reduced tariffs on products like corn, soybeans, apples, almonds and ethanol, as well as increased access for US dairy products. New Delhi is, however, strongly opposing these demands as these will have a direct bearing on farmers. India has never given any duty concessions to any of its trading partners, including Australia and Switzerland, with whom it has signed trade agreements.