Summary of this article

Young people in Lucknow use mule accounts to launder cyber fraud money.

Transactions linked to Southeast Asian handlers, using encrypted channels and crypto wallets.

Authorities plan specialized cyber units and public awareness to combat fraud networks.

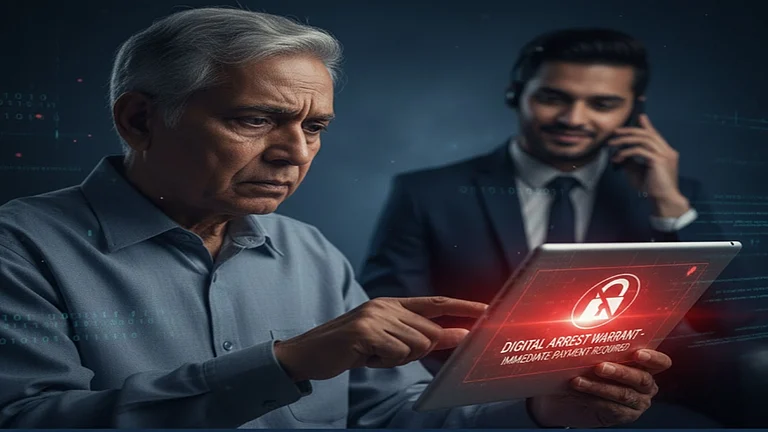

Ajay, a 24-year-old restaurant waiter from the winding lanes of Old Lucknow, thought he had stumbled upon an easy way to make money.

A friend introduced him to a crypto trader who offered Rs 20,000 if Ajay allowed the use of his bank account for a day's transaction. Tempted, he agreed.

The next morning, lakhs of rupees flowed into his account before these were withdrawn under someone else's instructions, and handed over to strangers.

Within weeks, police knocked on Ajay's door. The money, they told him, was part of an elaborate international cyber fraud routed through his account.

Shaken, Ajay turned approver, helping investigators identify other account holders and middlemen in a growing nexus that links the narrow lanes of Chowk, Indira Nagar, and Vrindavan Yojna, Sushant Golf City to handlers operating out of Cambodia, Vietnam, Laos and Thailand.

Police investigations by Crime Branch and Cyber Cell over the past three months reveal that dozens of mule accounts - bank accounts used to launder illicit funds - belong to young men and women from Lucknow.

Many work in restaurants, small shops, or contractual jobs; others are college students. Lured by commissions ranging from Rs 10,000 to Rs 30,000, they knowingly lend their accounts to local facilitators, who route cyber fraud proceeds into cryptocurrency, mainly USDT (Tether), through unregulated peer-to-peer networks on the TRC-20 blockchain.

How the Network Operates

According to police, the operations are coordinated on encrypted Telegram channels run by Chinese handlers or their proxies in the Chinese language. Local recruiters collect account details and documents - often avoiding proper KYC or using forged papers.

On transaction days, mule account holders are escorted to banks to withdraw cash immediately after large NEFT, RTGS, or IMPS transfers. The cash is then handed to crypto brokers, who convert it into USDT using decentralized, non-KYC wallets. Crypto wallets like Binance were found preferred choices.

The funds come from a range of cybercrimes in India: online investment frauds, fake job or task schemes, sextortion, and bogus trading platforms. Victims' payments are funnelled into mule accounts before disappearing into the blockchain - beyond the jurisdiction of any single country.

In just the last two months, Lucknow police tracked Rs 5 lakh to Rs 5 crore being laundered through such accounts, with all funds eventually converted into USDT and sent abroad. The network avoids legal exchanges, taxation, and banking compliance, disguising its activity as "crypto trading".

Lucknow: A Hub for Mule Accounts

What alarms police is the concentration of mule accounts in Old Lucknow localities like Chowk, Indira Nagar, Madiyaon, Malihabad and Bakshi Ka Talab as well as recently-developed neighbourhoods like Sushant Golf City, Vrindavan Yojna and suburban Mohanlalganj, Gosainganj areas.

The police also detained for questioning around 60 young men from different areas who were found as the actual holders of the accounts used as mules in cases of cyber fraud that involved crores of rupees.

"These young people aren't hardened criminals, but their actions enable large-scale fraud," Additional Deputy Commissioner of Police (Lucknow South) Rallapalli Vasanth Kumar told PTI.

Kumar, who has been involved in busting multiple such gangs in the capital, said, "Several youth have confessed regret, admitting they underestimated the legal risks." The phenomenon also ties into the darker side of the global cybercrime economy: cyber slavery rackets in Southeast Asia. Thousands of Indians are trafficked or lured abroad with fake job offers, then forced to work in scam factories targeting victims in India and elsewhere - feeding proceeds back into networks that rely on mule accounts at home.

The Way Ahead

While Lucknow police have cracked multiple such cases and identified the pattern, officials admit the scale and sophistication make detection difficult. The combination of encrypted communication, decentralized crypto wallets, and disposable bank accounts leaves little paper trail.

The Uttar Pradesh Police and the Indian Cyber Crime Coordination Centre (I4C), a dedicated unit of the Union Ministry of Home Affairs, have drawn up a joint action plan to strengthen the state's cybercrime response.

At a high-level meeting chaired by DGP Rajeev Krishna on August 6, officials agreed to set up a dedicated Cyber Crime Centre, create a special unit for offences against women and children, identify fraud hotspots, and deploy trained tech-savvy personnel. Public awareness drives will also be expanded.

During a video conference on August 8 with police chiefs of all 75 districts, the DGP directed that cyber cells be manned only by trained officers, NCRP portal usage be maximised, and CyTrain enrolment via I4C be completed within 15 days.

As for Ajay, he now warns his friends never to "rent out" their accounts.

"I thought it was just extra cash," he says.

"Now I know it was crime - and I'm lucky I got a second chance."